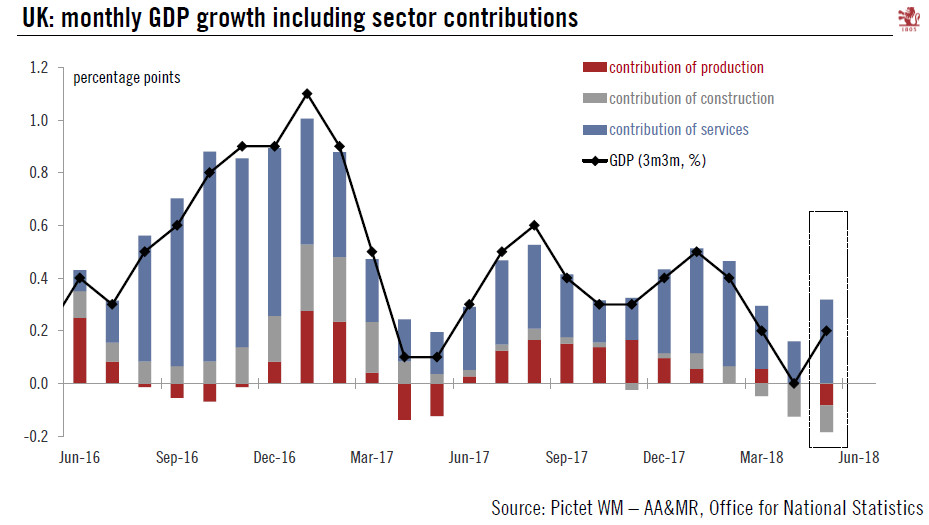

Short-term rebound in the UK, driven by services.The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below).Looking at the details, the services sector (79% of the economy) grew by 0.3% in the three months to end-May and was the only positive contributor to GDP growth. Services enjoyed a boost from temporary factors such as the warm weather and the royal weeding. By contrast, industrial production (14% of the economy) and construction (6% of the economy) detracted from GDP growth.The recent data releases,

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Short-term rebound in the UK, driven by services.

The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below).

Looking at the details, the services sector (79% of the economy) grew by 0.3% in the three months to end-May and was the only positive contributor to GDP growth. Services enjoyed a boost from temporary factors such as the warm weather and the royal weeding. By contrast, industrial production (14% of the economy) and construction (6% of the economy) detracted from GDP growth.

The recent data releases, including monthly GDP, have been consistent with the Bank of England’s (BoE) view that the soft patch in Q1 was largely due to transitory factors, and that it would be followed by a rebound in activity in Q2. Political uncertainty and the risk of escalating trade tensions remain, but this should not be enough to prevent a majority of the BoE’s Monetary Policy Committee (MPC) members from voting for a rate hike (bringing the bank rate up from 0.50% to 0.75%) at the 2 August MPC meeting.

Beyond that, we continue to expect the UK economy to underperform on a more structural basis, especially as services, including financial service, may face a harder Brexit than industry. This suggests monetary tightening may remain very gradual (one quarter-point rate hike per year, in our view).