Cue up the old VHS tapes of Bill Clinton. The former President was renowned for displaying, anyway, great empathy. He famously said in October 1992, weeks before the election that would bring him to the White House, “I feel your pain.” What pain? As Clinton’s chief political advisor later clarified, “it’s the economy stupid.” Jay Powell is no retail politician in near the same company as Mr. Clinton. Yet, the Federal Reserve’s current Chairman is attempting to channel his inner-stupid anyway. Announcing the Fed’s first 50-bps rate hike in almost exactly two decades, this bureaucrat clumsily prefaced his post-FOMC press conference with a gimmick as if blatantly running for some office. Before I go into the details of today’s meeting, I’d like to take this

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Consumer Prices, currencies, Dollar, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, inflation, jay powell, Markets, newsletter, rate hikes, US dollar

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Cue up the old VHS tapes of Bill Clinton. The former President was renowned for displaying, anyway, great empathy. He famously said in October 1992, weeks before the election that would bring him to the White House, “I feel your pain.”

What pain? As Clinton’s chief political advisor later clarified, “it’s the economy stupid.”

Jay Powell is no retail politician in near the same company as Mr. Clinton. Yet, the Federal Reserve’s current Chairman is attempting to channel his inner-stupid anyway.

Announcing the Fed’s first 50-bps rate hike in almost exactly two decades, this bureaucrat clumsily prefaced his post-FOMC press conference with a gimmick as if blatantly running for some office.

Montagu Norman this ain’t. I mean, how much clearer an example of raw political pressure does anyone need? The rate hikes themselves are pure theater engineered by increasingly desperate politicians without regard for any other factors; including, right off the top, how a higher RRP or IOER isn’t going to get more oil out of the ground or ship off empty containers to Mao’s Xi’s increasingly off-limits China. One can only imagine (at least for the next five years of lock-up) what the FOMC’s private discussions look like. Maybe not totally Lagarde-like in being far more sober, yet quite probably more current European than previous Clintonian. |

|

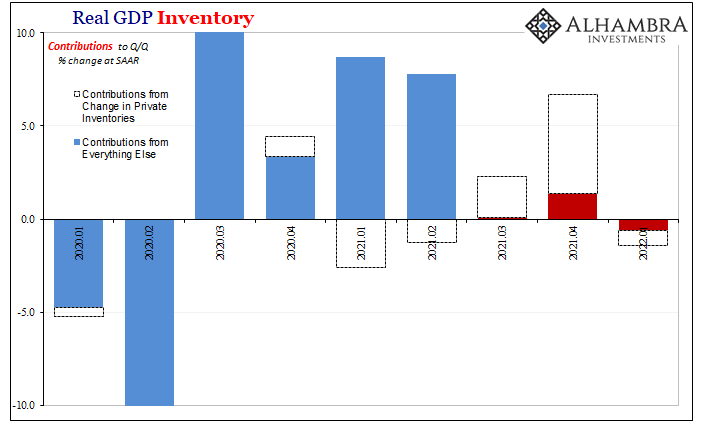

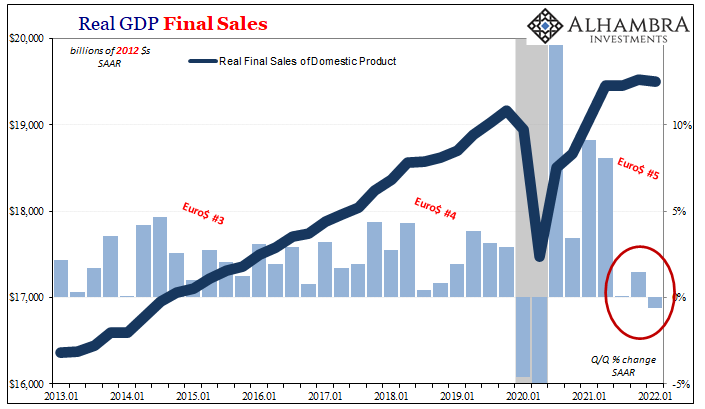

What’s more interesting is the economic assessment policymakers are and have to use in order to justify this stance toward inflationary risks; real or imagined. Following the above promise to straight up Draghi consumer prices (do whatever it takes), Mr. Powell added his assurances that Q1’s “unexpected” negative GDP was just an odd and idiosyncratic mix of nothing-to-see-here:

