L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains.La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis. Cette théorie adopte une approche expérimentale de l’économie, basée sur la conviction fondamentale que la monnaie est créée par le gouvernement à travers les dépenses budgétaires, et non par les banques...

Read More »Powell plays the ‘insurance’ card again

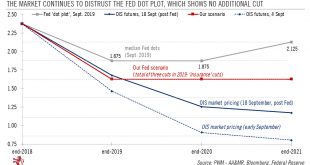

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and...

Read More »Powell plays the ‘insurance’ card again

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market. The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak...

Read More »What more QE means for Bund yields

In spite of an initial rise in 10-year Bund yields after the ECB’s latest stimulus, our central scenario is for a renewed decline by year’s end.The 10-year Bund yield moved up from its recent lows of -0.71% to -0.45% on September 16, driven mostly by an element of disappointment regarding the European Central Bank’s (ECB) latest stimulus measures and some renewed hopes for a US-China trade truce. In particular, we suspect the rebound in yields was triggered by the ECB’s failure to increase...

Read More »Modern Monetary Theory

This new theory is now in vogue in Washington DC, and its influence could grow.Modern Monetary Theory (MMT), a macroeconomic theory advocated by heterodox economists, is gaining traction in the US. The theory adopts an experimental approach to economics, underscored by the fundamental belief that money is created by the government via budget spending – and not via money creation by central and private banks, as per traditional theory.Proponents of MMT in the US interpret current low...

Read More »September Fed meeting preview

A rate cut is on the cards, but communication will be more difficultThe Federal Reserve (Fed) is very likely to cut rates again on 18 September, a follow-up to its 25-basis point (bp) rate cut at its last meeting in July. The explanation is likely to again be the need to take “insurance” against growing downside risks to the outlook, including from President Trump’s erratic trade policy as well as weaker foreign growth.Fed Chairman Powell is unlikely to pre-commit to a third rate cut at this...

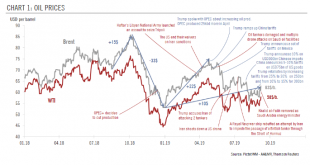

Read More »Oil market: supply disruption is here

The risk that similar attacks to the ones seen this weekend in Saudi Arabia could disrupt oil supplies, but it does not fundamentally change our medium-term scenario. We still forecast USD50 per barrel for Brent in 2020.After this weekend’s drone attack on the world’s most important crude oil facility, the Saudi Arabian authorities have announced that 5.7 million barrels per day (mbd), half of its daily oil production and 5% of the world total, will be taken off-line. Iran-aligned Houthi...

Read More »Weekly View – The ECB’s last bazooka

The CIO's view of the week ahead.Mario Draghi has now done (nearly) all that it takes to support the euro area economy. With only weeks left in his term as ECB president, Draghi deployed almost all that remains in the central bank’s toolkit. Following last Thursday’s meeting, he confirmed not only the expected interest rate cut, but also the relaunch of the quantitative easing (QE) bond-buying programme. He fell short of lifting issuer limits, which markets took negatively. Christine...

Read More »US-China – Towards a trade truce?

Our central scenario has long been that we would see some lowering of US-China trade tensions ahead of the US presidential elections. But deep-seated issues may prevent a major breakthrough.President Trump is considering offering a ‘limited’ or ‘interim’ trade agreement to China as his advisors prepare the ground for face-to-face talks scheduled for October. He has notably announced that the additional 5% tariffs on Chinese goods scheduled for early October were being pushed back to the...

Read More »Oil prices and the global economy

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down. Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org