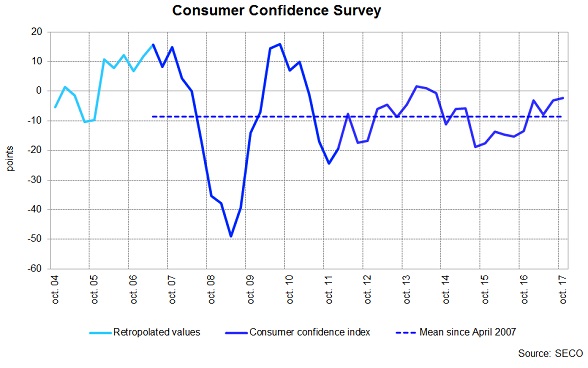

Bern, 02.11.2017 – Consumer sentiment in Switzerland remains above average. At -2 points, the overall index is virtually unchanged in October compared to the previous quarter (-3 points). Continued optimism regarding economic development and unemployment are supporting the positive outlook in particular, while expectations regarding the financial situation of households remain below average. This indicates that consumers’ perceptions have barely changed since the July survey, although there has been a significant increase in anticipated price trends. Consumer Confidence Survey At -2 points, the October 2017 consumer sentiment index* has come in above its long-term average (-9 points). The mood remains virtually

Topics:

SECO considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Consumer Confidence, Switzerland SECO Consumer Climate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Bern, 02.11.2017 – Consumer sentiment in Switzerland remains above average. At -2 points, the overall index is virtually unchanged in October compared to the previous quarter (-3 points). Continued optimism regarding economic development and unemployment are supporting the positive outlook in particular, while expectations regarding the financial situation of households remain below average. This indicates that consumers’ perceptions have barely changed since the July survey, although there has been a significant increase in anticipated price trends.

Consumer Confidence SurveyAt -2 points, the October 2017 consumer sentiment index* has come in above its long-term average (-9 points). The mood remains virtually unchanged since last July (-3 points). With the exception of the slightly poorer result in April, consumer sentiment has kept stable throughout 2017 and has markedly outperformed the previous two years’ figures. The last time the index was higher was back in July 2014. Consumers’ responses to the four questions used to calculate the index** did not differ significantly from the survey in July. They remain optimistic about the economic development in general over the coming 12 months. At +14 points, the corresponding sub index is still well above its long term average (-10 points) despite dropping 2 points. What is more, participants are once again anticipating brighter prospects for the job market compared to the long term average. For instance, the sub-index on unemployment forecasts has fallen 2 points to +39 points, dropping even further below the average (+50 points). By contrast, consumers’ expectations regarding their own households’ future financial situation remain pessimistic. At -6 points, the corresponding sub index is persisting far below its long term average (+2 points), having come in at -4 points in July. After a slight 5-point increase to +22 points, the sub-index on anticipated opportunities to save is now close to the average (+21 points). |

Consumer Confidence Survey, Q4/2017(see more posts on Switzerland Consumer Confidence, Switzerland SECO Consumer Climate, ) Sky blue line: Retropolated Values, Blue line: Consumer Confidence Index, Blue dashed line Source: admin.ch - Click to enlarge |

This suggests that, while households are optimistic about the development of the economy and the job market, they remain cautious regarding the assessment of their own financial situation. Therefore the propensity to consume remains modest. In this respect, participants responded to the question of whether now would be a good time to make major purchases significantly more negative than they did three months ago. The corresponding sub index has fallen from -4 points to -10 points, putting it below the long term average (-6 points).

Another significant change in the survey results can be seen in the views on past and future price trends. The sub-index that evaluates price trends over the past twelve months has risen from +40 points to +48 points, while that for expected price trends has climbed from +45 points to +56 points, putting both indices at their highest level since April 2011.

The overall results of the October survey indicate that consumers are expecting a positive development of the Swiss economy and a recovery of the job market, but they are sceptical that they themselves will benefit from the upturn. The fact that consumers expect the financial situation of their own household to develop below average may also be linked to increased inflation expectations, which will curb the development of real wages. If the expected positive job market development does indeed materialize, however, more households are likely to benefit from the economic recovery over time.

* The telephone survey of randomly chosen consumers takes place every January, April, July and October. The LINK institute for market research has carried out the survey since January 2017. A total of 1,113 people over the age of 16 took part in the survey in October 2017 in German, French or Italian.

** The consumer sentiment index is derived from the following four sub-indices: assessment of future economic prospects, of future development of unemployment, anticipated development of the financial situation of private households, and savings possibilities over the next twelve months.

Tags: Featured,newsletter,Switzerland Consumer Confidence,Switzerland SECO Consumer Climate