Bern, 02.11.2017 – Consumer sentiment in Switzerland remains above average. At -2 points, the overall index is virtually unchanged in October compared to the previous quarter (-3 points). Continued optimism regarding economic development and unemployment are supporting the positive outlook in particular, while expectations regarding the financial situation of households remain below average. This indicates that...

Read More »What Could Pop The Everything Bubble?

As central bank policies are increasingly fingered by the mainstream as the source of soaring wealth-income inequality, policies supporting credit/asset bubbles will either be limited or cut off, and at that point all the credit/asset bubbles will pop. I’ve long held that if a problem can be solved by creating $1 trillion out of thin air and buying a raft of assets with that $1 trillion, then central banks will solve...

Read More »Gold and Silver Get Powelled – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Rumors Driving Short Term Price Swings The prices of the metals dropped a bit more this week, -$7 and -$0.16. We all know the dollar is going down, that it is the stated policy of the Federal Reserve to make it go down. We all know that gold has been valued for thousands of years. So why do we measure the timeless metal...

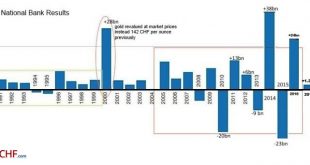

Read More »The good years have started, increasing SNB Profits

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But in 2017, the picture is changed. Assuming a “biblical” cycle of seven good years and seven bad years, the SNB could now increase profits every year – thanks to a weaker franc and the seven good years. … until the next recession comes and the...

Read More »FX Daily, October 31: Month-End Leaves Market at Crossroads

Swiss Franc The Euro has risen by 0.41% to 1.628 CHF. EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe’s Dow Jones Stoxx 600 is also flattish today, but up 1.6%...

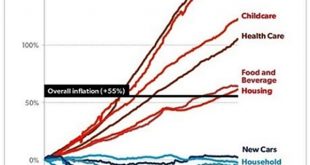

Read More »Swiss government says it has a plan to contain healthcare costs

© Blondsteve | Dreamstime As next year’s health premium bills find their way into Swiss mail or email boxes, the reality of another round of price increases starts to bite. Earlier this week, Switzerland’s Federal Council unveiled 38 measures that will be considered as part of a plan to tackle Switzerland’s rising health costs. A final plan will be presented next spring, according to 20 Minutes. A number of measures,...

Read More »Eurozone Crisis Is Back

– Gold will be safe haven again in looming EU crisis – EU crisis is no longer just about debt but about political discontent– EU officials refuse to acknowledge changing face of politics across the union– Catalonia shows measures governments will use to maintain control– EU currently holds control over banks accounts and ability to use cash– Protect your savings with gold in the face of increased financial threat from...

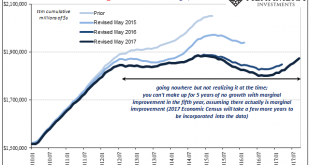

Read More »Subject To Gradation

Economic growth is subject to gradation. There is almost no purpose in making such a declaration, for anyone with common sense knows intuitively that there is a difference between robust growth and just positive numbers. Yet, the biggest mistake economists and policymakers made in 2014 was to forget that differences exist between even statistics all residing on the plus side. It was misconception sometimes by design,...

Read More »KOF Economic Barometer: Prospects for the Swiss Economy Continue to Brighten Up

The KOF Economic Barometer rose by 3.0 points in October. This is the second upward movement in succession. The indicator reached 109.1 points in October (after revised 106.1 in September). Autumn is welcoming the Swiss economy with a tailwind. In October 2017, the KOF Economic Barometer rose to a new reading of 109.1 points, its highest level since September 2010. The upward tendency is mainly driven by the...

Read More »Emerging Markets: What has Changed

Stock Markets EM FX gained some limited traction Friday but still capped off another awful week. So far this quarter, the worst EM performers are TRY (-6%), MXN (-5%), ZAR (-4%), COP, and BRL (both -2.5%). We expect these currencies to remain under pressure as political concerns are unlikely to dissipate anytime soon. Stock Markets Emerging Markets, October 30 Source: economist.com - Click to enlarge South...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org