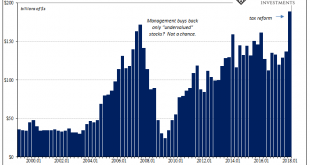

When it comes to the stock market and the corporate cash flow condition, our attention is usually drawn to stock repurchases. With good reason. These controversial uses of scarce internal funds are traditionally argued along the lines of management teams identifying and correcting undervalued shares. History shows, conclusively, that hasn’t really been true. Last year’s tax reform law was meant ideally to spur...

Read More »Learn about Crypto’s true revolutionary potential

The publication of the Bitcoin white paper immediately after the outbreak of the global financial crisis in 2008 is hardly a mere coincidence. The financial collapse especially touched on one crucial question: Money talks, but who talks money if you will? According to Satoshi Nakamoto, the pseudonym behind Bitcoin, it’s the world’s central and commercial banks which rule over our money. As a careful analysis of the...

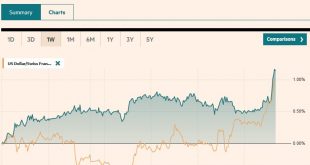

Read More »FX Daily, July 12: Dollar Remains Firm as Risk Returns

Swiss Franc The Euro has risen by 0.65% to 1.1698 CHF. EUR/CHF and USD/CHF, July 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar has broken out against the Japanese yen. Despite the global equity drop and decline in US yields, which often underpin the yen, the yen fell to its lowest level since early January yesterday and is continuing to sell-off today. The...

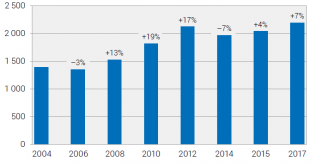

Read More »Research and Development: Federal Expenses and Staff in 2017

R & D expenses of the Confederation at record high 12 July 2018 (FSO) – In 2017, the Confederation spent 2.2 billion Swiss francs on research and experimental development (R & D), an increase of 7% compared to the last survey in 2015. The biggest share of this record amount was R & D contributions for research activities. At the same time, federal R & D personnel fell by 4% to 875 full-time...

Read More »Will AI “Change the World” Or Simply Boost Profits?

The real battle isn’t between a cartoonish vision or a dystopian nightmare–it’s between decentralized ownership and control of these technologies and centralized ownership and control. The hype about artificial intelligence (AI) and its cousins Big Data and Machine Learning is ubiquitous, and largely unexamined. AI is going to change the world by freeing humankind from most of its labors, etc. etc. etc. Let’s start by...

Read More »Work pension challenge targets age-related unfair dismissals

Some older employees fear being axed from the workplace because they cost to much to employ. A lobby group representing the interests of older workers has launched a people’s initiative to reform the occupational pension system to reduce the incentive for employers to sack people once they pass the age of 50. The Workfair 50+external link group announced on Tuesday its intention of forcing a nationwide vote on the...

Read More »Central Bank Investment Strategies

A survey of central banks and sovereign wealth funds by Invesco sheds light on their investment plans. The traditional separation of markets and the state may be helpful for ideological arguments, but the real situation is more complicated. Central banks and their investment vehicles (sovereign wealth funds) are market participants. In some activities, such as custodian, central banks compete with the private sector....

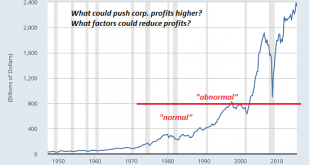

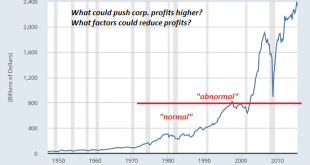

Read More »We Are All Hostages of Corporate Profits

We’re in the endgame of financialization and globalization, and it won’t be pretty for all the hostages of corporate profits. Though you won’t read about it in the mainstream corporate media, the nation is now hostage to outsized corporate profits. The economy and society at large are now totally dependent on soaring corporate profits and the speculative bubbles they fuel, and this renders us all hostages: “Make a move...

Read More »Gold – Macroeconomic Fundamentals Improve

A Beginning Shift in Gold Fundamentals A previously outright bearish fundamental backdrop for gold has recently become slightly more favorable. Ironically, the arrival of this somewhat more favorable situation was greeted by a pullback in physical demand and a decline in the gold price, after both had defied bearish fundamentals for many months by remaining stubbornly firm. The eternal popularity contest… - Click to...

Read More »Credit Suisse: “Our Risk Appetite Index Is Near Panic”

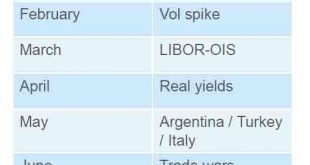

Sure, it’s been a bad year for investors, with the S&P posting the smallest of gains in the first half (all of which thanks to tech stocks) after several hair-raising, monthly incidents including February’s vol-spike, April’s real yield scare, May’s Emerging Market massacre and June’s trade war fears as shown in the following Citi chart… … but it’s hardly been apocalyptic: in fact, most of the shocks that took...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org