The term itself gives it away. They called it quantitative easing for a specific reason. Both words mean to convey substantial concepts. The first part, quantitative, was used because it sounds deliberate, even scientific. It implies a program where great care and study was employed to come up with the exact right amount. It’s downright formulaic, where you intend that by doing X you can predictably create Y. The second part, easing, is equally unambiguous. In any economic context, easing means something specific, being the opposite of tight or depressive. Easing means boost or accelerate. Put together, they tell us that Economists knew the right amount of the right thing to achieve precise and explicit goals. It

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, currencies, economy, Featured, Federal Reserve/Monetary Policy, Japan, Japanification, Markets, newsletter, they really don't know what they are doing

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The term itself gives it away. They called it quantitative easing for a specific reason. Both words mean to convey substantial concepts.

The first part, quantitative, was used because it sounds deliberate, even scientific. It implies a program where great care and study was employed to come up with the exact right amount. It’s downright formulaic, where you intend that by doing X you can predictably create Y.

The second part, easing, is equally unambiguous. In any economic context, easing means something specific, being the opposite of tight or depressive. Easing means boost or accelerate.

Put together, they tell us that Economists knew the right amount of the right thing to achieve precise and explicit goals. It sounds a lot like just PR, merely the purposeful gloss of scientific veneer to shield its wielders from criticism. It’s a common tactic in today’s mathematics obsessed world.

Complexity has become a substitute for debate and argument. In many ways, it is a new logical fallacy (evolved out of some of the old ones). I can do complex equations, therefore you can’t challenge my opinion. It doesn’t even matter if you can actually string together more than two variables competently anymore; you only need to appear able.

It’s 2018 and we are still talking about QE, so you don’t have to be a gambler to lay odds as to its successes. In many ways, that was the real point of the nomenclature. Like all things central bank, the idea was to buy time in the interest of creating some maneuvering space with the public. By telling people this was a scientific endeavor and winking and nodding that it must have been, they knew it would be more easily accepted without too much (political) incident.

Given the benefit of the doubt that way, policymakers expected that through little more than cyclical forces each economy would have recovered just on its own (recall that Economics assigns each country its own closed economic system). After not too much time, the Ben Bernanke’s of the world fully anticipated QE being remembered fondly even if it didn’t actually do all that much in practice.

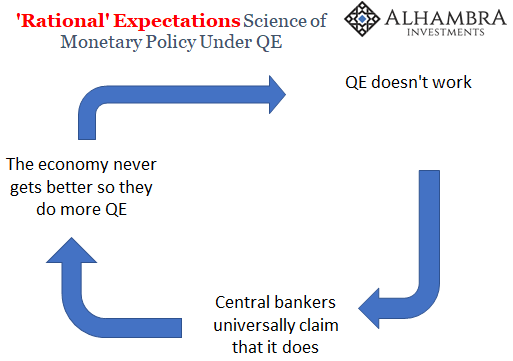

That last part has been proven several times over, dozens even. QE doesn’t do much of anything but provide central bankers with increasingly dubious cover. It’s the first part that has exposed the scam. There were no cyclical forces this time, their absence and more so the length of their absence leading instead to more desperation in the official sector.

First, it was to do more QE – even though by doing nothing more than a second round it totally obliterates the concept of “quantitative.” If you knew the right amount but feel compelled toward an additional right amount, then “right” can’t be anything but wrong.

| After experimenting with multiple factors and variables (amount of monthly purchases, amount of months, the absurd idea of modern forward guidance, etc.) and still no success, central bankers rather than re-evaluating QE have instead blamed you and me. The economy is broken, they claim, and we are the cause. We aren’t productive enough, we haven’t reproduced enough, we don’t spend enough of our limited wages, and too many of us are on drugs or have reached retirement.

The first commandment of Economics is now, thou shall not notice how all trends broke in 2008. As bad as things are, they would have been worse without the courage of central bankers. Or something. |

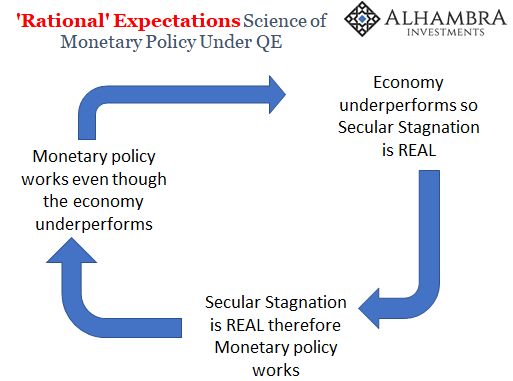

Rational Expectations Science of Monetary Policy |

Either way, it’s still a major shift away from the idea’s far less humble beginnings. To show you just how much of a change, just yesterday BoJ’s Kuroda spells it out on American television:

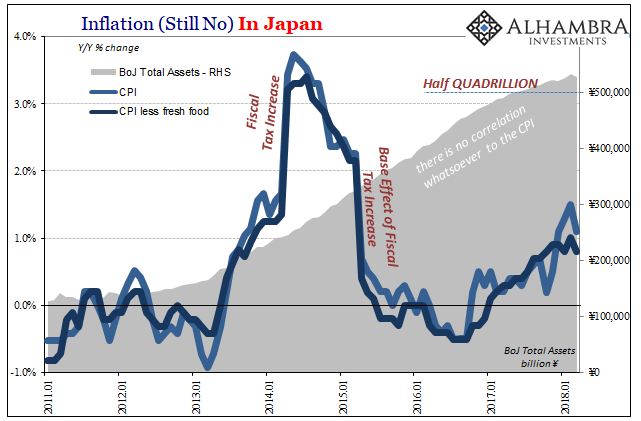

QQE, as it became for the BoJ in 2013, was predicted to take two years to reach that same goal. That would have been, for those keeping track, April of 2015. It’s now April of 2018, meaning half a decade and half a quadrillion yen later it still hasn’t accomplished what it was designed to. If half a decade and half a quadrillion aren’t enough, surely a full decade and a full quadrillion? |

Inflation in Japan, Jan 2011 - Apr 2018 |

| It’s a very long way from the “quantitative” measure it has been sold as. In fact, even if Japan’s CPI does reach 2% in the years ahead, would we even be able to trace it back to QQE?

At that point, over that length of time, it could be as much randomness or good luck as anything. We are into the realm of astrology and fortune cookies at this point. That’s a problem, of course, but not really the problem. Why does anyone still take these guys seriously? The only conclusion that they have empirically established is that they really don’t know what they are doing; but they are still doing it. There are no points for persistence since it is that persistence that is killing us. This is how you end up with global Japanification and multiple lost decades. It’s science. |

Rational Expectations Science of Monetary Policy |

Tags: currencies,economy,Featured,Federal Reserve/Monetary Policy,japanification,Markets,newsletter,they really don't know what they are doing