Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down.Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in new orders, industrial...

Read More »Swiss National Bank – Between a rock and a hard place

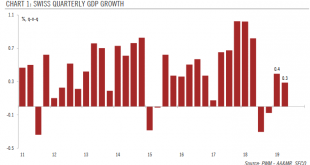

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings. Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical...

Read More »Swiss National Bank – Between a rock and a hard place

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings.Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical recession in H2 2018. Unlike...

Read More »Weekly View – Brothers in arms

The CIO's view of the week ahead.Having purged 21 moderate Tory members of parliament (MPs) who opposed him on Brexit, Boris Johnson has had to face the resignation of two high-profile members of his government, Amber Rudd and his own brother, Jo Johnson. British politics will provide more excitement this week, as a law is passed in parliament to prevent a no-deal Brexit. We feel the latest developments lower the probability of a no-deal Brexit on 31 October and support a temporary rebound...

Read More »House View, September 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset allocationWe remain underweight global equities, but continued stimulus and an economic backdrop that is not catastrophic mean this is nuanced by neutral positions in some regions. We favour stocks of companies that have pricing power as well as those showing healthy dividend growth and low leverage.We are neutral US Treasuries as a way to protect portfolios, but underweight negative-yielding...

Read More »How much ECB QE is needed? Go big, or go home!

We expect the ECB to strengthen its forward guidance by linking the future path of policy rates to a new asset purchase programme.We estimate that a new QE2 programme worth at least EUR600bn would be needed for the ECB to close a 0.50% inflation gap. If anything, the decreasing marginal returns of QE and the risk of a de-anchoring of inflation expectations call for a more aggressive programme.How much does the ECB need to ease? QE size matters, but so do other parameters including the...

Read More »T-bond yields trending down, but beware inflationary surprises

The downward tilt to bond yields means we have revised down our year-end forecast for the 10-year US Treasury yield.The impressive 52 basis points fall in the US 10-year Treasury yield to 1.5% made August a remarkable month.Unsurprisingly, the fall owed much to the fear that additional US tariffs on Chinese imports could prolong the global manufacturing recession, thereby increasing the risk of contagion to the services sector and hence sparking a general US slowdown. It seems that market...

Read More »Double pressure from Trump and the yield curve

We now see two additional Fed rate cuts, one in September and one in in October, versus our previous call of only one in September.We continue to expect the Federal Reserve (Fed) to cut rates by 25 basis points on 18 September.Instead of staying put at its 30 October meeting, we now think the Fed will use it to announce a further 25 bps cut, mostly due to the recent escalation of US-China trade tensions.Those two additional cuts still fit within the Fed’s vaguely-defined ‘insurance’...

Read More »Weekly View – A hot autumn in view

The CIO's view of the week ahead.Last week’s ousting of Matteo Salvini’s Lega from the Italian government and its replacement by the centre-left Democratic party holds out the prospect of much less-heated budgetary discussions between Rome and Brussels this autumn and lessens the risk that Italy’s sovereign rating will be cut by Moody’s this week. Helped also by the prospect of a substantial stimulus package from the European Central Bank, Italian bond yields and yield spreads sank last week...

Read More »Weekly View – Boris plays hardball

The CIO's view of the week ahead.Last week’s ousting of Matteo Salvini’s Lega from the Italian government and its replacement by the centre-left Democratic party holds out the prospect of much less-heated budgetary discussions between Rome and Brussels this autumn and lessens the risk that Italy’s sovereign rating will be cut by Moody’s this week. Helped also by the prospect of a substantial stimulus package from the European Central Bank, Italian bond yields and yield spreads sank last week...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org