While trade tariffs could impact prices at some point, inflation looks unlikely to spiral out of control.Leaving aside energy prices (up 24% y-o-y), core CPI inflation in the US remained moderate in June rising 0.16% m-o-m, which pushed the y-o-y reading slightly up, to 2.3% from 2.2% in May. A print of 2.3% y-o-y, while above the one-year average of 1.9%, is a relatively tame reading in light of the very low US unemployment rate of 4.0%. By contrast, core CPI inflation peaked at 2.9% y-o-y in September 2006, at the height of the previous expansion.Structural forces linked to globalisation, technological change and population ageing are continuing to dampen US consumer prices, and should remain in play in the coming months. To give one example, clothing prices were up only 0.6% y-o-y in

Topics:

Thomas Costerg considers the following as important: Macroview, US CPI inflation, US growth, US inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While trade tariffs could impact prices at some point, inflation looks unlikely to spiral out of control.

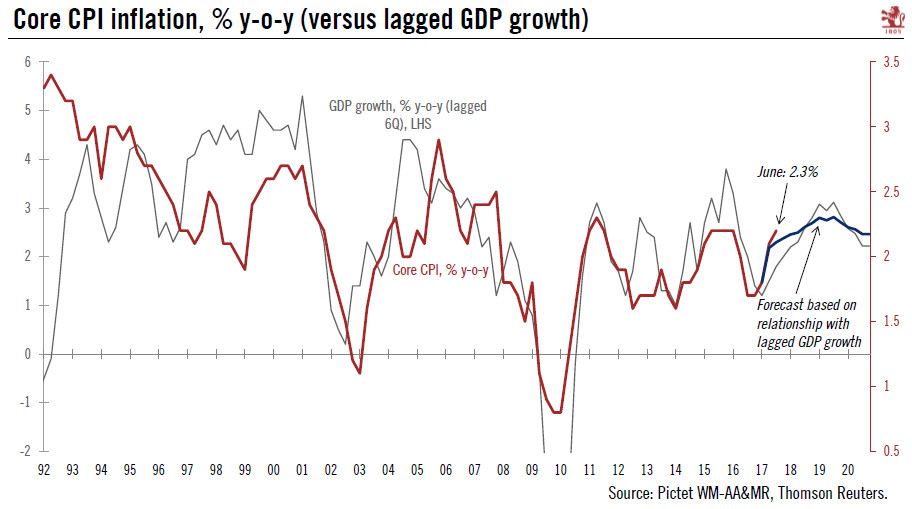

Leaving aside energy prices (up 24% y-o-y), core CPI inflation in the US remained moderate in June rising 0.16% m-o-m, which pushed the y-o-y reading slightly up, to 2.3% from 2.2% in May. A print of 2.3% y-o-y, while above the one-year average of 1.9%, is a relatively tame reading in light of the very low US unemployment rate of 4.0%. By contrast, core CPI inflation peaked at 2.9% y-o-y in September 2006, at the height of the previous expansion.

Structural forces linked to globalisation, technological change and population ageing are continuing to dampen US consumer prices, and should remain in play in the coming months. To give one example, clothing prices were up only 0.6% y-o-y in June, and have been flat over the past two years. Even though we expect the US labour market (and broader economy) to remain healthy in the second half of the year, we see core CPI staying below 2.5% in the coming months.

We maintain our 2.6% forecast for the annual average headline CPI inflation rate this year and 2.3% next year.

We also maintain our forecast that core PCE inflation – the crucial inflation metric for the Federal Reserve (Fed) – will average 1.9% this year and 2.4% in 2019. The difference between headline and core inflation is to down to oil prices, which we expect to edge down next year.