As central bank policies are increasingly fingered by the mainstream as the source of soaring wealth-income inequality, policies supporting credit/asset bubbles will either be limited or cut off, and at that point all the credit/asset bubbles will pop. I’ve long held that if a problem can be solved by creating trillion out of thin air and buying a raft of assets with that trillion, then central banks will solve the problem by creating the trillion out of thin air—nothing could be easier. This is the lesson of the past eight years: if a problem can be solved by creating new money and buying assets, then central banks will solve that problem. Problem: stock market is declining. Solution: create new money and

Topics:

Charles Hugh Smith considers the following as important: Everything Bubble, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Problem: stock market is declining. Solution: create new money and buy, buy, buy stock index funds. Problem solved! Market stops falling and quickly rebounds as “central banks have our backs.”

Problem: interest rates are inhibiting lending and growth. Solution: create a few trillion units of currency and buy enough sovereign bonds to drop interest rates to near-zero.

Problem: nobody’s left who can afford to buy the new nosebleed-priced flats that underpin China’s miracle-grow economy. Solution: create new currency, lend it to local government agencies who then buy the empty flats.

Problem: stagnant employment and deflation. Solution: create a trillion in new currency, buy a trillion in new government bonds that then fund infrastructure projects, i.e. bridges to nowhere.

|

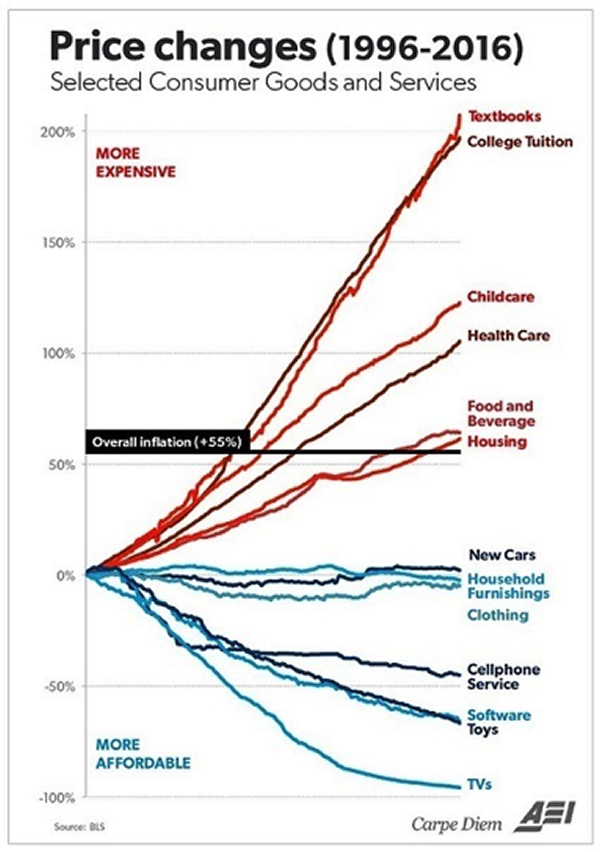

This is why inflation is already running extremely hot in nontradable sectors(which are often dominated, funded or controlled by the public sector/government), while deflation is still visible in tradable goods such as TVs, software, etc. I covered real-world inflation rates in The Burrito Index: Consumer Prices Have Soared 160% Since 2001(August 1, 2016))

Much of the real-world inflation in sectors such as healthcare is invisible to protected classes because it’s being absorbed by employers and the government, a topic I covered in Inflation Isn’t Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs (May 25, 2017)

Real-world inflation is also distorted by hedonics and substitution, tricks that lower the official rate of inflation but don’t change the reality that the average prices paid for vehicles have risen substantially, despite the official claim that vehicle prices have been flatlined for years, a topic I addressed in About Those “Hedonic Adjustments” to Inflation: Ignoring the Systemic Decline in Quality, Utility, Durability and Service(October 11, 2017)

Be Careful What You Wish For: Inflation Is Much Higher Than Advertised (October 5, 2017)

|

Selected Consumer Goods and Services Price Changes, 1996 - 2016 |

|

As political pressure on central banks mounts to fund QE for the people, QE for Main Street, etc., that is, helicopter money in one form or another, the introduction of new currency into the real economy has the potential to make real-world inflation undeniable.

Once inflation is undeniably in the 5% to 7% range, who will be willing to buy a negative-interest rate bond, or a bond paying 1%?

Another potential engine of inflation that’s widely discounted is global shortages of key commodities such as oil, grain, fresh water, etc. The global economy has come to view cheap, abundant commodities as the natural and permanent state of affairs, but history tells us that abundance and low prices are not permanent. Since essential commodities are integral to the global supply chain, any price increases due to scarcity or supply disruption quickly feed inflation into the entire supply chain.

Inflation is a problem that creating another trillion won’t solve; creating and distributing another trillion or two will actually make the problem worse.

Rising Social Disorder Due to Soaring Wealth-Income Inequality

Famed financer Ray Dalio recently penned a commentary labeling the divergence of the wealthy elite from the bottom 90% The Most Important Economic, Political And Social Issue Of Our Time.

This is a topic many alt-financial bloggers have covered for years; I’ve penned dozens of essays on the topic, most recently The Fading Scent of the American Dream (October 16, 2017)

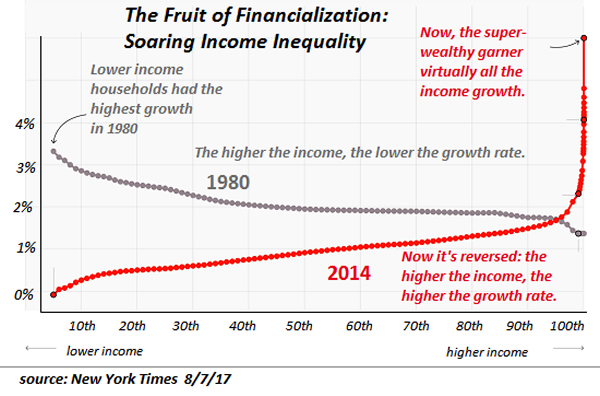

This chart depicts the inconvenient reality: central bank currency-creation-asset-buying has enriched the top of the wealth-power pyramid, with limited trickledown to the top 10% and negative effects on the bottom 90%.

|

US Household Incomes, 1980 - 2014 |

Tags: Everything Bubble,Featured,newsletter