This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious. Why? For one thing, she noted how Europe produces a lot of stuff that, at the margins of its economy, make the whole system go. Or don’t go, as each periodic case may be: Europe in particular benefited from the march of globalisation. . Trade as a share of GDP rose from 31% to 54% in the euro area between 1999 and 2019, whereas in the United States it rose from just 23% to 26%. Europe’s integration with global value chains was deeper too, with GVC participation roughly 20

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Bunds, Christine Lagarde, Consumer Confidence, Consumer Sentiment, currencies, ECB, economy, Europe, Featured, Federal Reserve/Monetary Policy, GDP, Germany, jay powell, Markets, newsletter, rate hikes, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious. Why?

For one thing, she noted how Europe produces a lot of stuff that, at the margins of its economy, make the whole system go. Or don’t go, as each periodic case may be:

|

|

| Trade as a share of GDP rose from 31% to 54% in the euro area between 1999 and 2019, whereas in the United States it rose from just 23% to 26%. Europe’s integration with global value chains was deeper too, with GVC participation roughly 20 percentage points higher than in the United States.

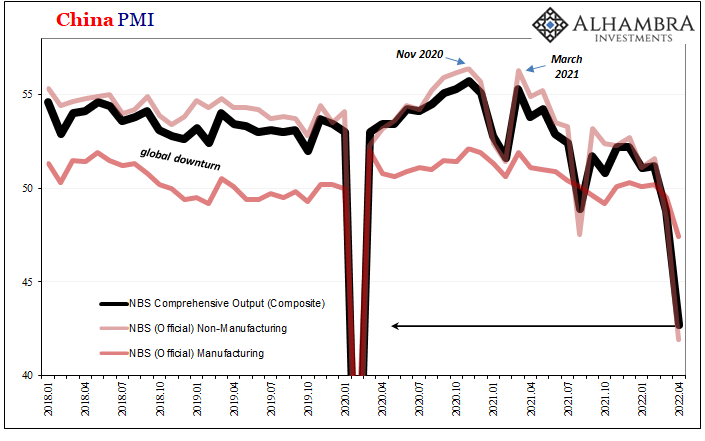

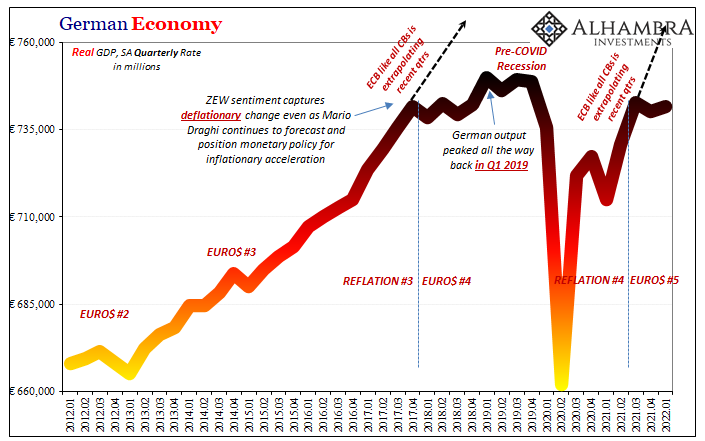

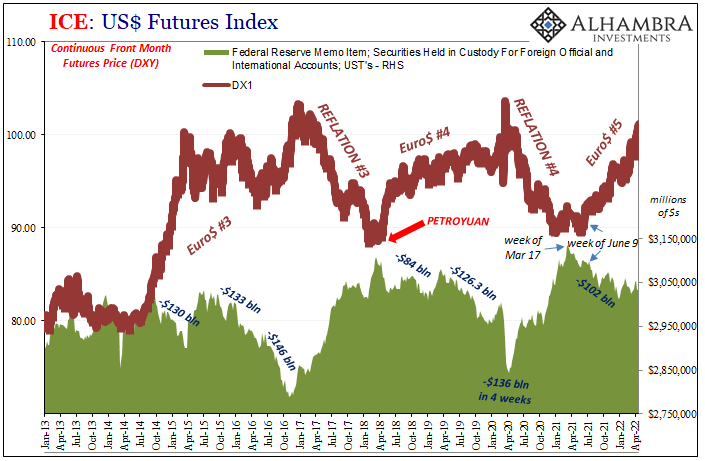

No wonder Germany and China (and Japan) are first on the receiving end. Trade requires, first and foremost, money to get done. Less fluid global money (and it needn’t always be in dollars since the eurodollar system transacts in any currency; thus, why Euro$ #2 seemed European centered yet devastated much of the global economy) then trade suffers. It really is that simple. Second, whatever your own policy settings or economic opinions, the local economy is going to be hugely influenced by events and conditions far away from home. For Europe, this means the country whose leader is that guy who’s become risibly comfortable running around in his Mao suit. |

|

| So, for Europe its high degree of trade means being susceptible to the availability of smooth finance along with the health of its chief customers. Don’t those add up to three strikes?The ECB is at least taking the possibility seriously. And with data increasingly forlorn all across the Continent, it’s actually fair to ask whether Europe gets very few if any rate hikes at all.

