More policy support is expected, and may lead to slight rebound in Q4.China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely to continue to moderate in Q3 and that the weakness may extend into Q4.In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has since June turned to policy easing. The latest PMI report shows that these policy adjustments may have started to boost activity in certain parts of the economy, particularly in construction.As in the previous month, Caixin PMI numbers for September may reflect the weakening performance of small-and-medium sized enterprises (SMEs), which are more reliant on the shadow banking sector for financing needs than bigger

Topics:

Dong Chen considers the following as important: China growth, China PMI, Chinese manufacturing, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

More policy support is expected, and may lead to slight rebound in Q4.

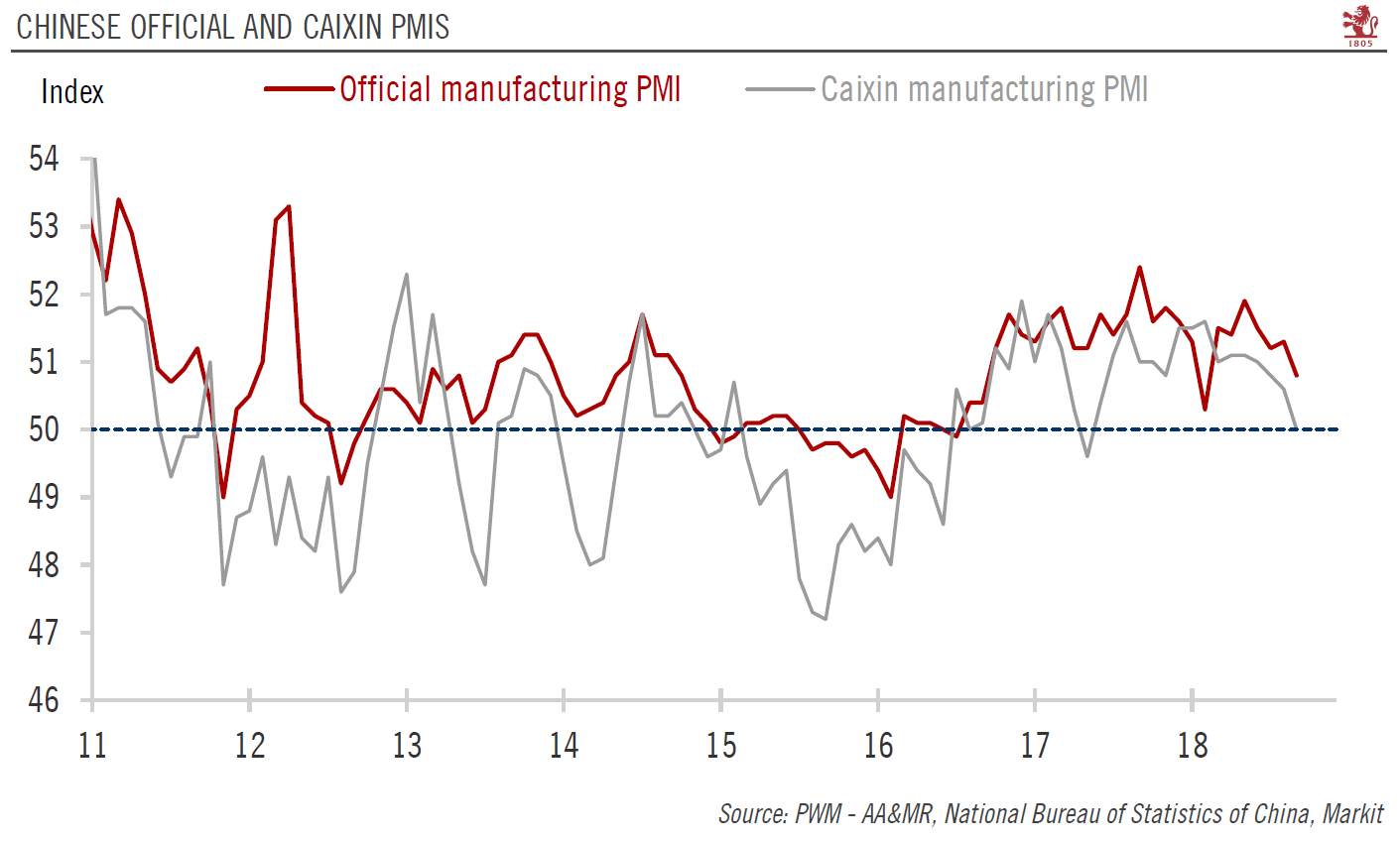

China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely to continue to moderate in Q3 and that the weakness may extend into Q4.

In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has since June turned to policy easing. The latest PMI report shows that these policy adjustments may have started to boost activity in certain parts of the economy, particularly in construction.

As in the previous month, Caixin PMI numbers for September may reflect the weakening performance of small-and-medium sized enterprises (SMEs), which are more reliant on the shadow banking sector for financing needs than bigger firms, and are therefore more affected by Chinese regulators’ deleveraging efforts. This is corroborated by the official September PMIs for large enterprises and SMEs, which diverged significantly.

In September, external sectors showed more weakness than the overall industrial space, with new export orders dropping by 1.4 points and the imports sub-index by 0.6, putting both indicators deep in contraction territory. Trade held up relatively well, but the September PMI readings suggest that the impact of trade tensions with the US may appear in future trade statistics. Non-manufacturing activities fared better than manufacturing. Official non-manufacturing PMIs picked up for the second consecutive month in September, rising to 54. This is mainly attributable to a sharp increase in construction activities.

We expect more monetary and fiscal policy support, which may lead to a modest rebound in growth towards the end of year, as government supports starts to seep into the real economy. However, the divergence between large enterprise and SME PMIs may persist.