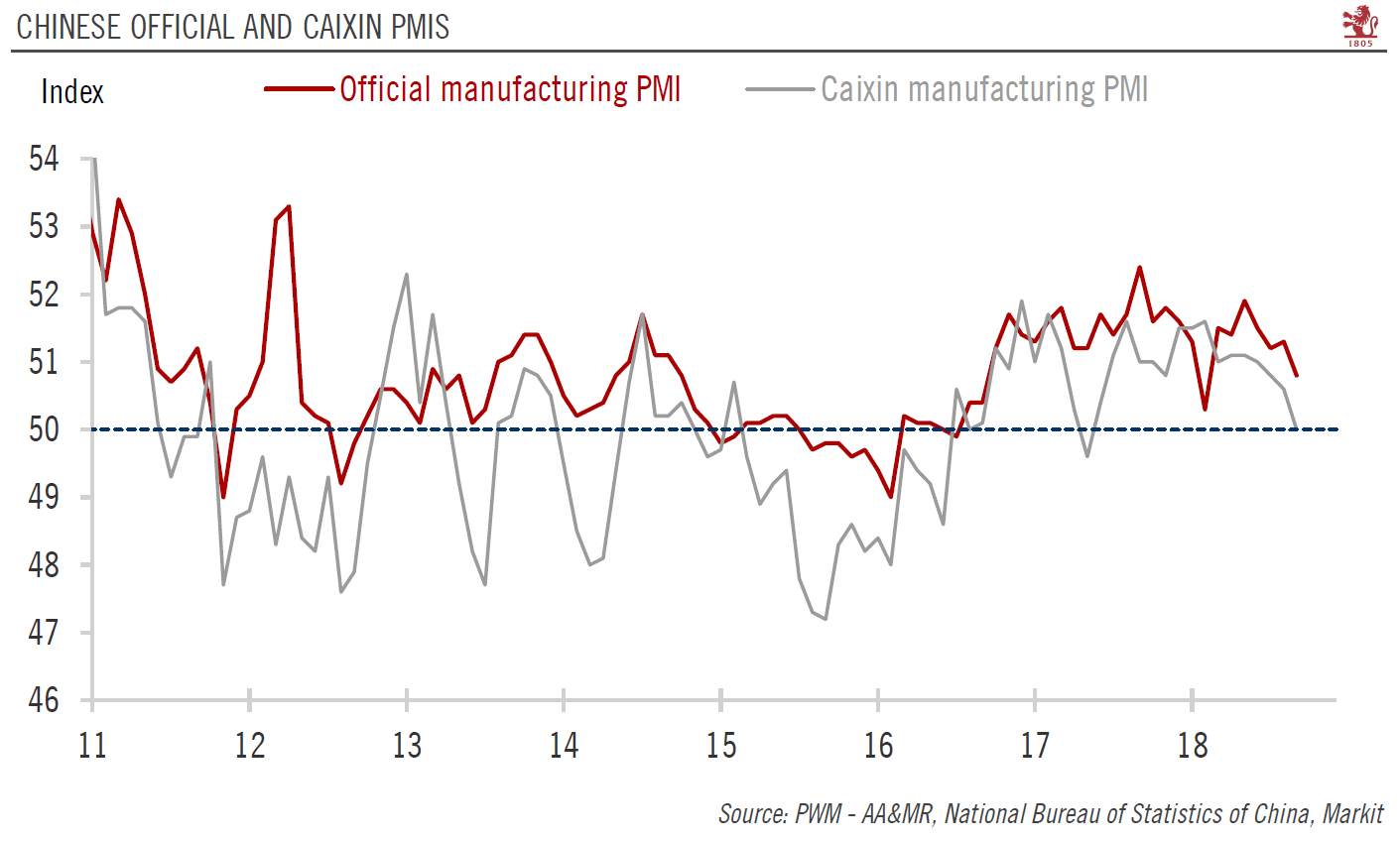

More policy support is expected, and may lead to slight rebound in Q4. China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4. In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June. The latest PMI report shows that these policy adjustments may have started to boost activity in certain parts of the economy, particularly in construction. As in the previous month, Caixin PMI numbers for September may reflect the weakening performance of small-and-medium sized enterprises (SMEs), which are

Topics:

Dong Chen considers the following as important: 2) Swiss and European Macro, China growth, China PMI, Chinese manufacturing, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

More policy support is expected, and may lead to slight rebound in Q4.

China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4.

In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June. The latest PMI report shows that these policy adjustments may have started to boost activity in certain parts of the economy, particularly in construction.

| As in the previous month, Caixin PMI numbers for September may reflect the weakening performance of small-and-medium sized enterprises (SMEs), which are more reliant on the shadow banking sector for financing needs than bigger firms, and are therefore more affected by Chinese regulators’ deleveraging efforts. This is corroborated by the official September PMIs for large enterprises and SMEs, which diverged significantly.

In September, external sectors showed more weakness than the overall industrial space, with new export orders dropping by 1.4 points and the imports sub-index by 0.6, putting both indicators deep in contraction territory. Trade held up relatively well, but the September PMI readings suggest that the impact of trade tensions with the US may appear in future trade statistics. Non-manufacturing activities fared better than manufacturing. Official non-manufacturing PMIs picked up for the second consecutive month in September, rising to 54. This is mainly attributable to a sharp increase in construction activities. We expect more monetary and fiscal policy support, which may lead to a modest rebound in growth towards the end of year, as government supports starts to seep into the real economy. However, the divergence between large enterprise and SME PMIs may persist. |

Chinese Official and Caixin PMIs, 2011-2018(see more posts on China Caixin Manufacturing PMI, China Manufacturing PMI, ) |

Tags: China growth,China PMI,Chinese manufacturing,Featured,Macroview,newsletter