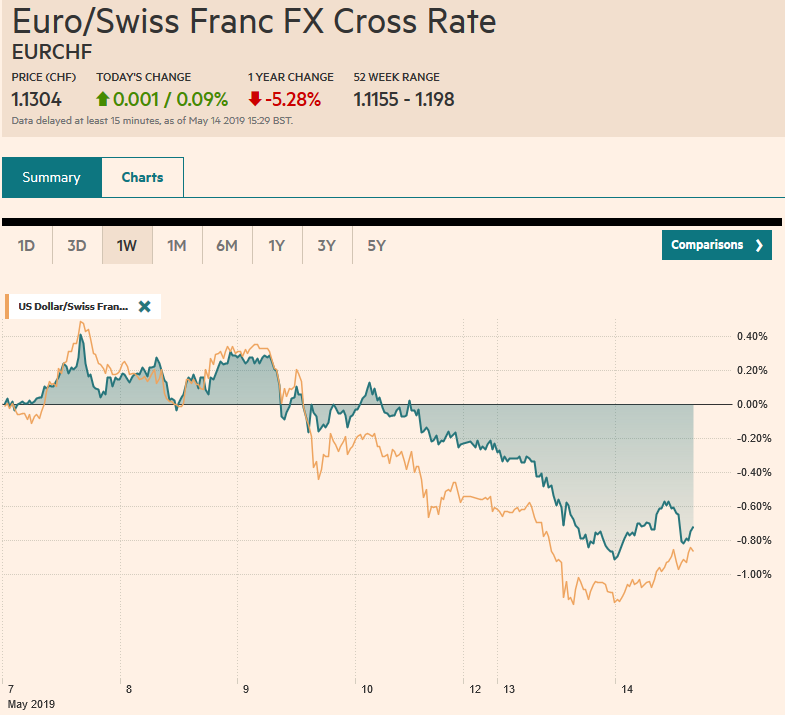

Swiss Franc The Euro has risen by 0.09% at 1.1304 EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s willingness to meet China’s Xi at the G20 meeting at the end of next month and his “feeling” that an agreement will still be found seemed sufficient to break the momentum that had swept through the capital market. Equities in the Asia Pacific were mostly lower, with Japanese benchmarks underwater for the seventh consecutive session. India and Korea bucked the regional trend. European bourses are firm, led by the communication and materials sectors. Up around 0.4% in late morning turnover, the Dow Jones Stoxx 600

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR/CHF and USD/CHF, Featured, Germany ZEW, Japan, newsletter, trade, U.K. Unemployment Rate, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.09% at 1.1304 |

EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

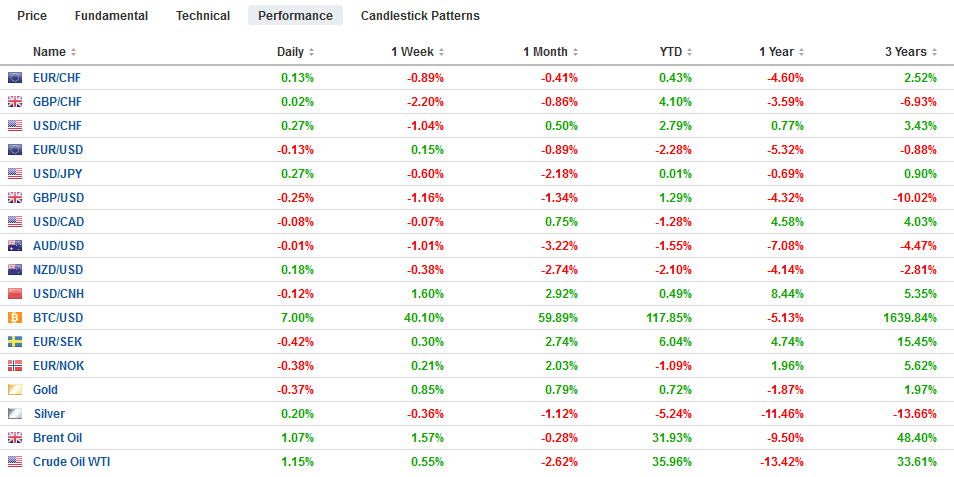

FX RatesOverview: President Trump’s willingness to meet China’s Xi at the G20 meeting at the end of next month and his “feeling” that an agreement will still be found seemed sufficient to break the momentum that had swept through the capital market. Equities in the Asia Pacific were mostly lower, with Japanese benchmarks underwater for the seventh consecutive session. India and Korea bucked the regional trend. European bourses are firm, led by the communication and materials sectors. Up around 0.4% in late morning turnover, the Dow Jones Stoxx 600 has recouped about a third of yesterday’s loss. US shares are trading higher, and around a quarter of yesterday’s 2.4% drop appears to be recovered. The dollar is mixed, with the recent leaders, the yen and Swiss franc paring the recent gains, while the Scandis lead the advancers. Emerging market currencies are trying to stabilize. While gold’s three-day rally is stalling around $1300, the Bitcoin rally is extending its 12th session. |

