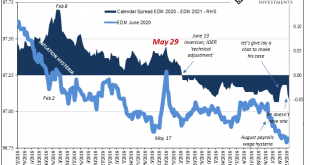

June 13 sticks out for both eurodollar futures as well as IOER. On the surface, there should be no bearing on the former from the latter. They are technically unrelated; IOER being a current rate applied as an intended money alternative. Eurodollar futures are, as the term implies, about where all those money rates might fall in the future. Still, the eurodollar curve inverted conspicuously starting June 13. That was...

Read More »Seasonality in Cryptocurrencies – An Interesting Pattern in Bitcoin

Looking for Opportunities The last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again. There is a simple reason for this: the lack of extensive historical data for...

Read More »Novartis to cut 2,200 Swiss jobs by 2020

Novartis currently employs 13,000 people across Switzerland The pharmaceutical giant Novartis will cut about 2,200 jobs in Switzerland over the next four years. Nearly 1,500 jobs are affected in production and about 700 in services. This restructuring is part of the manufacturing strategy launched in 2015 to adapt the industrial base to a reduced product portfolio, announced Novartis on Tuesdayexternal link. It...

Read More »FX Daily, September 26: The Dollar Index has Fallen Four of the Five Times the FOMC met this Year

Swiss Franc The Euro has risen by 0.13% at 1.1373 EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading with a softer bias in tight ranges. The euro and sterling have been confined to yesterday’s ranges, while the greenback briefly traded above JPY113.00 for the first time in two months. The South African rand and Turkish...

Read More »Almost one in five Swiss residents have dual nationality

Almost a quarter of Swiss dual nationals possess an Italian passport. Around 17% of Swiss residents over the age of 15 hold two passports. The canton of Geneva has the highest proportion of dual nationals at 45%. According to figures released by the Federal Statistical Office (FSO) on Tuesday, the double nationality rate exceeds 20% in the cantons of Zurich, Basel City, Ticino, Vaud and Neuchâtel. The cantons with the...

Read More »Droit du Seigneur and the Neofeudal Privileges of Class in America

Want to understand the full scope of neofeudalism in America? Follow the money and the power and privilege it buys. The repugnant reality of class privilege in America is captured by the phrase date rape: the violence of forced, non-consensual sex is abhorrent rape when committed by commoner criminals, but implicitly excusable date rape when committed by a member of America’s privileged elite. Compare the effectiveness...

Read More »We Need a Free Market in Interest Rates

We do not have a free market in interest rates today. We have not had one since the creation of the Fed in 1913. The Fed began buying bonds almost immediately, which pushes up the price and hence pushes down the interest rate. However, as I discuss in my theory of interest and prices, the Fed creates a resonant system with positive feedback loops. It wants lower rates (so the government can borrow more, more cheaply)...

Read More »SNB appoints new delegate for regional economic relations for Central Switzerland

With effect from 1 October 2018, Gregor Bäurle will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Central Switzerland region. He succeeds Walter Näf, who is taking on a new position, representing the SNB in the Swiss delegation to the OECD in Paris as of 1 January 2019. Following a research stay in the US as a visiting scholar, Gregor Bäurle received his doctorate in...

Read More »FX Daily, September 25: Greenback Remains at the Fulcrum

Swiss Franc The Euro has risen by 0.35% at 1.137 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few...

Read More »Swiss Health Insurance Costs to Rise Further in 2019

More bad news for Swiss household budgets was released today for residents of all but three Swiss cantons. ©-Hai-Huy-Ton-That-_-Dreamstime.com_ - Click to enlarge Health insurance premiums in 2019 will be on average 1.2% higher than in 2018 across Switzerland as a whole. However, within this figure there are significant cantonal variations. Hardest hit will be residents of Valais (+3.6%) and Neuchâtel (+3.1%), while...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org