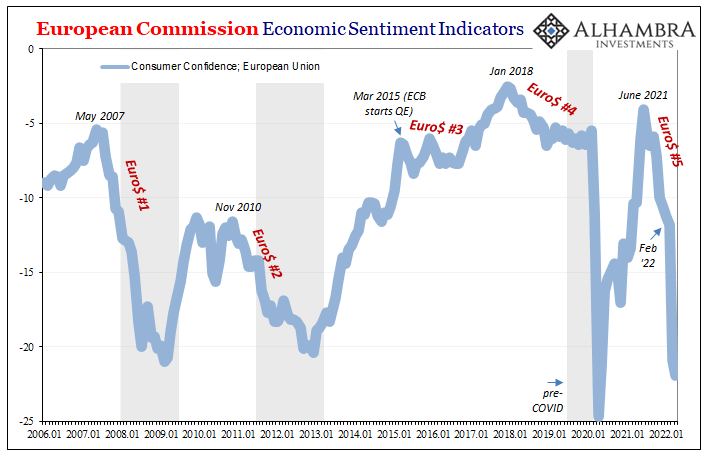

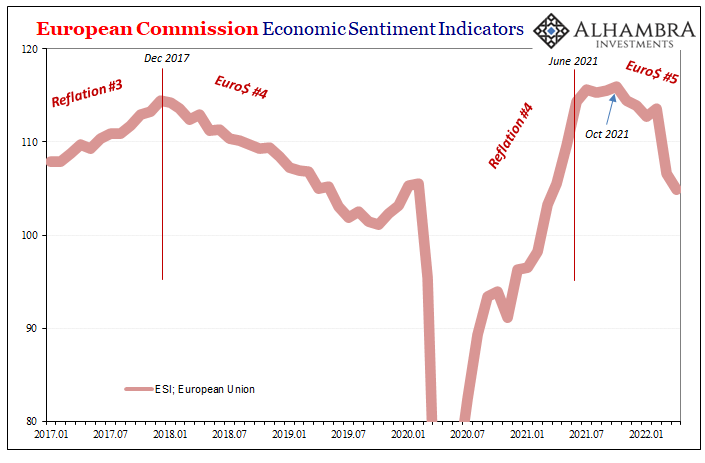

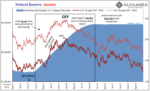

Another solid blow was issued by the European Commission which released just downright awful sets of Economic Sentiment Indicators (ESI). By far the worst – and perhaps most predictive – those for consumers. |

|

| Everyone will quickly blame the Russian invasion for the index’s utter collapse, but that’s only true for the more recent drop.

Consumer confidence, according to these numbers as well as a bunch of others, was already deep in the toilet by February 2022 (see: below). Every time sentiment has previously turned lower just a fraction of the way between June last year and February this year, a recession was quick to follow. |

|

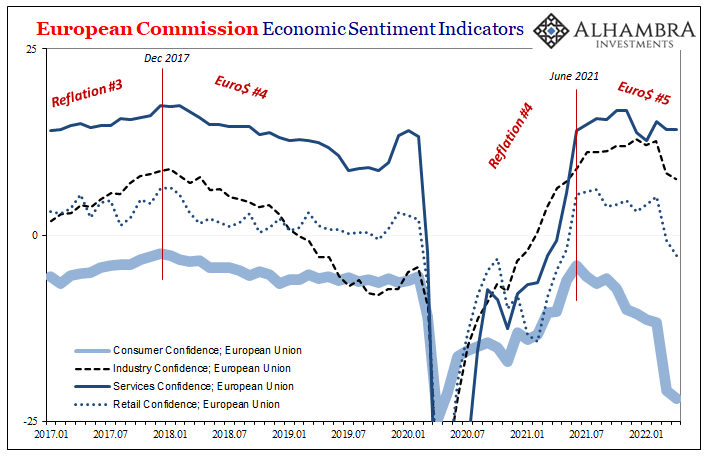

| Obviously, it’s not just consumers who have been feeling the pre-Russia pessimism. Out of the ESI’s four main groupings, only industry has held higher, but even that’s already rolled over.