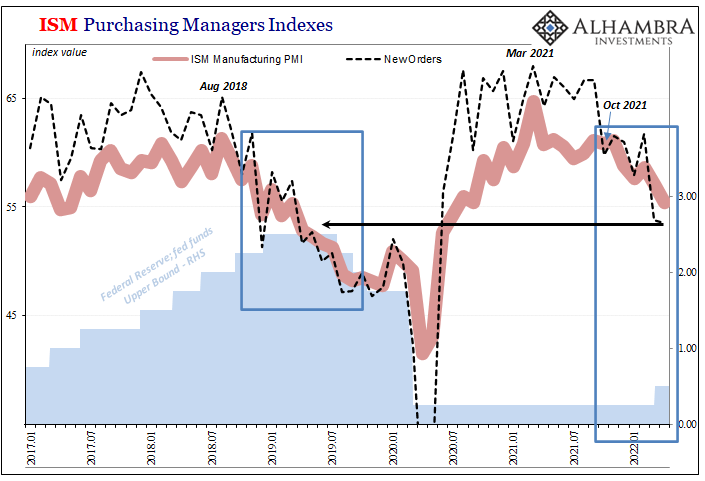

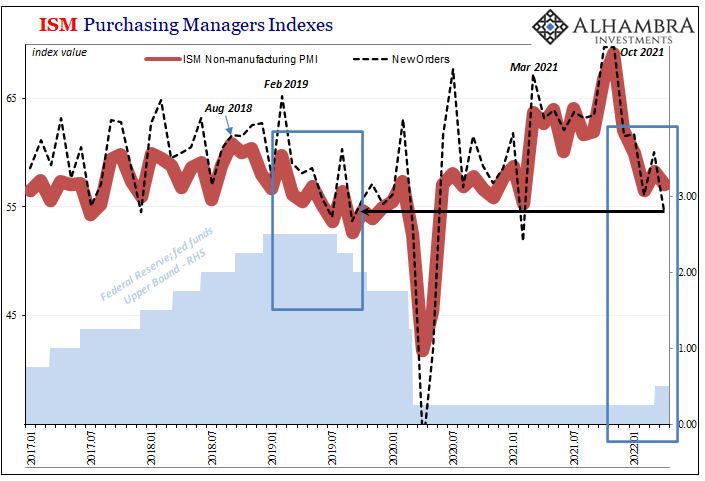

Yeah, but, you see the catalog of evidence is stacking up like GDP rather than JOLTS’ notoriously misleading Job Openings. Just this week, ISM. Both of them. Each ISM figure fell and not just in April. They’ve been down for some time – the same some time as GDP has been ringing the same alarm bells as markets. The latter is not merely an incidence of negative Q1; on the contrary, three straight quarters (and counting) of bad. In fact, taking Powell at his word, if you do take out inventory Q1’s contraction doesn’t go away, but Q4’s “strength” actually does. |

|

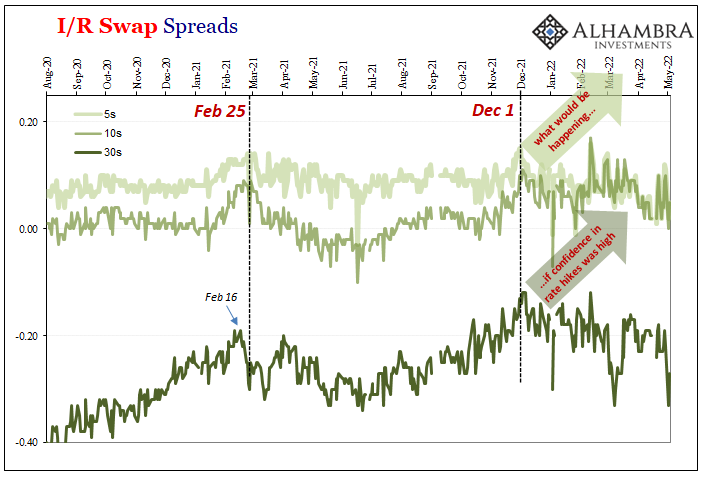

| The last time the ISMs had been trending downward while having also dove to the same depth as the current month of April 2022, guess what Jay Powell was doing? That’s right, he’d already sworn off 2018’s rate hikes and at the same level for the non-manufacturing ISM he had begun cutting them.

