Trade disputes should continue to weigh on emerging market currencies in the short term.Despite a relatively stable US dollar index and 10-year US Treasury yield since the end of May, emerging market (EM) currencies have remained under pressure, especially as a result of the recent escalation in trade tensions and a significant decline in the renminbi. The two latter factors have particularly weighed on Asian EM currencies.Since mid-June, the Chinese renminbi has weakened significantly relative to the US dollar. This is in part explained by the strong dollar and unfavourable interest rate differential. A sustained depreciation of the renminbi would likely weigh significantly on Asian EM currencies, with ripple effects across all EM currencies. However, we do not expect this scenario for

Topics:

Luc Luyet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Trade disputes should continue to weigh on emerging market currencies in the short term.

Despite a relatively stable US dollar index and 10-year US Treasury yield since the end of May, emerging market (EM) currencies have remained under pressure, especially as a result of the recent escalation in trade tensions and a significant decline in the renminbi. The two latter factors have particularly weighed on Asian EM currencies.

Since mid-June, the Chinese renminbi has weakened significantly relative to the US dollar. This is in part explained by the strong dollar and unfavourable interest rate differential. A sustained depreciation of the renminbi would likely weigh significantly on Asian EM currencies, with ripple effects across all EM currencies. However, we do not expect this scenario for the time being.

Our central scenario sees trade disputes rumbling on in the short term, which should continue to weigh on EM currencies.

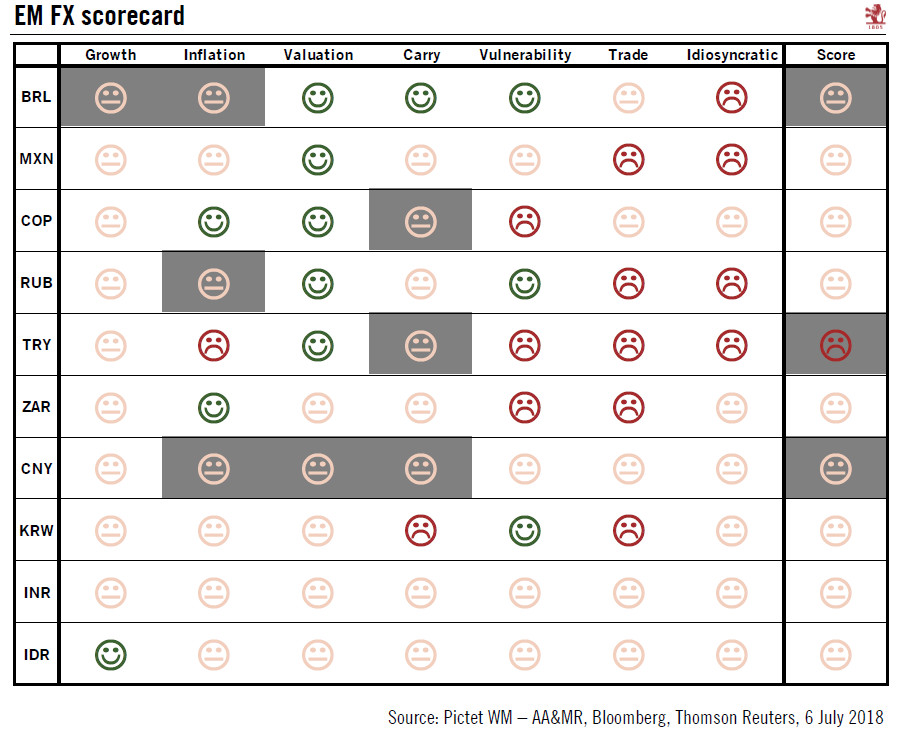

All in all, there have been few changes over the past month. Our scorecard (see table), constructed using a rules-based methodology, suggests that no EM currency at present is particularly attractive on a 12-month horizon.