Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem. The Establishment Survey was right in the (statistical) zone, so for most of the public the labor market looks good. However, as I pointed out last week, the “other” labor data pointed to potentially serious problems in April; first decline in it, and a big one, since April 2020! . . . When the BEA previously reported that negative for Q1 GDP, it was likewise dismissed as quirky and

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, economy, employment, establishment survey, Featured, Federal Reserve/Monetary Policy, GDP, household survey, Labor, Markets, newsletter, payrolls, Productivity, wages

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

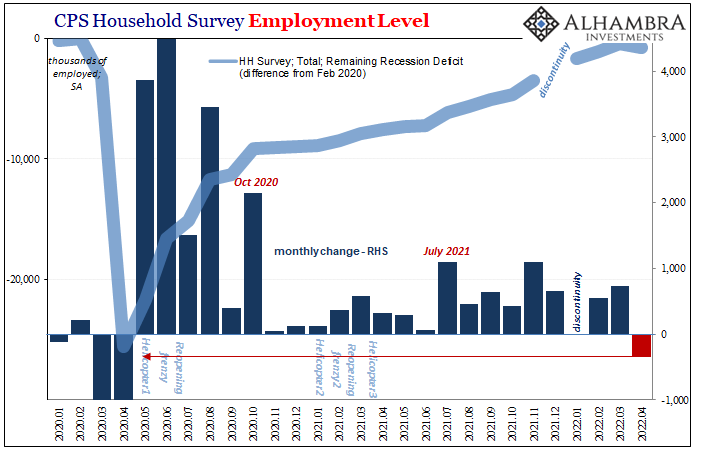

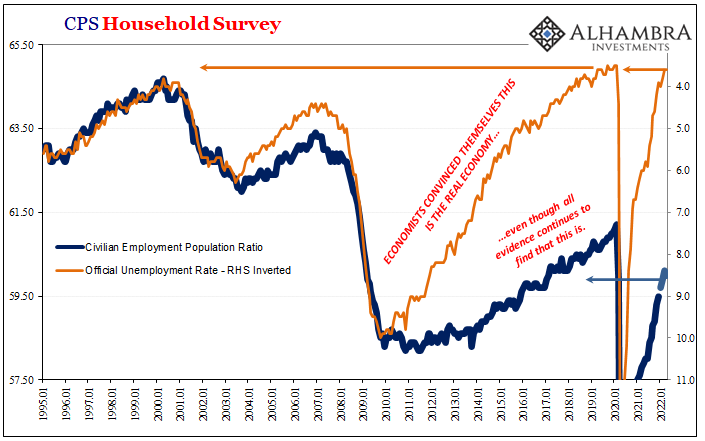

The Establishment Survey was right in the (statistical) zone, so for most of the public the labor market looks good. However, as I pointed out last week, the “other” labor data pointed to potentially serious problems in April; first decline in it, and a big one, since April 2020! |