FX Performance, May 14 |

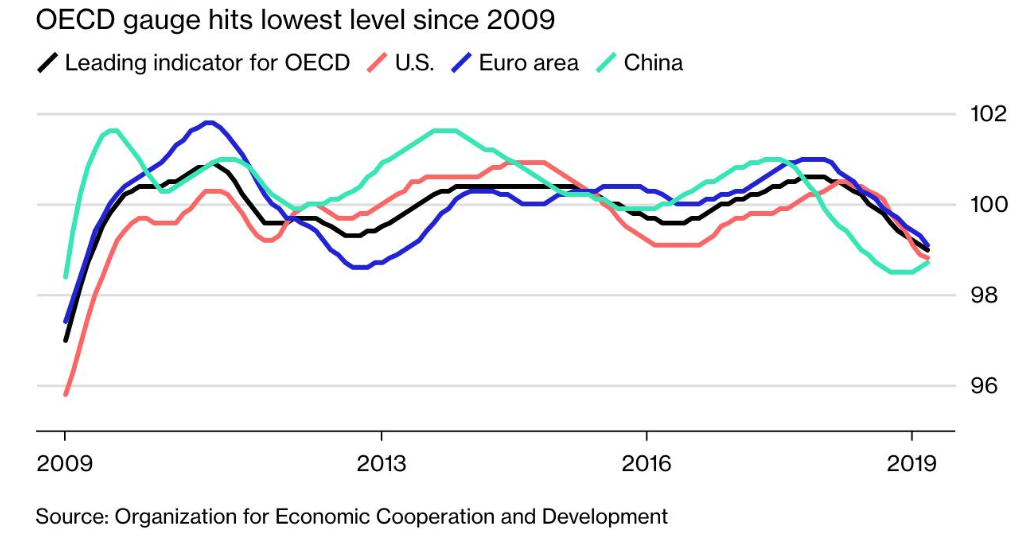

ChinaChina detailed its tariff response to the US actions, and roughly 90% of the imports from the US will have a 25% tariff. Both China and the US provocative actions left a small room to manoeuver. Specifically, the new US levies do not apply to goods in transit, and China’s tariff increases will not be implemented until June 1. However, no fresh talks have been scheduled. The process by which the US will slap a 25% tariff on the remaining Chinese goods that have not been covered yet has begun but will likely take several weeks to work through so that when Trump meets with Xi at the G20 meeting at the next of next month, the new tariff gun will be loaded. The conventional wisdom both sides want a deal. Of course, the economic logic is compelling, but it seems naive to think that simply because both sides have an economic interest in avoiding a tit-for-tat downward spiral in trade means that a deal must be forthcoming. The actions lead us to believe that both sides saw in their interest not to strike a deal now. The US claim that China was backtracking is not new. It made the same claim in February, but talks proceeded. What changed? The political calculus. Trump has said he wants a great deal (which means, we suspect, a comprehensive agreement) and despite the assurances, it was nearly at hand, the odds of such a resolution was increasingly unlikely. Trump apparently judged more could be achieved, and by that we mean his domestic agenda as well, through escalating the trade spat than by resolving it. With other actions intended to curb China, as the weapons sale to Taiwan, the efforts to block the Belt Road Initiative, the campaign against Huawei, the blocking of China Mobile, officials in Beijing recognize a new form of containment. |

OECD Gauge hits Lowest Level |

Japan’s current account stood at JPY2.85 trillion in March. With US-Japanese trade talks underway, today’s report is a timely reminder of what drives Japanese external surplus, and it is not trade. Of that current account surplus, only about JPY700 bln, less than a quarter, can be traced to the trade surplus. The c/a surplus is driven by investment income, which are dividends and coupons of portfolio investment but also profits, royalties, licensing fees, and dividends from direct investment. Included in the balance of payments data, Japan reports some of its portfolio purchases. Two developments stand out. First, Japanese investors bought almost as much French bonds (~JPY3.18 trillion) as they bought in the previous 12-months (~JPY3.45 trillion). Japanese investors bought JPY4.26 trillion of US bonds in March, nearly buying back three-quarters of what it had sold over the past year. Japan’s preference was for US corporate bonds, which accounted for almost 90% of its March purchases of US bonds.

