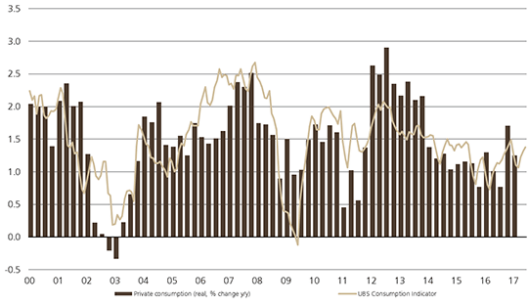

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals. Private consumption vs. UBS Consumption Indicator Zurich, 26 July 2017 – The UBS consumption indicator stood at 1.38 points in June, pointing to subdued growth in consumption at the end of

Topics:

UBS Switzerland AG considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Private Consumption, Switzerland UBS Consumption Indicator

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals.

Private consumption vs. UBS Consumption IndicatorZurich, 26 July 2017 – The UBS consumption indicator stood at 1.38 points in June, pointing to subdued growth in consumption at the end of the second quarter. The May figure was revised downwards slightly to 1.32. UBS’s consumption indicator has been hit by weak growth in Swiss employment in recent quarters. Indeed, across the last five quarters, data suggests employment has all but stagnated. Since 2000, the annual growth in employment has been 1.1 percent. We expect employment growth rates to pick up during the course of the year, which should support consumption. Somewhat offsetting weak employment data, new car registrations rose 2.1 percent year-on-year in June. Additionally, most recent available data reveals that hotel overnight stays by Swiss nationals increased by 2.4 percent year-on-year. The mood also improved in the retail sector, although it started from a low base. The UBS consumption indicator aligns with the forecasts issued by UBS’s Chief Investment Office Wealth Management, which forecasts private household consumption will grow by 1.3 percent in 2017. This value is slightly below the long-term average of 1.5 percent. |

UBS Consumption Indicator June 2017(see more posts on Switzerland Private Consumption, Switzerland UBS Consumption Indicator, ) Source: ubs.com - Click to enlarge |

How the UBS Consumption Indicator is calculated

The UBS Consumption Indicator signals private consumption trends in Switzerland with a lead time of one to three months on the official figures. At more than 50%, private consumption is by far the most important component of Swiss GDP. UBS calculates this leading indicator from six consumer-related parameters: new car registrations, business activity in the retail sector, the number of domestic overnight hotel stays by Swiss residents, the consumer sentiment index, employment figures and credit card transactions made via UBS at points of sale in Switzerland. With the exception of the consumer sentiment index and employment figures, all of this data is available monthly.

Tags: Featured,newsletter,Switzerland Private Consumption,Switzerland UBS Consumption Indicator