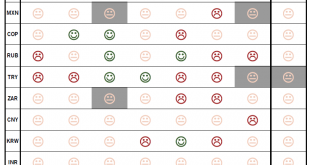

Up to now, emerging market (EM) currencies have been resilient in the face of market turmoil.Our EM FX scorecard, which ranks 10 EM currencies according to key criteria (such as growth and vulnerability to external shocks) saw few changes over the past month. The Fed’s current hawkish attitude remains a headwind for EM currencies, at it increases funding costs. That being said, the weakest EM currencies have seen some stabilisation, particularly for the Turkish lira and the Argentinian peso....

Read More »Weekly View – Moody’s to the rescue

The CIO office’s view of the week ahead.Italian bond prices regained some ground after Moody’s cut Italy’s credit rating by one notch on Friday, keeping it within investment grade, while upgrading its outlook from negative to stable. Investors welcomed this as positive news while they anticipate Italy’s response to Brussels’ criticism of its proposed 2019 budget due later today. This could prove an eventful week for peripheral bonds driven by news around Italy, with rating agency S&P...

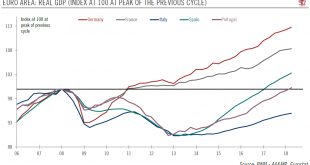

Read More »Portugal’s growth rate surpasses pre-crisis level

September growth and unemployment rates show how far it has come.In two decades, Portugal has gone through a boom (1996-2001), a slump (2002-2007), a deep recession (2008-2013), a timid recovery (2014-2016) and now a robust economic expansion. In 2017, real GDP grew by 2.8%, its fastest pace since 2000. This is even more remarkable when considering that the country exited its bailout programme only in mid-2014. Investment and robust exports were the main growth drivers in 2017.Starting in...

Read More »Bumpy Road Ahead for Italian Budget

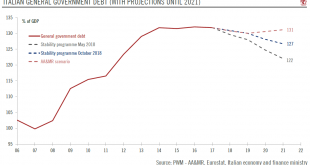

Rome’s budget plans put it on a collision course with the European Commission. The Italian government has submitted its 2019 draft budget plan (DBP) to the European Commission. The proposed DBP is not in line with European Union rules and sets the government on a collision course with the European authorities. Several elements within the Italian government’s budget plan have been raising eyebrows. First, the plans’...

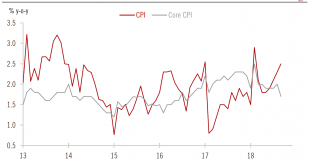

Read More »Inflation Environment remains Benign in China

Inflation is unlikely to be a constraint on central bank’s policy. The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August. Looking forward, we see some moderate upward...

Read More »Bumpy road ahead for Italian budget

Rome’s budget plans put it on a collision course with the European Commission.The Italian government has submitted its 2019 draft budget plan (DBP) to the European Commission. The proposed DBP is not in line with European Union rules and sets the government on a collision course with the European authorities.Several elements within the Italian government’s budget plan have been raising eyebrows. First, the plans’ economic assumptions seem too optimistic to us, and there is a risk that the...

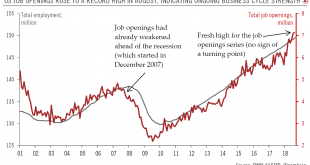

Read More »US labour market going strong

No sign of a let-up in the US business cycle as job openings continue to rise.We particularly like job openings data as an indicator for a turning point in the US macroeconomic cycle, even though this series has not much history (data start in December 2000), and in spite of its long lag to release (we just had data for August, i.e. it is more than two months old now).Still, job openings did a rather good job of indicating an inflexion point right before the global financial crisis: the US...

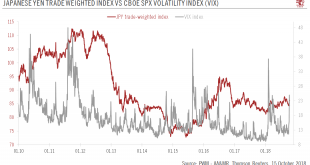

Read More »USD/JPY: a difficult balance

Limited upside for the dollar against the yen, but significant downside will take time.While widening interest rate differentials are supportive of the US dollar against the yen, if rates rise too far and too fast, they can help the yen against the dollar, as recent financial market volatility has shown. In October, the Japanese yen appreciated by 1.9% against the dollar and outperformed all other major currencies.Coupled with extreme fundamental yen undervaluation, the potential for the...

Read More »Inflation environment remains benign in China

Inflation is unlikely to be a constraint on central bank’s policy.The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August.Looking forward, we see some moderate upward pressure on Chinese headline inflation due to tariffs on US imports and...

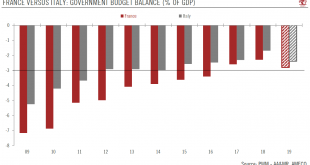

Read More »Devil is in the details: Italian and French deficits are not quite comparable

Italy’s structural weakness explain higher level of concern around its deficit target. Each EU member state is currently preparing 2019 budget plans for formal submission to the European Commission (EC) before mid- October. Among them, France and Italy’s budget plans have been raising eyebrows. Why is the EC concerned about Italy’s proposed 2.4% GDP deficit target for 2019 and not France’s target of 2.8%? Is Italy being...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org