See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Rumors Driving Short Term Price Swings The prices of the metals dropped a bit more this week, - and -%excerpt%.16. We all know the dollar is going down, that it is the stated policy of the Federal Reserve to make it go down. We all know that gold has been valued for thousands of years. So why do we measure the timeless metal in terms of paper currency? Money – sound and unsound - Click to enlarge It should be the other way around. We therefore encourage people to think of the price of the dollar measured in gold, rather than the price of gold measured in dollars. Last week, the dollar was up to 24.43 milligrams of gold.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

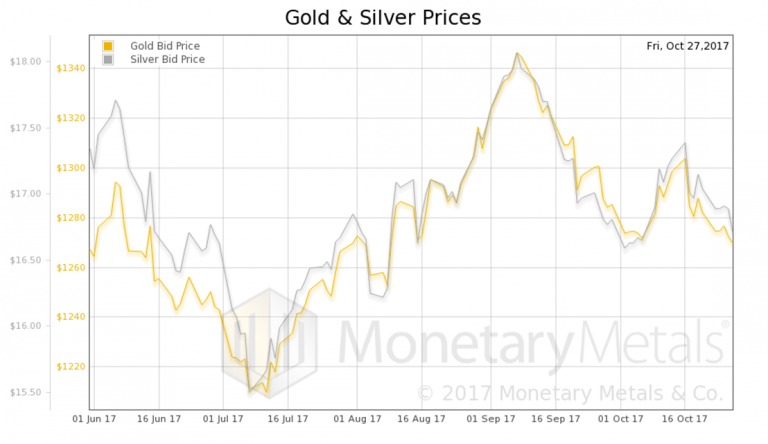

Rumors Driving Short Term Price SwingsThe prices of the metals dropped a bit more this week, -$7 and -$0.16. We all know the dollar is going down, that it is the stated policy of the Federal Reserve to make it go down. We all know that gold has been valued for thousands of years. So why do we measure the timeless metal in terms of paper currency? |

|

| It should be the other way around. We therefore encourage people to think of the price of the dollar measured in gold, rather than the price of gold measured in dollars. Last week, the dollar was up to 24.43 milligrams of gold.

On Friday, a curious thing happened. A report came out that Jerome Powell, who is on the Board of Governors of the Federal Reserve, is now the leading candidate to replace Janet Yellen as Chairman. This was deemed by the market to be good for gold and especially silver. Powell is not only an establishment guy, he has been part of the decision making body which has brought you the monetary policy which has caused/coincided with the drop in the price of gold from $1,558 when he took office. Presumably the reason why he is a candidate, and the reason why the gold market bid up the price of gold, is that he will continue the current central plan. This plan could be charitably dubbed “monetary largesse”. Notwithstanding the theory held by both the mainstream Fed apologists and alternative Fed critics, this policy has not resulted in skyrocketing prices of either consumer goods or gold. But no matter, the likely appointment of the mainstream insider (as opposed to the other leading candidate, John Taylor, who is an academic and not a Fed official) is good news. For gold. For now. Despite the fact that this same policy over the last 6 years has caused/coincided with falling and more recently sideways or weakly rising gold price action, Powell is deemed good for gold. Speaking of more recent weak rising price action, we know technical traders who see the small size of this move as proof of another down leg to come in the price. In the short term, of course, the price will bang about due to such Kremlinology. In the long term, equally of course, the price will change due to the fundamentals. That is what this report is all about. We have invested in many years of research and development (and a license to a tick history database that contains every bid and offer with sub-millisecond resolution, going back to 1996). The output of our data science work are graphs showing the internal structure of the market, with unprecedented accuracy and clarity. |

Jerome Powell, member of the governing board of the Fed. Powell is a member of the “we can be patient with tightening policy” faction, which presumably was the reason why rumors of his appointment were greeted with a positive reaction by the gold market. We would submit that it doesn’t really matter much which bureaucrat gets to head the central planning agency, at least in the long run. In the short to medium term we think the hawks rather than the doves have to be seen as the best friends of the gold market, which is inter alia exemplified by the fact that the gold price has been strengthening ever since the Fed has actually begun to hike rates after much hemming and hawing. How come? Aren’t rate hikes bearish for gold? First and foremost, they are bearish for free liquidity and money supply expansion, and as such they primarily endanger the Great Bubble. This is what we believe the buyers and exercisers of reservation demand who have driven gold prices up by more than 20% from their lows are focused on – they look beyond the short term to the denouement that will eventually be triggered by monetary tightening and what happens then. Since the mid 2000ds, the gold market has shown a tendency to anticipate such events far in advance, which has seen it occasionally rise despite a fairly gold-bearish macro backdrop. |

Fundamental DevelopmentsBelow, we will discuss both the long-term big picture supply and demand fundamentals, and the intraday action around the Powell news. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

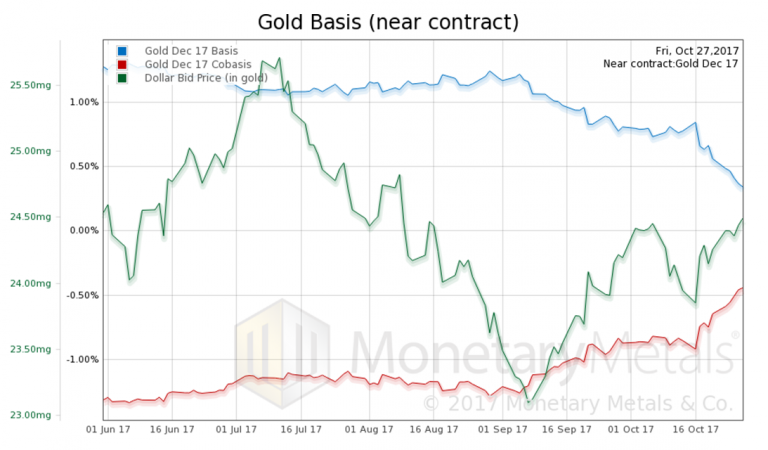

Here is the gold graph showing gold basis and co-basis with the price of the dollar in gold terms. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

| We see a rising co-basis (our measure of scarcity) along with a rising price of the dollar (i.e., a falling price of gold, in dollar terms). This is not surprising; it is the typical pattern nowadays.

Our calculated Monetary Metals gold fundamental price fell $10 to $1,347. Now let’s look at silver. We also see a rising co-basis along with rising price of the dollar in silver terms (i.e., a falling price of silver in dollar terms). Much of this rise is the mechanics of the contract roll, as traders start to sell the contract before expiry and buy the next month. Our calculated Monetary Metals silver fundamental price fell $0.05 to $17.03. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Now, on to Friday’s “Powell Spike”. Somebody thought Powell would be good for gold. The price rallied four bucks in a minute, and then another three bucks within 8 minutes. But who? Was it stackers loading up on coins, prepping for inflatiocalypse? Or was it speculators loading up on leverage, betting on futures?

In Part II of this article, we answer this question by analyzing intraday graphs of the gold and silver basis.

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price