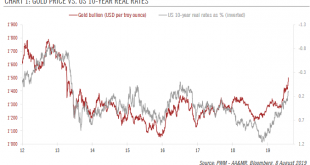

Increased trade tensions have boosted the gold price to above USD 1,500. The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce. The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled...

Read More »The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations. Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator. According to the US Treasury Department, the decision was triggered by the perceived lack...

Read More »Currency update – the Chinese renminbi

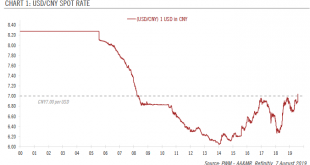

Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD. The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the...

Read More »The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations.Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator.According to the US Treasury Department, the decision was triggered by the perceived lack of action by the PBoC to resist the renminbi depreciation. Given that the US...

Read More »Currency update – the Chinese renminbi

Despite the CNY's recent fall, we believe the People's Bank of China will refrain from competitive devaluationFollowing US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD.The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the deteriorating outlook for trade negotiations with the US and the resulting...

Read More »BoJ stays put amid economic headwinds

Japan’s central bank has little room for further easing despite a downbeat outlook. At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand. However, we do not expect the BoJ to make any changes to its current monetary easing...

Read More »BoJ stays put amid economic headwinds

Japan's central bank has little room for further easing despite a downbeat outlook.At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand.However, we do not expect the BoJ to make any changes to its current monetary easing framework until H1 2020 as it has probably reached the limit of its easing capacity....

Read More »House View, August 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset allocationWhile dovish central banks have resulted in an impressive ‘everything rally’ this year, we now need to see an improvement in fundamentals, as 12-month forward earnings for global equities are still 2% below their highs of October 2018. We therefore remain generally cautious on equities, waiting for a correction before we increase exposure.Trading volumes have declined and market gains are...

Read More »Weekly View – Powell throws in the towel

The CIO Office's view of the week ahead.After a brief lull, Trump renewed escalating trade tensions with China by threatening new tariffs on USD 300bn of Chinese imports to the US. A global sell-off ensued and the Chinese authorities now appear less inclined to resist renminbi weakness relative to the dollar, having allowed the renminbi to break the CNY7/USD “psychological threshold”. Unsurprisingly, exporter-heavy indices were hit particularly hard in equities, as investors fled to safety,...

Read More »US-China: Trump’s tariff net expands

With additional tariffs in the pipeline, should the Fed take notice?US President Trump pre-announced a further expansion of the US tariffs on imports from China: the remaining half of imports not yet taxed will be at a rate of 10%. It was our central scenario that the tariff net would be increased before the 2020 elections, but we are surprised by the timing, so close on the heels of the G20 meeting in Osaka.Such tariffs further reduce the possibility of an encompassing trade deal with China...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org