Sure, it’s been a bad year for investors, with the S&P posting the smallest of gains in the first half (all of which thanks to tech stocks) after several hair-raising, monthly incidents including February’s vol-spike, April’s real yield scare, May’s Emerging Market massacre and June’s trade war fears as shown in the following Citi chart… … but it’s hardly been apocalyptic: in fact, most of the shocks that took place were well telegraphed to those who paid attention. And yet, according to Credit Suisse, after the first six months of the year investors are in a state of near shock. Next Month, Another Mishap - Click to enlarge According to Credit Suisse economist James Sweeney, “our Global Risk Appetite Index is

Topics:

Tyler Durden considers the following as important: 2) Swiss and European Macro, Credit Suisse, Featured, newsletter

This could be interesting, too:

investrends.ch writes UBS zahlt für CS-Steuerstreit mit US-Justizministerium weitere halbe Milliarde

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

| Sure, it’s been a bad year for investors, with the S&P posting the smallest of gains in the first half (all of which thanks to tech stocks) after several hair-raising, monthly incidents including February’s vol-spike, April’s real yield scare, May’s Emerging Market massacre and June’s trade war fears as shown in the following Citi chart…

… but it’s hardly been apocalyptic: in fact, most of the shocks that took place were well telegraphed to those who paid attention. And yet, according to Credit Suisse, after the first six months of the year investors are in a state of near shock. |

Next Month, Another Mishap |

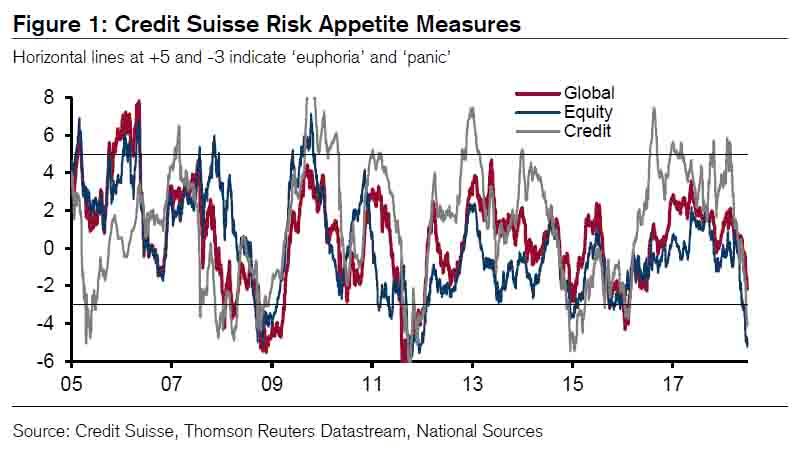

| According to Credit Suisse economist James Sweeney, “our Global Risk Appetite Index is near panic” and adds that “our equity-only (relative performance across EM and DM countries) and credit-only (relative performance of US IG sector/rating/maturity buckets) versions are already there.”

What is causing paralysis? According to the second largest Swiss bank, the investor “panic” can be attributed to:

To Sweeney, who focuses mostly on economic developments, “there is a significant chance that our global risk appetite index falls below -3 in the coming months, which we define as “panic”.

|

Credit Suisse Measures, 2005 - 2018 |

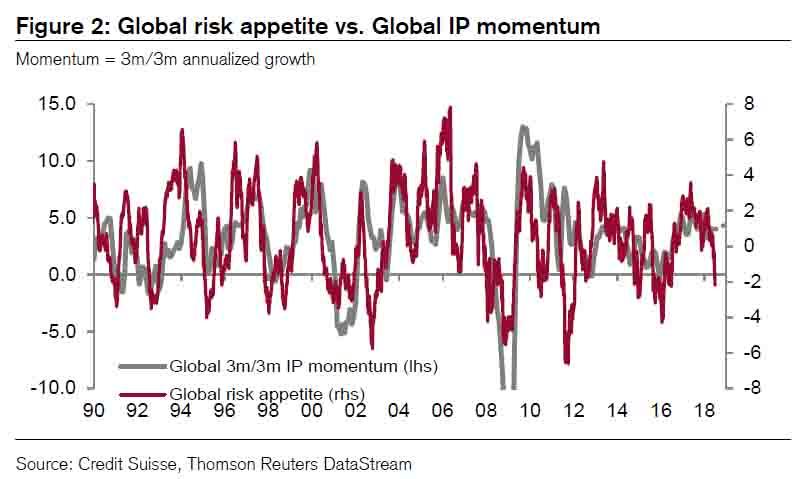

| Indeed, as the chart below shows, IP is nowhere near “panic” territory, suggesting that there is something well beyond economic sentiment to spook investors and traders.

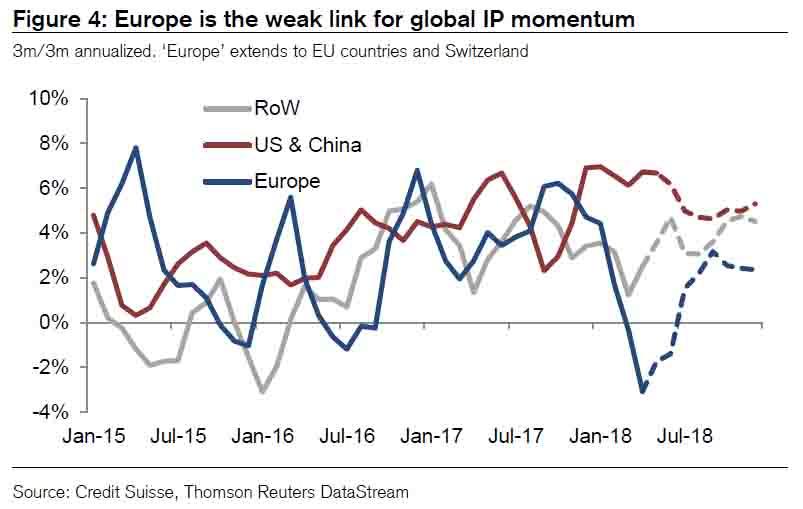

And yet, one specific region poses significant risk to the future global economy: Europe. According to Sweeney, “at the end of last year European business surveys hit multidecade highs and IP momentum reached 7%. Such growth was unsustainable but the abruptness of the slowdown has been extreme.” |

Global Risk vs Global IP Momentum, 1990 - 2018 |

| That’s putting it mildly, because after Europe’s cliff-like divergence in Q1 when the Citi eco surprise index plunged to near record low, “broad signs of a Q2 rebound did not emerge, contrary to our expectations. Whether we should “give up” on European growth is a central question now, which we try to answer by addressing what went wrong in the first place.”

Sweeney’s take: “for global growth to stay strong in the second half of 2018, European growth must improve.” Which in a time of escalating protectionism and trade war for the export heavy continent, could be a major problem. However, there is a silver lining: if and when investors panic, and the projected IP rebound fails to materialize, central banks will have no choice but to respond, effectively voiding any ECB plans to not only end QE but to hike rates, whether in the summer of 2019 or the last months of the year. In short: global investors panicking is the best possible thing that could happen to, well, global investors as it means another bailout from central banks. Unless of course, central banks refuse to get involved this time, and leave markets to their own devices. Which could be a problem: with 40% of today’s traders never living through a real market crisis where central banks did not step in, the next time price discovery takes place without a central bank backstop, investors may just learn what panic really means. |

Europe Global IP momentum, Jan 2015 - Jul 2018 |

Tags: Credit Suisse,Featured,newsletter