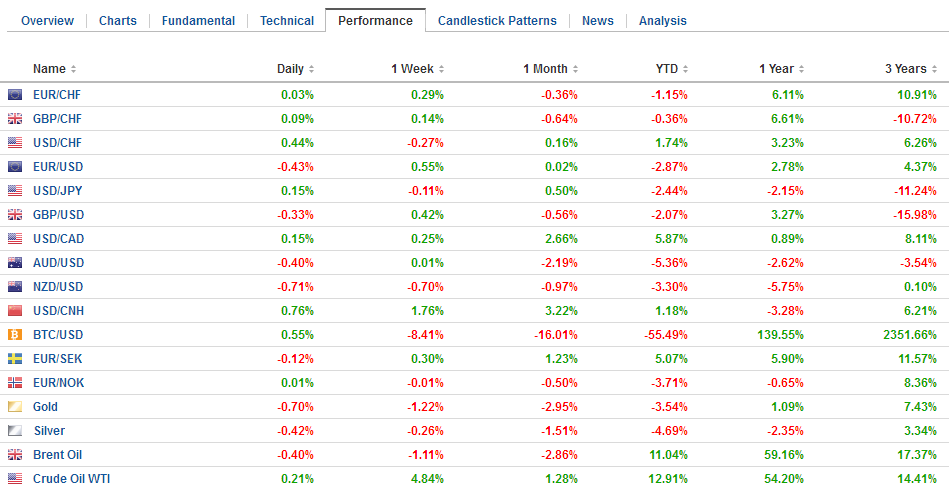

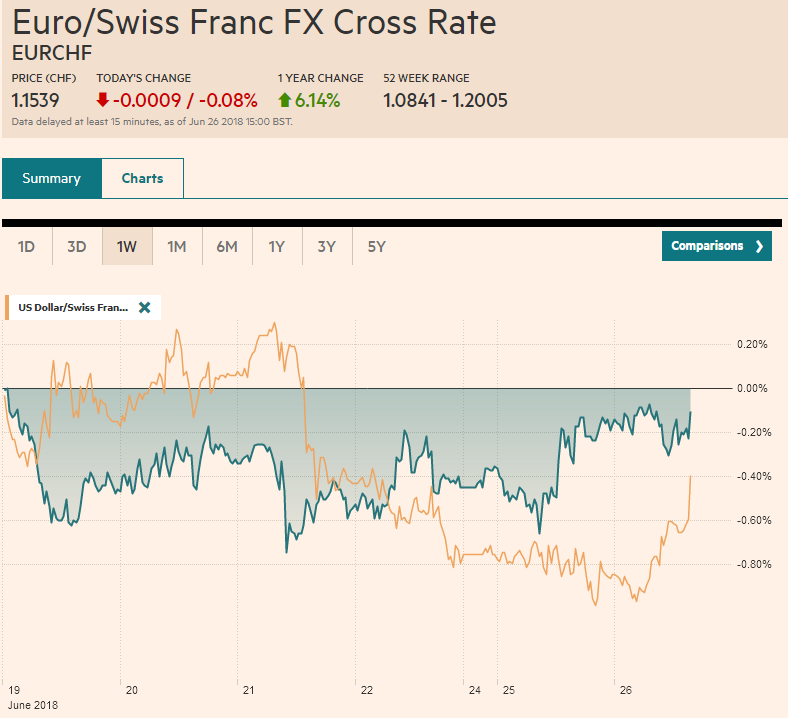

Swiss Franc The Euro has fallen by 0.08% to 1.1539 CHF. EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets have stabilized today after yesterday’s rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China’s retaliatory tariffs on the US is still ten days off. The immediate focus is on actions expected to curb the technology transfer. However, there have been conflicting signals over the intent. Treasury Secretary Mnuchin, who is seen as one of the remaining voices that try to minimize or soften, the administration’s conflict with, well, the world, sought to broaden the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, SPY, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% to 1.1539 CHF. |

EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe global capital markets have stabilized today after yesterday’s rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China’s retaliatory tariffs on the US is still ten days off. The immediate focus is on actions expected to curb the technology transfer. However, there have been conflicting signals over the intent. Treasury Secretary Mnuchin, who is seen as one of the remaining voices that try to minimize or soften, the administration’s conflict with, well, the world, sought to broaden the actions on intellectual property, by downplaying that it is aimed at China. Navarro, head of the National Trade Council, has pushed aside Mnuchin’s comments and reaffirmed that the Section 301 investigation was about China. Last week in Sintra, there was nearly universal agreement among central bankers that the escalating trade tensions posed risks to the economic outlook. This assessment resonates among investors, many, like ourselves, are watching late-cycle data accumulate in the US, Europe, and Japan. The large fiscal stimulus that is in the pipeline in the US, and the relatively closed nature of the US economy (exports plus imports as a percentage of GDP), leaves the world’s largest economy in a better position to weather the storm. However, as has repeatedly been experienced, American prosperity is limited if large parts of the world economy are under duress. Equity markets have steadier today, though quarter-end adjustments continue. Japanese equities rose fractionally, and those bourses open late tended to do better. China’s Shanghai Composite, the Hang Seng, an index H-shares that trade in HK, and Korea and Taiwan’s markets extended declines. The MSCI Asia Pacific Index fell nearly 1% initially before recovering to close less than 0.1% lower. It was near the high of the session, barely it back into yesterday’s range. |

FX Performance, June 26 |

European bourses are mostly edging higher in quiet turnover. The Dow Jones Stoxx 600 is up about 0.3%, led by utilities, information technology, and materials. Telecom and health care are laggards. Italy’s bourse is outperforming and with its nearly 0.8% gain, today pushes the DAX to the bottom of the major markets over the past five sessions with almost a 3% loss. However, in the fixed income side, Italian bonds are softening in line with other peripheral bond markets, with a 2-3 bp increase in yields. Greek bonds stand out. They are rallying in the aftermath of S&P’s decision to boost the country’s credit rating one notch to B+ and changed the outlook to stable from positive.

US stocks are little changed after yesterday’s slide. The Dow Jones Industrials closed below the 200-day moving average for the first time in two years. The S&P 500 gapped lower yesterday, and that gap has added significance because the gap was below last week’s low. The gap was also below the uptrend line drawn off the early and late May lows and last week’s lows. The gap, found between 2742.9 and 2752.7, is likely to be an important area to watch. We suspect that with corporate share buybacks likely entering the quiet period ahead of earnings, and concerns about the impact of trade tensions, may turn investors cautious, especially given the inflows into US equity funds in Q2.

Yesterday’s dollar losses are being pared, though they were initially extended in Asia. The Dollar Index is trying to snap a three-day slid and found support ahead of the 61.8% retracement of the ECB-induced rally from June 14. That retracement is just above 94.10. A move above 95.00 would lift the tone.

The similar retracement in the euro is found at $1.1720, the single currency’s session high. Initial support is seen near $1.1640. There are several large options expires today beginning with 1.5 bln euros at $1.1650. An expiring option struck at $1.1690 is for 1.8 bln euros and another 2,9 bln euros at $1.1625. Meanwhile, Merkel is still seeking consensus at the European Council later this week. Both immigration and EU reform are divisive issues. At the same time, German Interior Minister and head of the CSU in Bavaria played down the risks to the alliance with Merkel’s CDU.

The dollar held yesterday’s low against the yen, a little below JPY109.40. It is near the highs of the session (~JPY109.80) near midday in London. There are also large option expirations today, featuring $1 bln at JPY109.60 and $1.1 bln struck at JPY110.00.

Sterling is threatening to take the dubious honor of being the weakest currency of the day from the New Zealand dollar. In a note from a fortnight ago, the RBNZ indicated policy was on hold for a considerable period, and the currency is still elevated. The results of this weeks RBNZ meeting will be known early Thursday in Wellington (late Wednesday in the US). The New Zealand dollar appears headed to retest last week’s low near $0.6825.

The BOE’s McCafferty, a dissenting hawk, sticks to his knitting in what may be his last remarks before stepping down. McCafferty warns that the UK economy may be rebounding and sees a significant risk that inflation stays about its target. Haskel, who will replace him, agrees there is little scope for lower rates but identifies potential slack in the labor market. Haskel identifies his views as consistent with the BOE’s broad direction of interest rates–modest rise is needed in the medium term. There is no discussion of the immediate term and the outlook for the August 2 MPC meeting (Haskel will not vote) where the market has discounted a nearly 70% chance of a hike. It had dipped below 50% before last week’s hawkish hold.

At roughly $1.3210, sterling retraced 50% of the rally spurred by the BOE. It has traded on both sides of yesterday’s range. A close below $1.3220, yesterday’s low would be a poor sign. The 61.8% retracement is found a little below $1.3185.

The Canadian is trading quietly inside yesterday’s range. The Australian dollar has slipped through yesterday’s lows but may find support ahead of $0.7375.

The North American data stream is light. The US reports include house prices, Richmond Fed survey, and the Conference Board’s consumer confidence measures. The Fed’s Bostic and Kaplan speak in the afternoon (ET).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Featured,newsletter,SPY