|

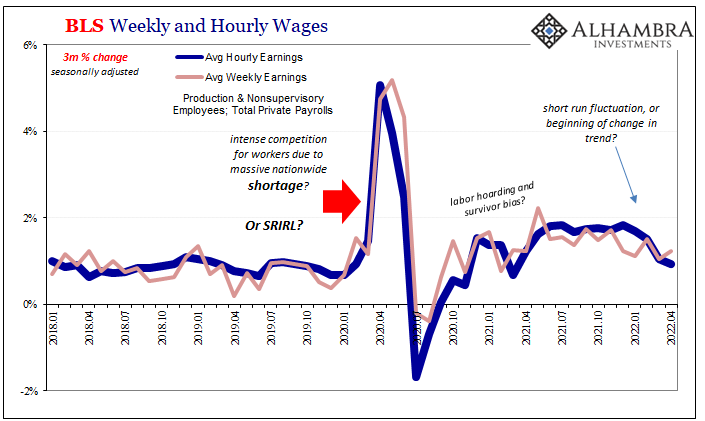

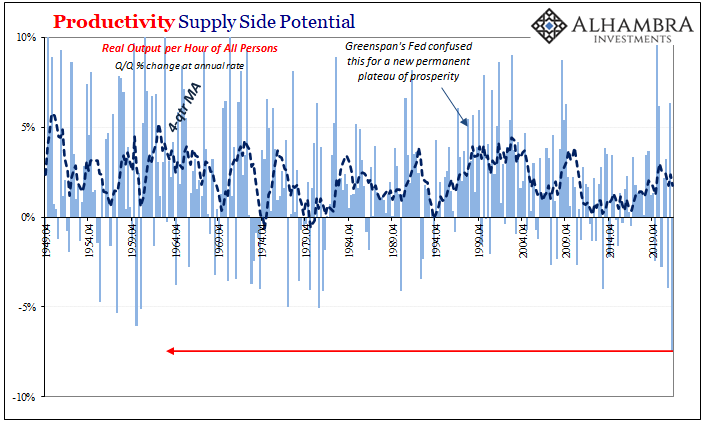

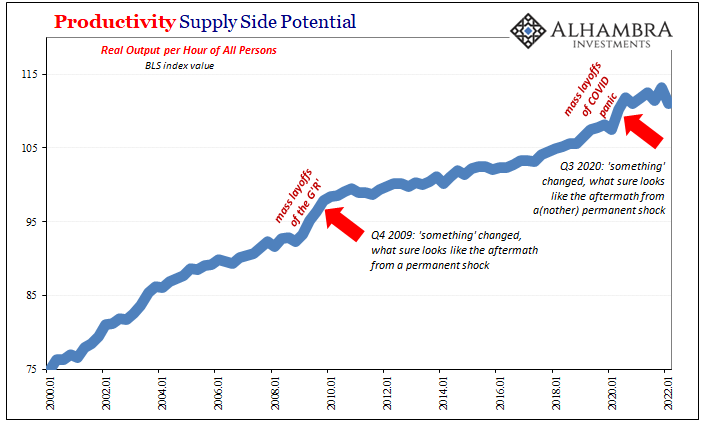

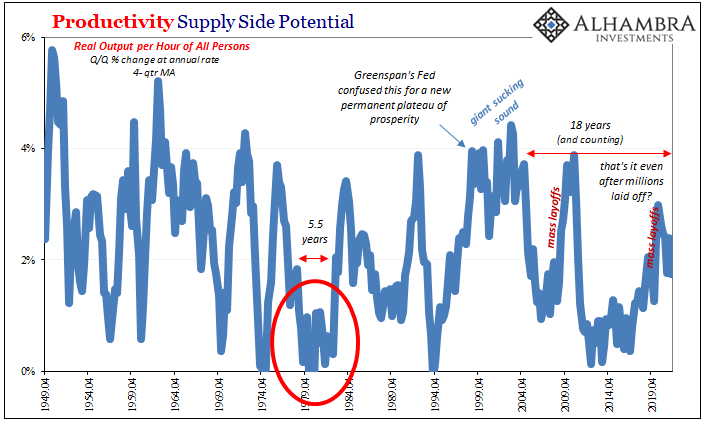

| When the BEA previously reported that negative for Q1 GDP, it was likewise dismissed as quirky and idiosyncratic. Yet, working together with the BLS, both government agencies last Thursday, the day before payrolls, published their estimates for productivity. Labor market trouble goes along with any unproductive use of workers.What they published flies in the face of all mainstream perception, the estimate a shocking result. With a negative GDP number, productivity wasn’t going to be good no matter what. But, as it turned out, it was the worst…ever. | |

| According to the blended results of BLS hours and BEA private output, Q1 2022 productivity declined at a 7.5% seasonally-adjusted annual rate. This kind of number, businesses aren’t going to be hiring no matter how many times the FOMC references “full employment” for their rate hikes. In fact, they’d be seeking to cut back for how weak the situation must be.

While the Establishment Survey whistled past the productivity graveyard, the HH Survey did not (though, you can just bet, next month’s HH will be “good” again and then we’ll see). Despite claims to the contrary, this was the second really bad quarter of productivity (like GDP) out of the previous three. |

|

| Working on three-quarters of a year when, taking account of inventory, output isn’t justifying the rebound in work.

That’s not the worst part, either. Instead, it is how, very clearly, productivity in the US economy in the post-2008 world (those darn GFC thing-ies) only ever rises when businesses lay off millions upon millions. In case you’re wondering, this isn’t how healthy economies operate. |

|

On the contrary, what’s going on here you won’t ever hear in policymaker speeches nor read in the FOMC’s ridiculous “full employment” rate hike justifications. As I wrote two quarters ago, closer to the inflection just when the global economy was turning the wrong way, back when productivity in Q3 2021 had been the worst in (“only”) decades:

|

|

| Ever. Productivity suffers because there is no recovery, not a real one, and therefore, no matter how many times each successive Fed Chair talks about a tight labor market, what use do employers have for even more employees?

