Loss of global economic momentum and elevated global uncertainties cast a shadow over Scandinavian currencies.The ongoing moderation in global growth continues to weigh on Scandinavian currencies despite their undervaluation. In particular, the weak Q2 GDP figure for Sweden is a reminder that weak economic activity in Germany and the UK (two key trading partners) is spreading to other countries. Furthermore, despite Sweden’s and Norway’s defensive features, such as a structural current account surplus and a positive net international investment portfolio (NIIP), their currencies remain cyclical. Low market liquidity makes Scandinavian currencies unsuitable as safe havens.The Norges Bank has already toned down its previous hawkishness because of increasing uncertainty. Furthermore, the oil

Topics:

Luc Luyet considers the following as important: Macroview, Scandinavia currency forecast, Scandinavian currencies, Scandinavian monetary policy, Swedish krona

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Loss of global economic momentum and elevated global uncertainties cast a shadow over Scandinavian currencies.

The ongoing moderation in global growth continues to weigh on Scandinavian currencies despite their undervaluation. In particular, the weak Q2 GDP figure for Sweden is a reminder that weak economic activity in Germany and the UK (two key trading partners) is spreading to other countries. Furthermore, despite Sweden’s and Norway’s defensive features, such as a structural current account surplus and a positive net international investment portfolio (NIIP), their currencies remain cyclical. Low market liquidity makes Scandinavian currencies unsuitable as safe havens.

The Norges Bank has already toned down its previous hawkishness because of increasing uncertainty. Furthermore, the oil price is likely to be hurt by an oversupplied market next year. Consequently, the outlook for the Norwegian krone is deteriorating. Our forecast is NOK9.75 per euro in three months and NOK10.00 in 12 months.

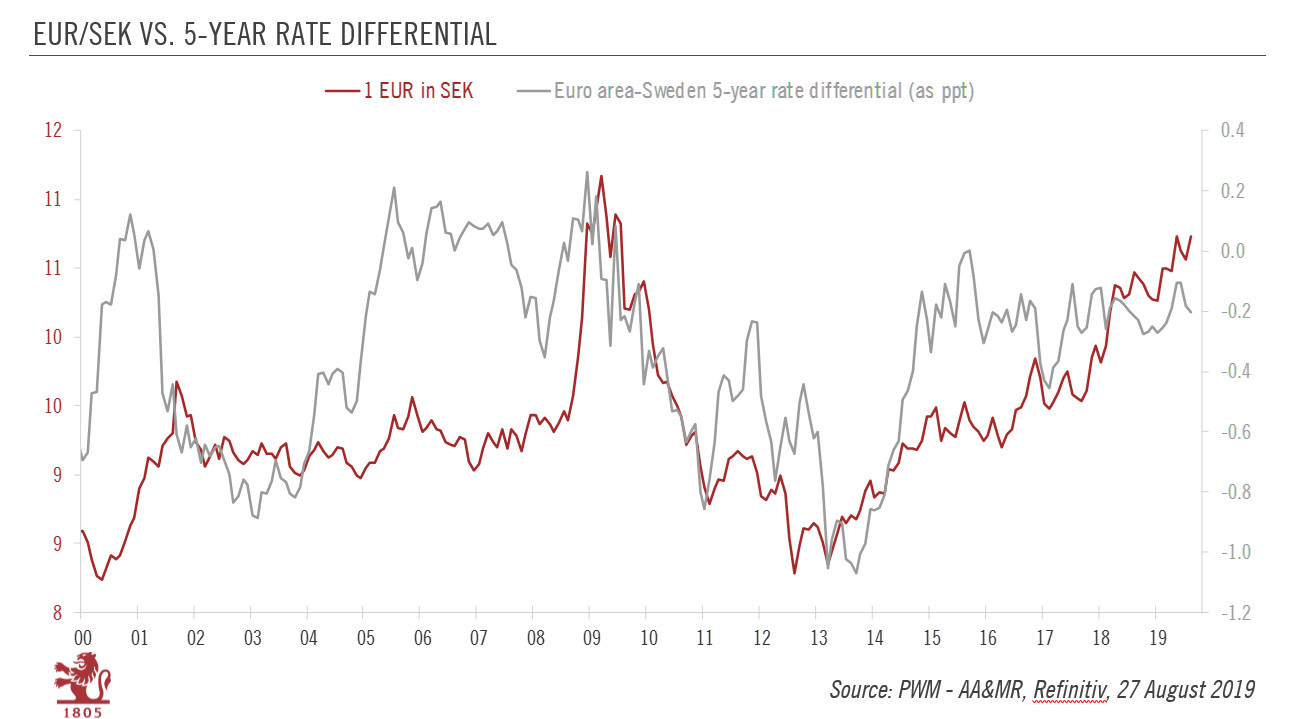

Sweden’s Riksbank may also have a hard time normalising its monetary policy as global growth moderation spills over into the Swedish economy. However, we think that interest rate differentials may prove more supportive of the Swedish krona going forward. Our three-month forecast is SEK10.60 per euro and our 12-month projection is SEK10.50.

The Danish krone has scope to recover after the recent decline below its central rate against the euro. With the ECB likely to ease policy in September, the Danish central bank may decide not to defend the interest rate differential with the euro area at its current level in order to strengthen the krone relative to the euro (currently the ECB’s deposit rate is at -0.40% versus -0.65% on Denmark).