Services sector confidence seems to have broken down around last October (recurring theme) and now declines already at levels equal to mid-2019 – just prior to that recession. More of a concern, confidence among retailers has sunk well below any point in 2019, never having achieved much lift even at the European rebound’s best point. What is, or should be, most troubling about all this is not really sentiment; rather, it’s how these trends in confidence mirror and corroborate a vast swath of economic data and market-based perceptions – beginning with the timing of Euro$ #5 (just like when Euro$ #4 arrived). |

|

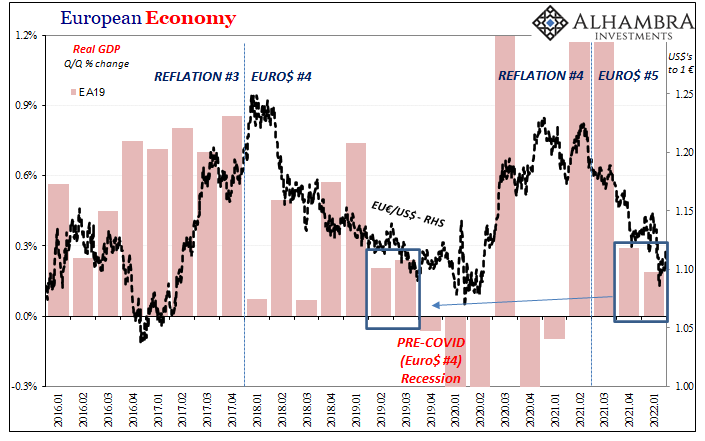

You can see how when the entire global economy began to pivot last May it had an effect on the Europeans even as during last year’s third quarter that economy was propelled by post-delta (or something) reopening. |

