The new US tariffs threatening Chinese imports and probable retaliation could bite into US and Chinese growth. As US midterm elections approach, the situation could worsen before it gets better.The Trump administration has stepped up its trade actions further by increasing the net of Chinese imports that will be subject to US tariffs: on top of the USD50 billion of Chinese imports subject to a 25% tariff already announced, the US Trade Representative has prepared a list of a further USD200 billion of imports to be subject to a 10% tariff. After a brief consultation period, the tariffs could enter into force in September.Largely targeting Chinese consumer products that are not easily replaceable, the new 10% tariff looks like a consumption tax. A wide range of goods are being targeted by

Topics:

Thomas Costerg and Dong Chen considers the following as important: Chinese growth, Macroview, Trump tariffs, us china trade, US growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The new US tariffs threatening Chinese imports and probable retaliation could bite into US and Chinese growth. As US midterm elections approach, the situation could worsen before it gets better.

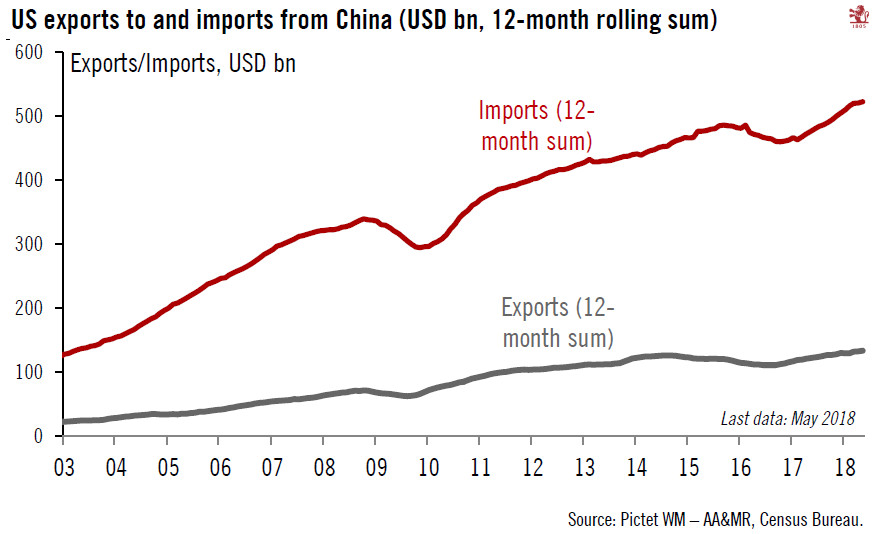

The Trump administration has stepped up its trade actions further by increasing the net of Chinese imports that will be subject to US tariffs: on top of the USD50 billion of Chinese imports subject to a 25% tariff already announced, the US Trade Representative has prepared a list of a further USD200 billion of imports to be subject to a 10% tariff. After a brief consultation period, the tariffs could enter into force in September.

Largely targeting Chinese consumer products that are not easily replaceable, the new 10% tariff looks like a consumption tax. A wide range of goods are being targeted by the new tariffs, including clothing, furniture, electronic goods (but not mobile phones or tablets), household appliances and car parts.

From a macroeconomic standpoint, this means risks to our 2019 growth forecast of 2.3% for the US are tilted to the downside and that risks to our 2019 core PCE inflation forecast, currently 2.4%, are tilted to the upside. We have previously noted that further escalation in trade tensions could deduct 0.3% from 2019 GDP growth in the US. In China, we estimate that the tariffs already introduced by the US and those now threatened could cost it around 0.5% of GDP.

The new US tariffs and inevitable Chinese retaliation raise the risk of slipping into a genuine trade war, especially as President Trump has warned that all merchandise imports from China (worth USD506 billion in 2017) could end up being subject to tariffs; the room for a negotiated deal with China is therefore narrowing further and the situation could get worse before it gets better, especially as the November midterm elections approach.