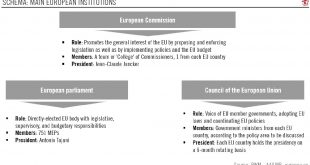

European Parliament elections, to be held between 23 and 26 of May, will be a key political event in Europe. However, we expect limited short-term impact, given the European Parliament’s limited ability to set Brussels’ agenda. European Parliament (EP) elections will be a key political event in Europe, a form of ‘midterm election’ in which the electorates can state their approval or disapproval of their...

Read More »Q&A on European Parliament elections

European Parliament elections, to be held between 23 and 26 of May, will be a key political event in Europe. However, we expect limited short-term impact, given the European Parliament's limited ability to set Brussels' agenda.European Parliament (EP) elections will be a key political event in Europe, a form of ‘midterm election’ in which the electorates can state their approval or disapproval of their respective national governments. Turnout in EP elections has been on a downward trend over...

Read More »House View, April 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAlthough we expect the economic picture to brighten and the decline in earnings expectations to end, we have a prudent stance on global equities, as expressed in our decision to book some profits on global equities and to invest in put options on large-cap European and small-cap US equities.At the same time, our willingness to take on reasonable risk means that the reduction in equities...

Read More »China PMIs jump in March

Industrial gauges rebound on seasonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report generally point to improvement in growth momentum, both on the domestic and...

Read More »Weekly View – Cautious steps forward

The CIO office’s view of the week ahead.Good news came from the world’s second-largest economy after China’s manufacturing sector resumed growth in March, following three consecutive months of contraction. Employment in the sector also grew and new export orders even managed to move back into expansion territory, despite continued uncertainty around the outcome of trade talks between China and the US. We read these indicators as encouraging signs that the Chinese government’s fiscal stimulus...

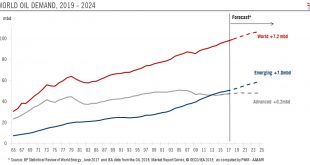

Read More »Oil prices supported by OPEC+ cuts…before market risks being flooded again

Increased US export capacity would probably force OPEC+ to change its current tactics.After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018.The recent release of the International Energy Agency’s annual report is an occasion to answer this question and to...

Read More »Germany: signs of rebound ?

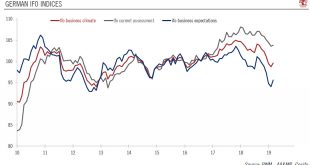

German growth may remain subdued in H1 2019, before picking up somewhat in H2 2019 as some near-term risks dissipate.Germany’s leading indicator, the Ifo index, rose in March, driven by an increase in both sub-components: current assessment and expectations. The Ifo index differs in make-up from Markit’s purchasing manager indexes, but at the sector level, the story is the same: the more domestically driven services sector is showing signs of resilience, while the most export-oriented...

Read More »Germany: signs of rebound ?

German growth may remain subdued in H1 2019, before picking up somewhat in H2 2019 as some near-term risks dissipate. Germany’s leading indicator, the Ifo index, rose in March, driven by an increase in both sub-components: current assessment and expectations. The Ifo index differs in make-up from Markit’s purchasing manager indexes, but at the sector level, the story is the same: the more domestically driven services...

Read More »Weekly View – Yields inverted!

The CIO office’s view of the week ahead.Last week, the 10-year US Treasury yield dipped below the yield on the 3-month bill for the first time since 2007, a year before the last recession. Should we be worried? Not excessively. Yes, the Federal Reserve has lowered its rates and growth forecast (just like the European Central Bank – ECB – before it), German manufacturing has slumped, and the Chinese economy is still in a funk. Yet we think that the signals sent by the yield curve have been...

Read More »Fed meeting review: a strong dovish undertone

The outcome of the March Fed meeting had a strong dovish undertone, crystallising the dovish policy shift at play since early January.The Fed confirmed the end of balance sheet reduction for September 2019. Meanwhile, the dot plot showed an overwhelming majority of members expected no rate hike at all this year (versus two rate increases expected at the December meeting).As expected, Powell took his ‘central banker to the world’ hat, expressed concern about the global economy, including the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org