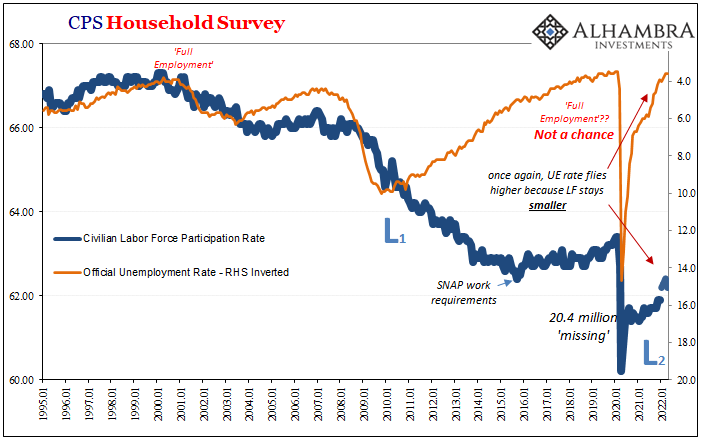

Eventually, employers begin to recognize the primrose path. The data is extremely uniform and clear as to this version of economic (small “e”) history. The first time this happened, Economists repeatedly insulted American workers, saying they were too drug-addled and too indolent for retraining (officials, for a time, even tried to blame Baby Boomer retirees until the data completely obliterated that attempt). |

|

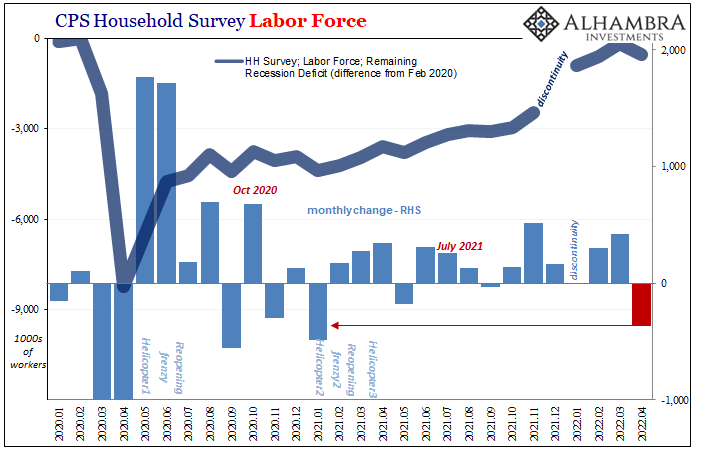

| Economists today now ask us to believe that there is some Great Resignation afoot to explain post-2020 when post-2020 looks exactly like post-2009. In their eyes, meaning math-ed models, the US labor force has only become lazier still following COVID; Americans once too lazy to go back to school, now they’re apparently too lazy to even go to a job of any kind (their proposed labor shortage).

Perhaps there aren’t all these mythical jobs we constantly hear so much about? Couldn’t it be that US workers have a much better handle on the true economic state than the Ivory Tower Occupiers? Maybe, just maybe the economy they say recovered actually didn’t. Twice. Janet Yellen was so close to accepting this truth way back in 2014, before her Economist tendencies took back hold of her:

|

|

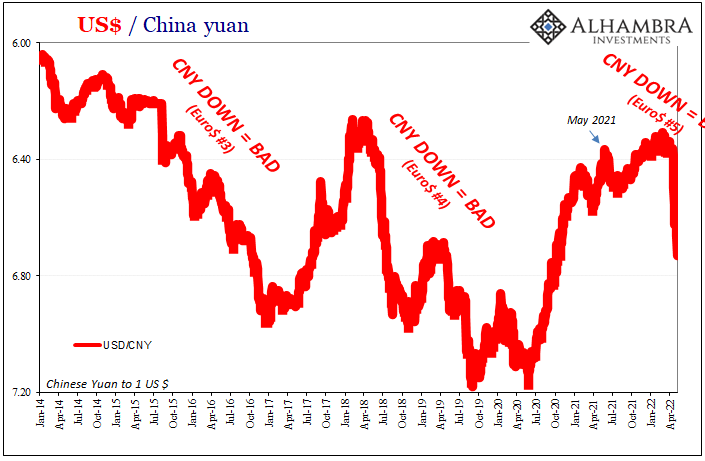

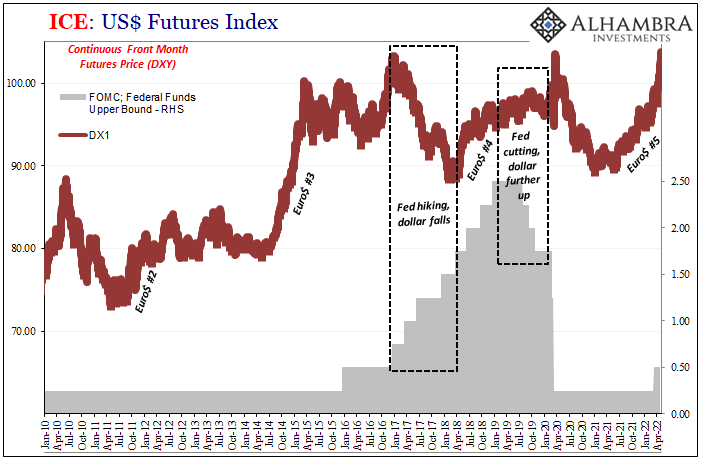

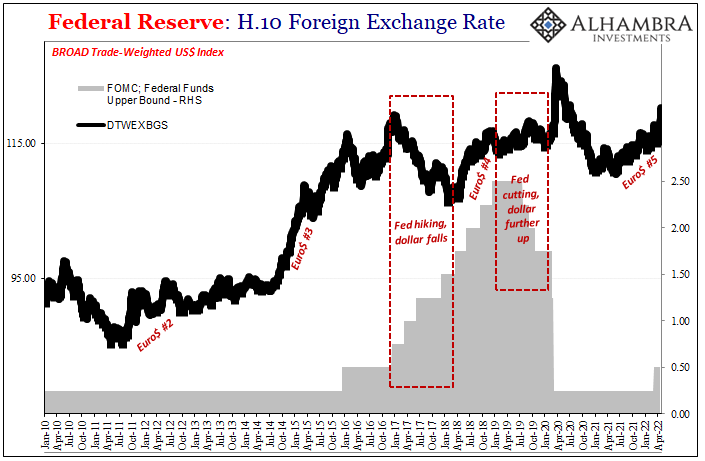

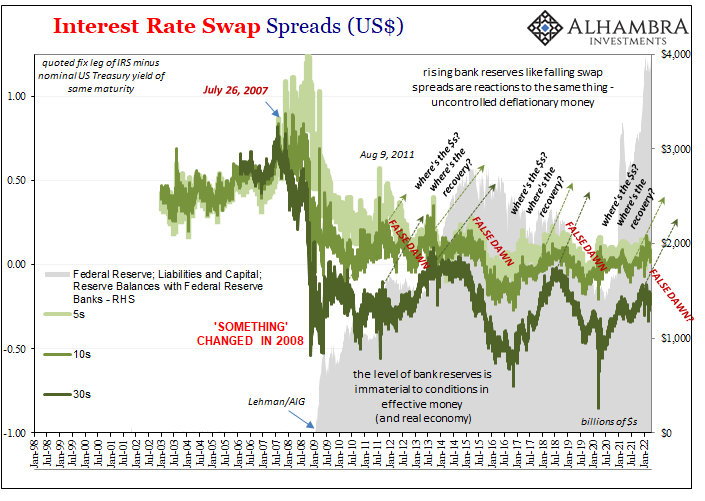

| If it’s a “portion of the decline in labor force participation”, then it’s the vast majority. Therefore, productivity – lack of – tells us about why so much slack, why the labor situation remains nowhere near actual rather than statistical full employment. The economy doesn’t recover, any rebound in labor is left unproductive because employers hire too many for what little happens (strangled by the Euro$ shortfall globally), reinforcing all the negative tendencies.

That won’t matter one bit to the heavily politicized FOMC. The unemployment rate covers the public picture, increasing confusion (somewhat on purpose), while the rate hikes continue – at least until the Euro$ puts another stop to them for reasons no one seems able to explain. It isn’t actually that difficult, once you permit the possibility of permanent shocks (and the reasons for them). But that would require rethinking “central banking” and even the disaster that has become modern Economics. No wonder they insist on condemning you and me for everything. |

|

Tags: currencies,economy,employment,establishment survey,Featured,Federal Reserve/Monetary Policy,GDP,household survey,Labor,Markets,newsletter,payrolls,productivity,wages