Summary Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody’s cut the outlook on Pakistan’s B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index Brazil’s government its split on the inflation target for 2021. Ivan Duque will be the next president of Colombia. Stock Markets In the EM equity space as measured by MSCI, Mexico (+2.4), Turkey (+1.7%), and Russia (+1.5%) have outperformed this week, while the Philippines (-6.6%), UAE (-4.3%), and Thailand (-3.9%) have underperformed. To put this in better

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, Colombia, emerging markets, Featured, Hungary, Israel, Malaysia, newsletter, Pakistan, Saudi Arabia

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

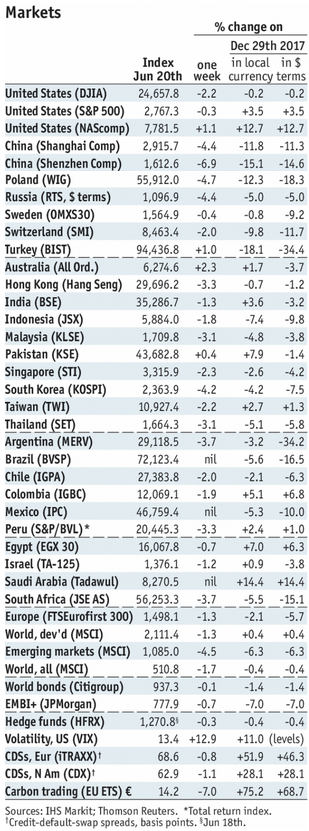

Stock MarketsIn the EM equity space as measured by MSCI, Mexico (+2.4), Turkey (+1.7%), and Russia (+1.5%) have outperformed this week, while the Philippines (-6.6%), UAE (-4.3%), and Thailand (-3.9%) have underperformed. To put this in better context, MSCI EM fell -2.4% this week while MSCI DM fell -0.8%. In the EM local currency bond space, Mexico (10-year yield -28 bp), South Africa (-14 bp), and Poland (-7 bp) have outperformed this week, while Czech (10-year yield +10 bp), Israel (+10 bp), and Hungary (+9 bp) have underperformed. To put this in better context, the 10-year UST yield fell 3 bp to 2.91%. In the EM FX space, ARS (+4.3% vs. USD), MXN (+2.9% vs. USD), and TRY (+1.3% vs. USD) have outperformed this week, while PKR (-1.7% vs. USD), CNH (-1.1% vs. USD), and TWD (-0.9% vs. USD) have underperformed. To put this in better context, MSCI EM FX fell -0.6% this week. |

Stock Markets Emerging Markets, June 20 |

MalaysiaNor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Shamsiah was Deputy Governor until November 2016 and helped investigate the 1MDB scandal. She replaces Muhammad Ibrahim, who resigned from the job this month due to questions about the central bank’s role in a deal linked to 1MDB. Shamsiah’s five-year term will reportedly start July 1. PakistanMoody’s cut the outlook on Pakistan’s B3 rating to negative from stable. The agency said the move was driven by heightened external vulnerability, noting that foreign reserves have fallen to low levels. We note PKR has been devalued three times since December and so there are clear pressures building. Our own ratings showed Pakistan’s implied rating falling sharply to B/B2/B vs. actual ratings of B/B3/B. Still, we are not sure a cut to Caa territory is warranted. HungaryNational Bank of Hungary tiled more hawkish. While keep rates steady this week, the bank said that “the current loose monetary conditions can no longer prevail up to the end of the 5 to 8-quarter horizon” that held earlier. It also removed language saying monetary policy would be kept loose for “an extended period.” Lastly, the bank identified two risk scenarios that would require tightening. One was sustained capital outflows from EM that lead to further currency depreciation and higher inflation, and the second was rising wages that feed through to inflation. IsraelIsraeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. Sara Netanyahu was charged with using nearly $100,000 of state money to cover unauthorized spending on meals between September 2010-March 2013, which she denies. The charges come as the Attorney General is deciding whether to indict Netanyahu himself on corruption charges. Saudi ArabiaMSCI added Saudi Arabia and Argentina to its Emerging Markets index. It will officially reclassify both starting in June 2019. MSCI dropped Argentina to Frontier status back in 2009. MSCI had delayed a decision last year, saying it needed more time to assess the “irreversibility” of President Macri’s changes. Lastly, MSCI announced it was reviewing Kuwait for possible inclusion in its Emerging Market index. BrazilBrazil’s government is split on the inflation target for 2021. The Treasury reportedly wants to reduce it to 3.75% while the Planning Ministry wants to keep it steady at 4%. The targets for 2019 and 2020 are 4.25% and 4% +/-1.5 percentage points, respectively. This compares to the 2018 target of 4.5% +/- 2 percentage points. ColombiaIvan Duque will be the next president of Colombia. Duque won the second round handily by 54-42%, with 4% casting blank ballots. Duque is a protege of former President Alvaro Uribe, with both taking a hardline approach to the rebels. Duque wants to rework the FARC peace deal. He has also pledged to cut taxes, which Fitch warned would make the 2019 deficit target difficult to meet. |

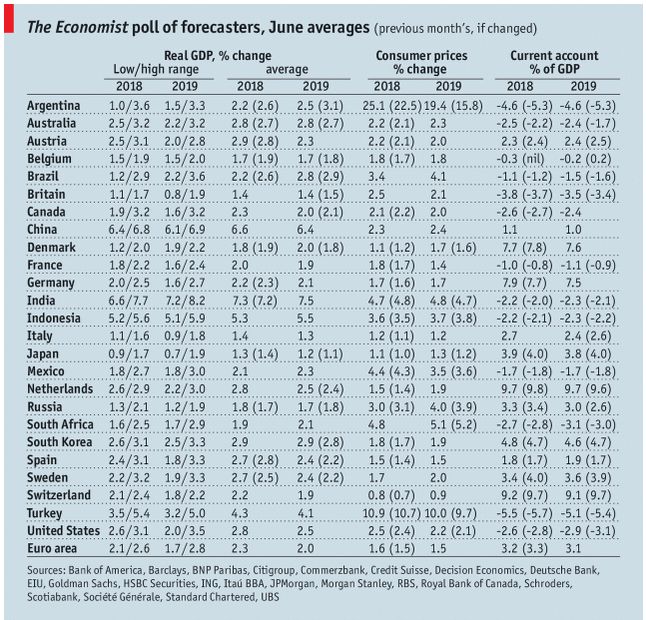

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Colombia,Emerging Markets,Featured,Hungary,Israel,Malaysia,newsletter,Pakistan,Saudi-Arabia