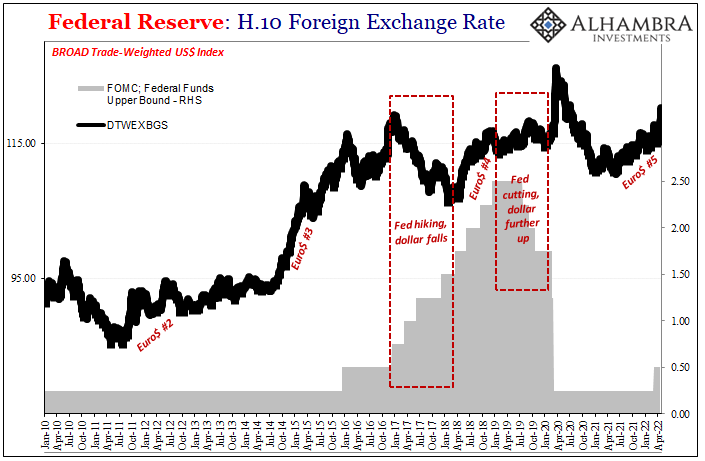

Where the ISMs are right now, the Fed was in full-blown panic mode. Not inflation panic, either. Hardly the only measure equaling 2019, up and down the line the same thing. Most importantly, the dollar which, as I’ve been writing all week, is decidedly in the not-inflation-it’s-recession camp and growing worse by the day (it seems). |

|

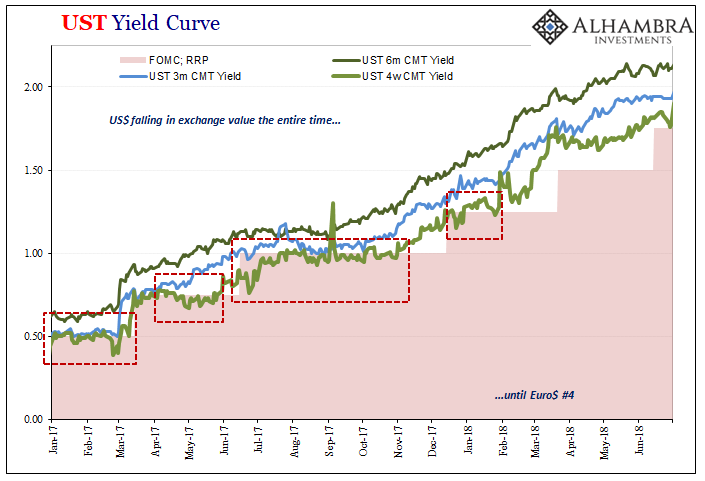

| And while the Federal Reserve and its rate hikes (theater) certainly don’t control (nor even influence) the dollar, the Fed has in the past absolutely responded to the conditions a higher dollar value has represented by tucking tail and running.

Is Powell fooling himself, or only trying to fool the public? If the latter, it’s not working:

|

The reasons for their anxiety are clear: Economic activity shrank in the first three months of the year, inflation is at a 40-year high and the stock market is sliding.

Of course, no mainstream article about conflicting (to the mainstream narrative) data would be complete without the obligatory reference to Economists who only agree with the Fed’s, um, Economists (“Despite those signals, most Wall Street economists do not expect a recession this year.”)

So, while Chairman Powell isn’t fooling much of the public, maybe those in it aren’t his target, either. Like Lagarde, he’s probably aware of these too many similarities to 2018, certainly not yet having forgotten how embarrassing the episode proved to be (as if anyone at the ECB wouldn’t remind those at the FOMC since they talk and share data like opinions regularly).

What I mean is, for all the Clintonian charades Chairman Powell is really trying to fool the politicians, the same politicians who are simultaneously trying to, and to some degree succeeding at, pulling Jay’s strings.

Just who, here, is the puppetmaster?

Actually, none of the above.

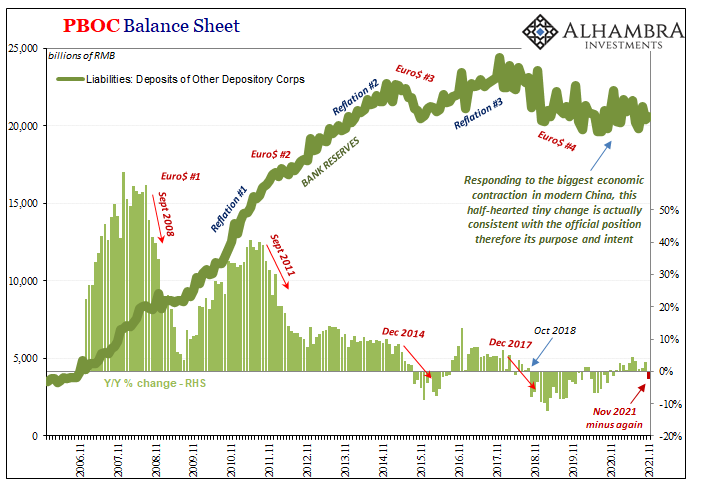

It’s the eurodollar’s world, and we’re all just trying to live in it. And to drive this point home for the third time this week: 4-week T-bill today at 49 bps yield with RRP set to be 80 bps tomorrow.

Tags: Bonds,Consumer Prices,currencies,dollar,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,inflation,jay powell,Markets,newsletter,rate hikes,US dollar