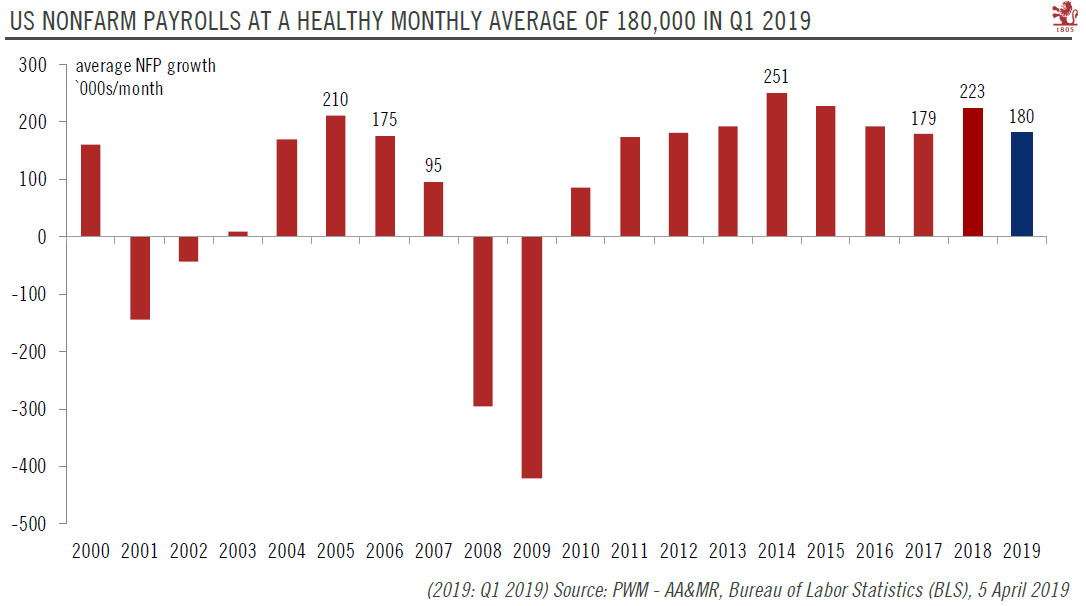

Latest nonfarm payroll report shows the ongoing resilience of the US economy, although some cyclical sectors are being affected by global headwinds.US employment rose by 196,00 in March, bringing the three-month average to a healthy 180,000/month— less than the 2018 average of 223,000, but more than in 2017.The unemployment rate was unchanged at 3.8%, below the Federal Reserve’s (Fed) ‘full employment’ estimate of 4.4%.Wage growth softened to 3.2% year-on-year (y-o-y) from 3.4% in February.From a Fed perspective, this report shows the ongoing resilience of the US economy with no sign of labour market ‘overheating’. In other words, it contains nothing to shift the Fed from its current ‘on hold’ mode.From a business cycle perspective, while there is some slowing in cycle-sensitive sectors

Topics:

Thomas Costerg considers the following as important: Macroview, US employment, US payrolls

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest nonfarm payroll report shows the ongoing resilience of the US economy, although some cyclical sectors are being affected by global headwinds.

US employment rose by 196,00 in March, bringing the three-month average to a healthy 180,000/month— less than the 2018 average of 223,000, but more than in 2017.

The unemployment rate was unchanged at 3.8%, below the Federal Reserve’s (Fed) ‘full employment’ estimate of 4.4%.

Wage growth softened to 3.2% year-on-year (y-o-y) from 3.4% in February.

From a Fed perspective, this report shows the ongoing resilience of the US economy with no sign of labour market ‘overheating’. In other words, it contains nothing to shift the Fed from its current ‘on hold’ mode.

From a business cycle perspective, while there is some slowing in cycle-sensitive sectors like manufacturing (somewhat masked by strength in more domestic-driven industries like healthcare), underlying data show that the risk of recession this year remains modest.