Swiss Franc The Euro has risen by 0.02% to 1.1821 CHF. GBP and CHF The Pound has remained fairly range bound against the Swiss Franc during the last couple of weeks as the markets appear to adopting a wait and see approach as to what might happen in the medium to long term. The Pound fell marginally during this time after the Bank of England once again decided to keep interest rates on hold at a split of 7-2 in...

Read More »Global Asset Allocation Update

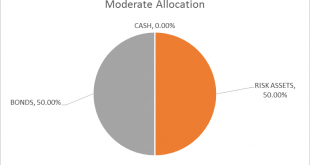

The risk budget changes this month as I add back the 5% cash raised in late October. For the moderate risk investor, the allocation to bonds is still 50% while the risk side now rises to 50% as well. I raised the cash back in late October due to the extreme overbought nature of the stock market and frankly it was a mistake. Stocks went from overbought to more overbought and I missed the rally to all time highs in...

Read More »Global Turn-of-the-Month Effect – An Update

In Other Global Markets the “Turn-of-the-Month” Effect Generates Even Bigger Returns than in the US The “turn-of-the-month” effect is one of the most fascinating stock market phenomena. It describes the fact that price gains primarily tend to occur around the turn of the month. By contrast, the rest of the time around the middle of the month is typically far less profitable for investors. The effect has been studied...

Read More »Government defends Swiss Post-Amazon deal

Making its way to a Swiss home near you: an Amazon package The government has defended the deal struck that will see Swiss Post delivering packages for retail giant Amazon. There is no question of preferential treatment, it said. The response by the government came in response to a parliamentary question raised by politician Olivier Feller (Liberal-Radical), querying the deal that will see Swiss Post delivering Amazon...

Read More »All The World’s A (Imagined) Labor Shortage

Last year’s infatuation with globally synchronized growth was at least understandable. From a certain, narrow point of view, Europe’s economy had accelerated. So, too, it seemed later in the year for the US economy. The Bank of Japan was actually talking about ending QQE with inflation in sight, and the PBOC was purportedly tightening as China’s economy appeared to many ready for its rebound. Operating under these...

Read More »Internships – Switzerland’s Young Socialists caught preaching one thing and practicing another

In collaboration with the Swiss union Unia, Switzerland’s Young Socialists have launched a protest against the exploitation of interns. © Loganban | Dreamstime.com - Click to enlarge To get on the career ladder, many young people feel compelled to take internships offering little or no pay. The Young Socialists are demanding interns be better paid. Recent data from the Federal Statistical Office shows that 23% of...

Read More »A Funny Thing Happened on the Way to Market Complacency / Euphoria

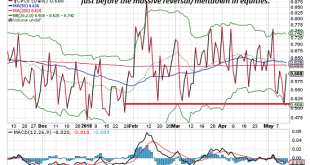

Fortunately for Bulls, none of this matters. A relatively reliable measure of complacency/euphoria in the stock market just hit levels last seen in late January, just before stocks reversed in a massive meltdown, surprising all the complacent/euphoric Bulls. The measure is the put-call ratio in equities. Since this time is different, and the market is guaranteed to roar to new all-time highs, we can ignore this (of...

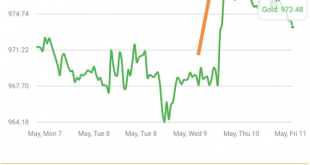

Read More »Oil price highest in 3 years, gold ready to follow

U.S. withdraws from Iran nuclear deal Oil jumps past $70 Argentina hikes interest rates to 40% S. 10 year disparity Western buying returns to gold Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%). In sterling, gold was up strongly on Thursday...

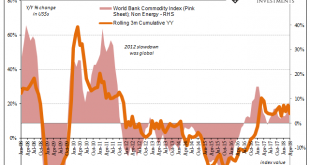

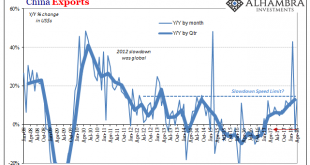

Read More »What China’s Trade Conditions Say About The Right Side Of ‘L’

Chinese exports rose 12.9% year-over-year in April 2018. China Exports, Jan 2008 - Apr 2018(see more posts on China Exports, ) - Click to enlarge Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot...

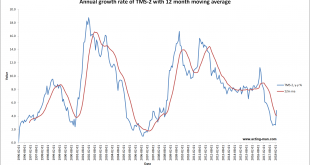

Read More »US Money Supply Growth Jumps in March , Bank Credit Growth Stalls

A Movie We Have Seen Before – Repatriation Effect? There was a sizable increase in the year-on-year growth rate of the true US money supply TMS-2 between February and March. Note that you would not notice this when looking at the official broad monetary aggregate M2, because the component of TMS-2 responsible for the jump is not included in M2. Let us begin by looking at a chart of the TMS-2 growth rate and its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org