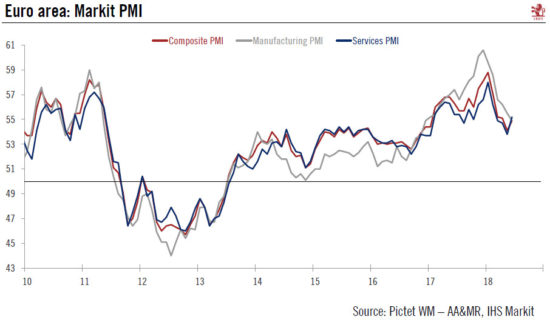

Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit noted, the decline in business optimism “reflects rising trade worries, political uncertainty and the impact on ongoing capacity constraints”. On a brighter note, the services PMI jumped to 55.2 from 53.8 in May, boosted by strong data in Germany, France and Italy. The robust headline PMI in June was partly

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, euro area, Euro area GDP growth, Euro area PMI, Europe chart of the week, Featured, Macroview, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

|

Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit noted, the decline in business optimism “reflects rising trade worries, political uncertainty and the impact on ongoing capacity constraints”. On a brighter note, the services PMI jumped to 55.2 from 53.8 in May, boosted by strong data in Germany, France and Italy. The robust headline PMI in June was partly due to calendar effects. Markit noted that the number of holidays was unusually large in May and depressed activity and new order flows. The breakdown by sub-indices showed that employment growth remained solid in all of the nations covered. Meanwhile, price pressure increased at the end of the second quarter. Higher wages and fuel costs lifted input price inflation. Part of the rise was passed on in the form of higher output charges. Overall, June PMI surveys were quite reassuring. Composite PMI data now point to GDP growth of just over 0.5% quarter-over-quarter in Q2. Other leading indicators such as the European Commission Economic Sentiment Index paint a similar picture. While manufacturing is losing momentum, the resilience of the services PMI is good news for the euro area economy. Nevertheless, downside risks remain and a downturn in trade could spill over into the services sector. |

Eurozone Markit PMI, 2010 - 2018 |

Tags: Euro area,Euro area GDP growth,Euro area PMI,Europe chart of the week,Featured,Macroview,newslettersent