The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation of the situation on foreign exchange as “fragile”. The SNB emphasized that the Swiss franc had appreciated noticeably against major currency as well as against emerging currencies, and reiterated that it was willing to intervene in the foreign exchange market in order to keep the value of the Swiss

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter, Pictet Macro Analysis, Swiss franc appreciation, Swiss headline inflation, swiss inflation forecasts, Swiss monetary policy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

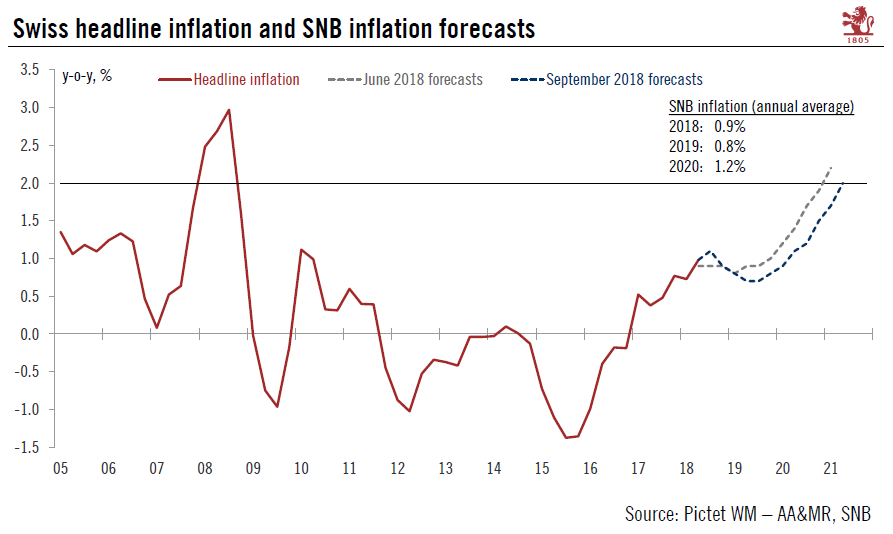

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019.

At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation of the situation on foreign exchange as “fragile”. The SNB emphasized that the Swiss franc had appreciated noticeably against major currency as well as against emerging currencies, and reiterated that it was willing to intervene in the foreign exchange market in order to keep the value of the Swiss franc in check.

The SNB acknowledged the dynamism of Swiss growth in 2018. It now anticipates GDP growth of 2.5-3.0% in 2018, up from its earlier forecast of around 2%. But the SNB also stressed that relatively high growth in the first half of the year was due in large part to special factors.

| The most important element in today’s SNB press release was the significant downward revision of the 2020 consumer inflation forecast from 1.6% to 1.2%, which the central bank said was due to renewed appreciation of the Swiss franc. Delayed market expectations for ECB rate hikes, which mean less depreciation of the CHF than in previous forecasts, may also have had a role in this revision.

The downward revision of inflation forecasts for 2020 and its toning down of the good news on economic growth send dovish signals. Recent developments confirm the SNB’s view of the fragility of currency markets. These factors are likely to encourage the SNB to maintain its ultra-loose monetary stance so as “to keep the attractiveness of Swiss franc investments low and ease pressure on the currency”. Our call remains unchanged: we expect the first 25bp policy rate increase from the SNB in September 2019, after the first ECB deposit rate hike the same month. |

Swiss Monetary Policy, 2005 - 2018(see more posts on Swiss headline inflation, ) |

Tags: Featured,Macroview,newsletter,Swiss franc appreciation,Swiss headline inflation,swiss inflation forecasts,Swiss monetary policy