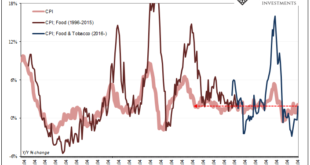

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More »Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

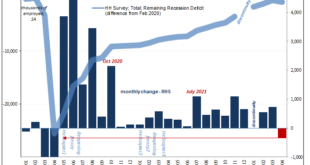

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem. The Establishment Survey was right in the (statistical) zone, so for most of the public the...

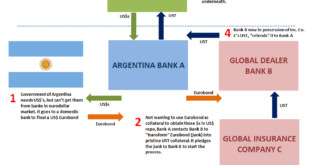

Read More »Eurobonds Behind Euro$ #5’s Collateral Case

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat. So, how smart can Eurobond agents really be if they’ve gone and done it again? What is it? Let’s roll the clock back to the landmine of 2018. Collateral shortage,...

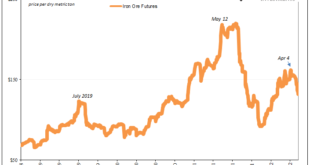

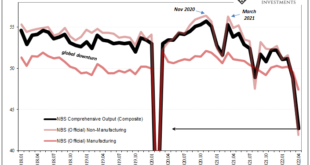

Read More »Industrial Synchronized Demand

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April. This despite supply bottlenecks and production shortfalls which continue to plague each. Copper has now fallen to its lowest since last...

Read More »Who’s Playing Puppetmaster, And Who Is Master of Puppets

Cue up the old VHS tapes of Bill Clinton. The former President was renowned for displaying, anyway, great empathy. He famously said in October 1992, weeks before the election that would bring him to the White House, “I feel your pain.” What pain? As Clinton’s chief political advisor later clarified, “it’s the economy stupid.” Jay Powell is no retail politician in near the same company as Mr. Clinton. Yet, the Federal Reserve’s current Chairman is attempting to...

Read More »China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious. Why? For one thing, she noted how Europe produces a lot of stuff that, at the margins of its economy, make the whole system go. Or don’t go, as each periodic case may be: Europe in...

Read More »Collateral Shortage…From *A* Fed Perspective

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods. There was, as I wrote...

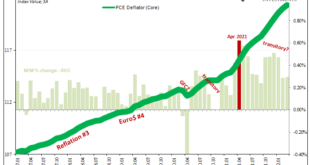

Read More »Some ‘Core’ ‘Inflation’ Difference(s)

The FOMC meets next week, with everyone everywhere expecting a 50 bps rate hike to be announced on Wednesday. Yesterday’s “unexpected” and “shocking” negative GDP is unlikely to deter anyone on the committee. Most have already dismissed it as nothing more than quirky, temporary factors, not unlike when they did the same to Q1 2014’s similarly negative result. At least that one had the Polar Vortex (uh oh). Jay Powell’s group can’t see beyond the US border, doesn’t...

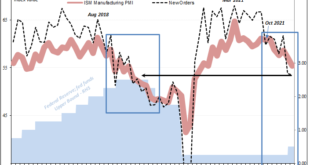

Read More »Synchronized Manufacturing, Hopefully Not Mao

This is one of those cases when Inigo Montoya, the lovable if fictional rapscallion from the movie The Princess Bride, would pop into the scene to devastatingly deliver his now famous rebuke. Last week, China’s one-man Dear Leader said that the country was going to start up its own version of Build Back Better. Immediately cheered by the entire Western media, every single news story contained the same phrase. “All out.” Cue Mr. Montoya’s wry witticism. . Did...

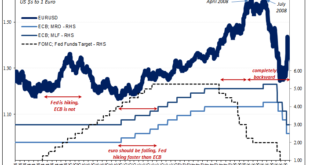

Read More »What Really ‘Raises’ The Rising ‘Dollar’

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials. A relatively more “hawkish” US policy therefore the wind in the sails of a “strong” dollar exchange regime. How else would we explain, for example, the euro’s absolute plunge since around May last year?...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org