|

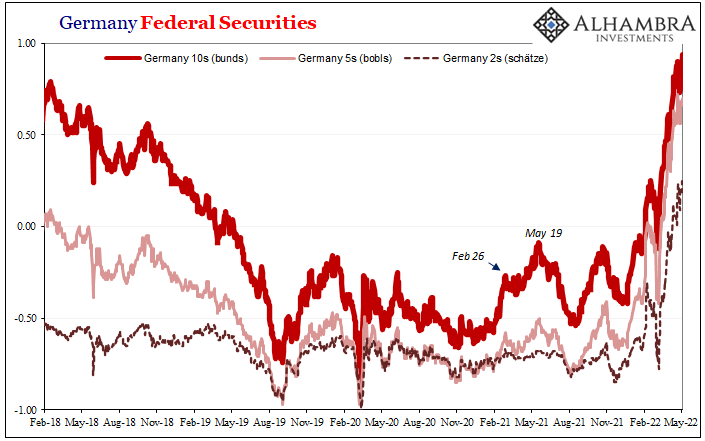

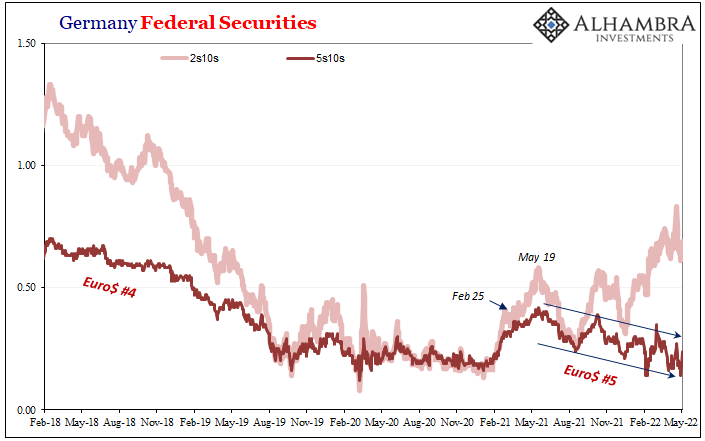

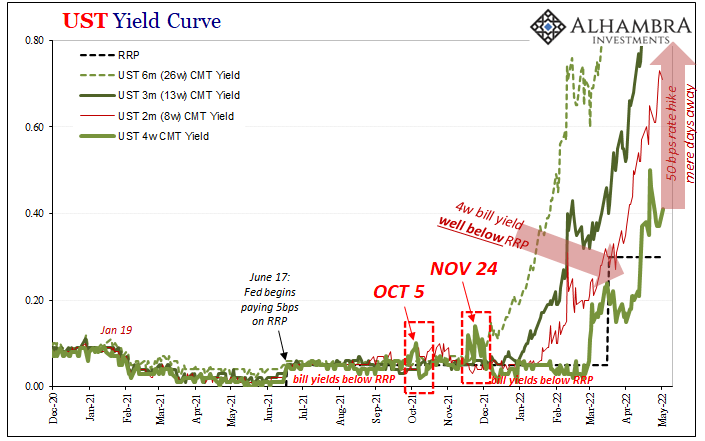

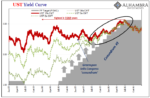

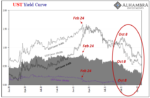

| Like the UST curve would, the German curve between the 5s and 10s shifted to flattening right in mid-May 2021 after having failed to steepen by all that much (for why the 2s10s is a different set of indications, you can go here or listen to our podcast discussion with MacroAlf all about European collateral).

The real kicker was October; or, when Euro$ #5 really got going. Another round of bobl to bund flattening accompanying that particular month featuring prominently across these sentiment trends along with the fact it’s also right there in European GDP, too; especially Germany and its heavy trade allocation to the Chinese (both ways). |

|

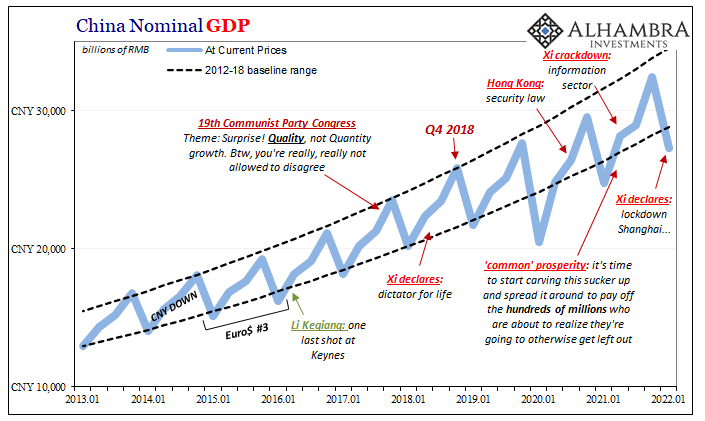

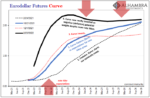

| Again, this is all familiar territory so long as you haven’t been captured by especially the American financial press getting all its “information” from Mr. Powell. Pretty much all the same factors as we witness today were already just as serious back in the middle of 2018, from a rising “dollar” (rapidly falling euro) to the Chinese increasingly struggling and then Europe piling in with two straight bad quarters.

I had cautioned in early August that year, and the same applies today (the race we all lose):

|

|

| The US would be unable to resist and inflation hysteria crept toward the even more hysterical.

That was 2017. In 2018, China’s economy has already slowed to a substantial degree and now Europe’s, too. Q1 2018 GDP was a meaningful step down from Q4 2017, a warning that at the very least the narrative on globally synchronized growth had some serious holes in it. GDP in Q2 has proved no better, as Eurostat reports. It was, actually, slightly less than Q1. The rather uncomfortable and eventually embarrassing rate cut punchline for Jay Powell, “There’s economic trouble brewing in the world, and if Europe’s rebound was foretelling of a global one…” was all you needed to know about what was going to come to a head late in 2018 and then pummel the world in 2019. It may be that European policymakers have learned a lesson from that experience which, obviously, their ultra-hawkish (if we’re being honest about bird avatars for policymakers, it’s really ostrich rather than either of the other two choices) compatriots in the US clearly have not. Then again, maybe Lagarde didn’t pay much attention to the ECB’s fumbling in 2018 and 2019 at all, rather she’s just being more pragmatic about Europe’s biggest customer and the growing fallout from Mr. Mao. And if so, as the global disease spreads for a fifth time, neither Europe nor America will be spared. Lagarde’s ECB might get spared this time, if only in the sense of avoiding another embarrassing error. Not Powell, though, as we’ll see tomorrow the FOMC charging headlong to fight an inflationary fire that’s quickly disappearing on its own, if it ever really existed to begin with. |

Tags: Bonds,Bunds,Christine Lagarde,Consumer Confidence,Consumer Sentiment,currencies,ECB,economy,Europe,Featured,Federal Reserve/Monetary Policy,GDP,Germany,jay powell,Markets,newsletter,rate hikes,Yield Curve