For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so...

Read More »FX Daily, May 14: Too Weak to Muster Much of a Turnaround Tuesday, Markets See Small Reprieve

Swiss Franc The Euro has risen by 0.09% at 1.1304 EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s willingness to meet China’s Xi at the G20 meeting at the end of next month and his “feeling” that an agreement will still be found seemed sufficient to break the momentum that had swept through the capital market....

Read More »FX Daily, May 13: Investors Still Looking for New Balance

Swiss Franc The Euro has fallen by 0.53% at 1.131 EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the...

Read More »What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

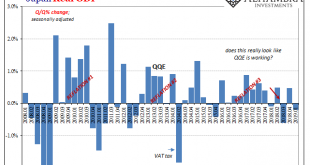

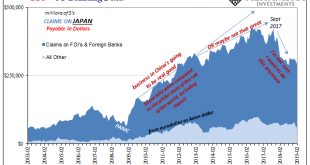

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective. Before the...

Read More »FX Daily, April 26: Greenback Consolidates Ahead of Q1 GDP

Swiss Franc The Euro has risen by 0.14% at 1.1373 EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe’s...

Read More »FX Daily, April 19: Holiday Note

Swiss Franc The Euro has fallen by 0.03% at 1.1399 EUR/CHF and USD/CHF, April 19(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Many financial centers are closed today. These include Australia, India, most European markets, and the US. In Asia, equity markets that were open moved higher. The Nikkei, which gapped higher on Monday, rose 0.5% today for a 1.5%...

Read More »Slump, Downturn, Recession; All Add Up To Sideways

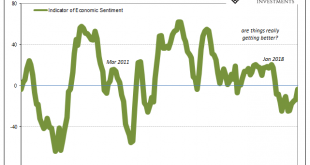

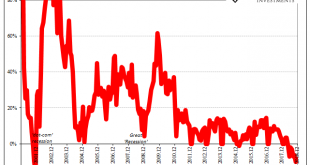

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6. That’s up from -24.7 back in October, though sentiment had likewise improved at one point last year, too. In July, the number...

Read More »Meanwhile, Over In Asia

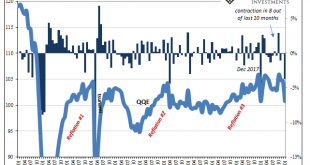

While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something. Therefore, Q4 US GDP wasn’t as bad as feared, cushioning...

Read More »Something Different About This One

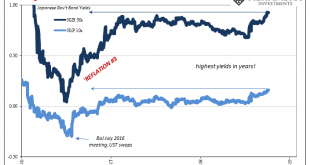

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes. That would be powerful stuff. Instead, in June last year the narrative...

Read More »Lost In Translation

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish. At the end of last July, BoJ’s governing body made a split...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org