Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafter We have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term. Indeed, economic growth in the US is likely to be strong thanks notably to an upswing in US capex but also because of a potential boost from consumption ahead of a rise in the tariff rate applied to Chinese goods at the start of 2019. Furthermore, the US Federal Reserve is subtly turning more hawkish, which has led us to change our baseline scenario on the number of

Topics:

Luc Luyet considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafter

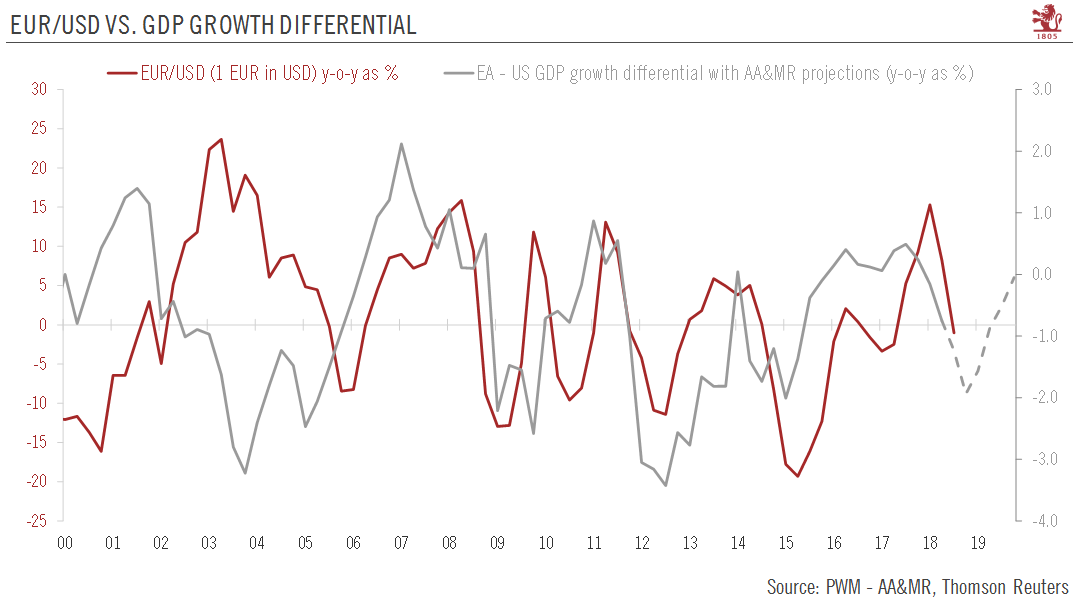

We have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term.

Indeed, economic growth in the US is likely to be strong thanks notably to an upswing in US capex but also because of a potential boost from consumption ahead of a rise in the tariff rate applied to Chinese goods at the start of 2019. Furthermore, the US Federal Reserve is subtly turning more hawkish, which has led us to change our baseline scenario on the number of rate hikes we expect in 2019 (from two to three). Consequently, GDP growth and monetary policy are likely to be supportive of the greenback a bit longer than we previously thought.

| In spite of renewed concerns over Italy and tensions surrounding Brexit, the euro proved quite resilient against the US dollar in September. We think the euro is likely to remain resilient on a three-month time horizon for a number of reasons. The most important one stems from our central scenario that underlying inflation in the euro area will edge higher from October on. That should push the market to start moving closer to our scenario of two ECB rate hikes in 2019. Capital flows should also remain supportive thanks to the euro area’s large current account surplus. Furthermore, our central scenario that political noise (Italy and Brexit) will abate by the end of the year is likely to be a tailwind for the single currency. Finally, the growth differential between the euro area and the US should narrow at the beginning of next year as the US economy begins to be hit by higher import tariffs and seasonal weakness and the euro area stabilises around current levels

All in all, our central scenario is that the US dollar is unlikely to depreciate significantly against the euro in the short term. But while the very short term may prove volatile for the single currency, we do not see significant downside potential for the euro against the dollar on a three-month time horizon either. We are therefore keeping a neutral stance on the EUR/USD rate, with our three-month projection unchanged at USD1.15 per euro. We then see a gradual appreciation of the euro relative to the dollar, with a six-month forecast of USD1.19 per euro and a 12-month forecast of USD1.23 per euro. |

EUR/USD vs. GDP Growth Differential, 2000-2019(see more posts on EUR/USD, ) |

Tags: Featured,Macroview,newsletter