In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward $44 a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50...

Read More »The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers. First, the measures implemented since 2009 created an artificial stability and an asset price boom in many markets. But the absolute rate of GDP expansion and level of price changes is inadequate to solve global debt problems. Second, new initiatives seem the risky response of clever...

Read More »St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

“At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?” Those are the shocking words of St.Louis Fed Director of Research Christopher Waller whose brief note today will be required reading for everyone at The Bank of Japan, The ECB and every other central banker on the verge of NIRP… If you pick up any principles of...

Read More »Gold And Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and concentrated than before the financial crisis, energy loans being an accident waiting to happen, the markets having veto power over the Fed, and gold having more room to run. * * * Mr. Bianco, negative interest are causing a lot of stir at the...

Read More »Interest Rates: How Low Can They Go?

When Denmark introduced negative interest rates in 2012, it was a pioneer. But the policy has become such an accepted part of central banks’ toolbox in the years since that financial pundits hardly batted an eyelash when Hungary became the world’s sixth central bank to introduce negative rates in March 2016. As the practice becomes more widespread, the question of how low interest rates can go has become increasingly relevant for investors. While every country (or region, in the case...

Read More »INTERACTIVE: How Do Negative Interest Rates Work?

VIDEO: Why Japan Really Went Negative

Was the Bank of Japan’s surprise foray into negative interest rates this January truly motivated, as some have said, by a desire to weaken the yen? Watch Tomomi Inada, Chair of the Policy Research Council for Japan’s Liberal Democratic Party, discuss the central bank’s dramatic policy shift.

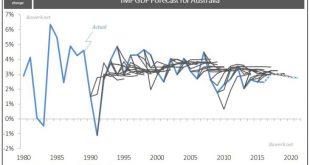

Read More »Chinese Dragon: Breathing Credit Fumes

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate. However, spending millions of dollars to do the job of a ruler doesn’t seem like wise...

Read More »Japanese Capital Flows: Six Observations

The following observations are drawn from the weekly report of Japan’s Ministry of Finance unless noted otherwise. We use the weekly data instead of monthly to identify changes of trend earlier. We use simple convention of the week by the last rather than the first day. That means that the report for the week ending April 1 is the first week of April. To smooth out the volatility, we will often refer to a four-week average. The latest MOF report was released earlier today. 1....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org