Spreads on Italian debt could continue to drop, as Italy’s relations with Brussels become calmer. But much will depend on the new government’s durability and its commitment to reducing the debt burden.President of the Republic Sergio Mattarella has instructed Giuseppe Conte to form a new government backed by a coalition of the Five Star Movement (M5S) and the Democratic Party (PD). Importantly, there are still many hurdles to overcome, and a last-minute breakdown in discussions cannot be...

Read More »Germany: Why Sunday’s state elections matter

Together with the economic slowdown, declining support for the governing coalition may (or may not) open the way to greater fiscal stimulus.The results of Sunday’s state elections in Saxony and Brandenburg will be scrutinised closely. A heavy CDU or SPD defeat would send shock waves through Berlin.Germany’s slowdown has raised expectations for further fiscal stimulus. The fragile situation of the two mainstream parties makes decision-making more complicated.Nevertheless, at least the debate...

Read More »What if we have a ‘no deal’ Brexit ?

Although still not our central scenario, a no-deal Brexit is a distinct possibility on the 31 October, with distinct implications for the UK economy and financial assets.Prime Minister Boris Johnson has chosen a more aggressive negotiation technique than predecessor Theresa May, flagging the UK’s readiness to exit the European Union without a transition deal (current deadline is 31 October) if the withdrawal agreement that May reached with Brussels is not improved to match his demands....

Read More »Scandi currencies hurt by moderating global growth

Loss of global economic momentum and elevated global uncertainties cast a shadow over Scandinavian currencies.The ongoing moderation in global growth continues to weigh on Scandinavian currencies despite their undervaluation. In particular, the weak Q2 GDP figure for Sweden is a reminder that weak economic activity in Germany and the UK (two key trading partners) is spreading to other countries. Furthermore, despite Sweden’s and Norway’s defensive features, such as a structural current...

Read More »Weekly View – Tariff train takes off

The CIO's view of the week ahead.Last week was so full of market-moving news that ordinarily major events took the backseat. Critically, trade tensions escalated rapidly from Friday, with China announcing tariff retaliations of the order of between 5% and 10% on USD 75bn of US imports from September. Trump took to Twitter in turn, raising both current and planned tariffs to 30% on USD 250bn and 15% on USD 300bn worth of Chinese imports. This puts an already fragile global economy in greater...

Read More »Brazilian real stands out in EM currency scorecard

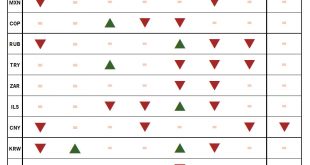

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others. In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More...

Read More »Brazilian real stands out in EM currency scorecard

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others.In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More hopefully, the global...

Read More »Reform of benchmark rates will likely lead to effective rate cut in China

A shake-up in interest-rate policy in China promises to cut lending rates and should benefit the broad Chinese economy over time.Over the weekend, the People’s Bank of China (PBoC) announced a major change in its benchmark lending interest rate, establishing a closer linkage between banks’ funding costs and their lending rates.Given the notable decline in short-term market interest rates since last year due to the PBoC’s liquidity injections, this likely will lead to a decline in commercial...

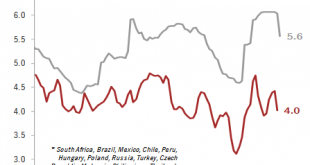

Read More »Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward.Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a lower oil price and less...

Read More »Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org