The dollar has been confined to yesterday’s ranges (~JPY119.00 to JPY119.85) as the market catches its collective breath. The $680 mln in a JPY119 strike that expires today looks safe as does the $630 mln in a JPY109.40 option that also will be cut today. The intraday technicals give a reasonable chance that the $690 mln at JPY110 could be in play before the expiration. A close above the JPY110.10 area would boost the technical chances that a low is in place. The Australian dollar is not finding much traction, and it remains pinned near yesterday’s low (~$0.6940). It is trading like a proxy for China sentiment, but employment data, early Thursday in Sydney may offer a domestic distraction. Initial resistance is seen near $0.6960. The yuan weakened for the eighth session of the past nine, but the fix was in line with market expectations and did not seem to reflect an attempt to drive it lower. We expect Chinese officials to seek to temper the depreciation as the dollar draws close to CNY6.90 as the official tolerance may extend toward CNY7.0.

United Kingdom

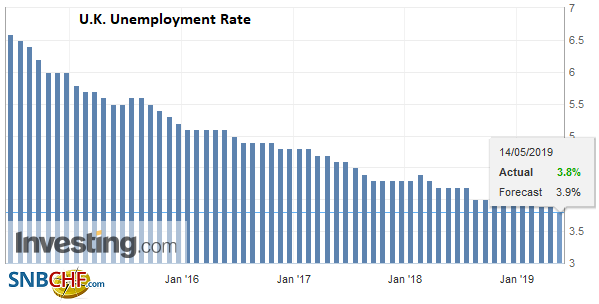

The UK’s cross-party talks apparently ended without much progress. May holds a cabinet meeting today and will meet with the party’s rank-and-file on Thursday. The latest polls show that May is leading the party into a third electoral defeat. She lost the parliament majority. The recent local elections saw a defeat of historic proportions. The Tories are polling around 10% in the EU Parliament elections. Labour is not doing much better at 16%. The new Brexit party is drawing a third of the vote. Separately, the UK reported a higher claimant count (24.7k vs. a revised 22.6k in March), softer pay increases, and an unexpected fall in unemployment (3.3% vs. 3.4%). |

U.K. Unemployment Rate, March 2019(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Germany

Germany’s ZEW survey was mixed. The assessment of the current situation improved to 8.2 from 5.5, which is more than economists anticipated. It is the first increase since last September. On the other hand, the expectations component fell back into negative territory (-2.1) where it had been since April 2018 except for last month. Note that Germany reports Q1 GDP tomorrow. Recall that it contracted in Q3 18 and was virtually flat in Q4 18. It is projected to have grown about 0.4% in Q1 19.

The euro is trading in the lower half of yesterday’s range (which was roughly $1.1220-$1.1265). There is a 910 mln euro at $1.1240 that expires today. It looks to be another consolidative session. The euro has not traded above the $1.1265 area since April 18. Just below $1.2925, sterling made a new low for the month today. While it has stabilized in the European morning, the $1.2970 is the nearby cap, which may prove sufficient to limit gains today. Separately, stronger than expected industrial output figures (2.1% increase in March, the third consecutive increase) from Turkey and the better market mood may be helping the lira stabilize today.

America

The US economic calendar is light. Import and exports price indices don’t move the market in the best of times, let alone in the current environment. Fed Presidents George and Daly speak today. Williams spoke in Asia. The market has turned very aggressive about pricing in Fed easing. The January fed funds contact implied a 2.24% yield before Trump’s tweets announcing the end of the tariff truce. The yield fell to 2.15% by the end of last week. It is currently implying a yield of 2.08%. Meanwhile, the effective average fed funds rate has eased seven basis points to 2.38% since the Fed cut the interest on reserves to 2.35% from 2.40%. From the current 2.38%, the market has nearly 1/5 cuts priced in, if we assume that the interest on reserves will be cut a little more than a fed funds target rate reduction.

The last pullback in the S&P 500 was in March. The 2810 area, which the S&P 500 traded through but closed back above is the (61.8%) retracement of that rally since March. There are two levels to monitor. The first is the 2840 area. A move above here would begin repairing the technical damage. It seems premature to expect this today. The second is the 2775 area where the 200-day moving average is found. A break of it would likely target those March lows near 2722.

The US dollar remains in a CAD1.34-CAD1.35 range. It is difficult to get enthusiastic one way or the other. We see a sharp narrowing of the interest rate differential and better than expected data to be a net positive but due to the risk-off sentiment and the weakness in oil prices, the interest rate consideration has been unable to express itself. We expect Mexico’s high real and nominal interest rates to continue to attract speculative flows. The US dollar remains within last Friday’s range against the peso (~MXN19.045-MXN19.283).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,EUR/CHF and USD/CHF,Featured,Germany ZEW,Japan,newsletter,Trade,U.K. Unemployment Rate