Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others.In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More hopefully, the global decline in yields could be supportive of EM currencies by providing more space for EM central banks to cut rates at a time of low domestic inflationary pressure. Furthermore, a dovish Fed should eventually weigh on the US dollar through a less supportive interest rate differential.Overall, however, barring

Topics:

Luc Luyet considers the following as important: Brazilian real, EM currency forecast, Emerging market currencies, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others.

In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More hopefully, the global decline in yields could be supportive of EM currencies by providing more space for EM central banks to cut rates at a time of low domestic inflationary pressure. Furthermore, a dovish Fed should eventually weigh on the US dollar through a less supportive interest rate differential.

Overall, however, barring a trade agreement between the US and China, the spot performance of EM currencies is likely to be constrained, suggesting that carry should be the main positive driver of EM currencies’ total returns.

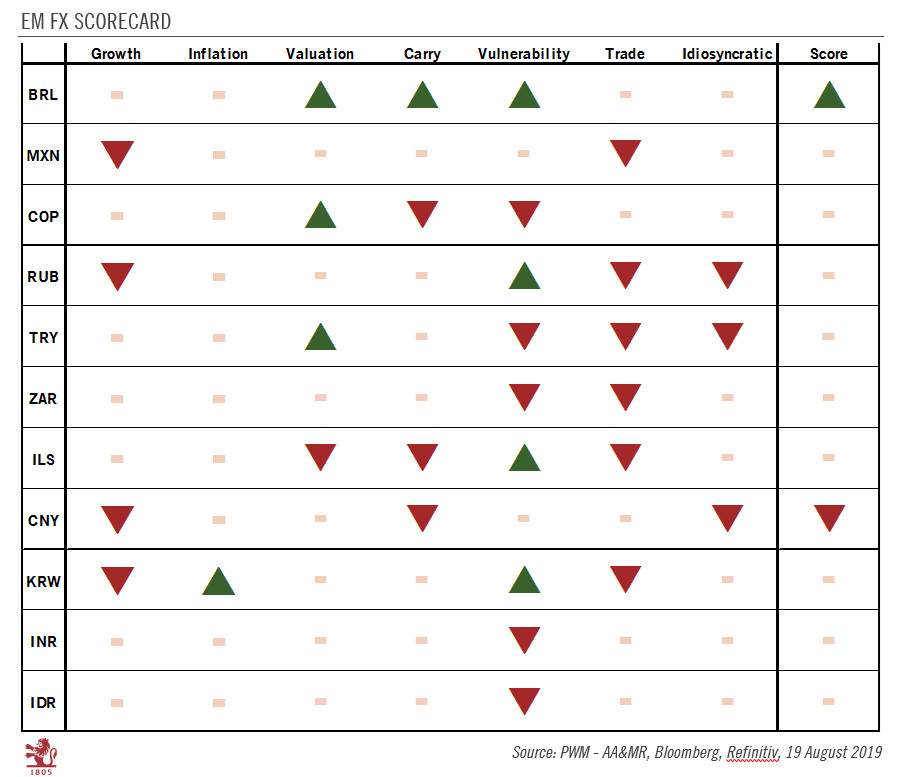

Our EM currency scorecard is designed to assess the attractiveness of major EM currencies using a rules-based methodology. The latest update suggests that, at present, the Brazilian real is the only particularly attractive EM currency on a 12-month horizon. This is because it offers a high carry, has decent external buffers and is seen as undervalued. Brazil is also perceived as a relatively closed economy, hence potentially less impacted by the decline in global trade. Furthermore, the real should be supported by the robust pension reforms that have been pushed through parliament.

Although they do not score as well as the real, we see the Indian rupee and Indonesian rupiah as potential outperformers among the EM currencies we monitor. As they are not particularly open (as defined by the sum of imports and exports divided by output), the Indian and Indonesian economies are less impacted by trade tensions than other EM countries and they are both benefiting from depressed oil prices. The rupee looks less attractive than the rupiah as geopolitical risks have recently increased in India. Its weakness in recent weeks has made the Russian rouble somewhat more attractive. While the Russian economy is suffering from the slide in commodity prices and faces the threat of US sanctions, the rouble offers high carry and Russia has a large current account surplus (and limited flows in portfolio and foreign direct investment).

To sum up, unless trade tensions abate significantly, a broad and sustained rally in EM currencies remains unlikely. In choppy markets, the high-carry currencies of countries with decent external buffers should be favoured as should those of countries with limited exposure to global trade.