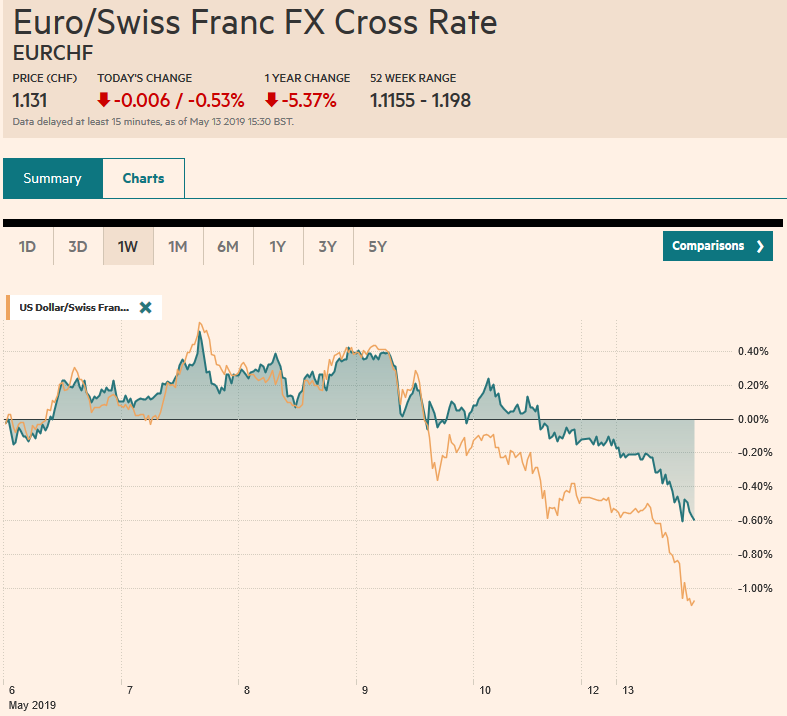

Swiss Franc The Euro has fallen by 0.53% at 1.131 EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the agreement. Now China was given around a month to capitulate to US demands or face a 25% tariff on their remaining exports to the US. The lack of an immediate formal response (retaliation) by China and indications that talks will resume at some point, helped the S&P 500 reverse higher ahead of the weekend, but

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, Australia, EUR/CHF and USD/CHF, Featured, Italy, Japan, newsletter, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.53% at 1.131 |

EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

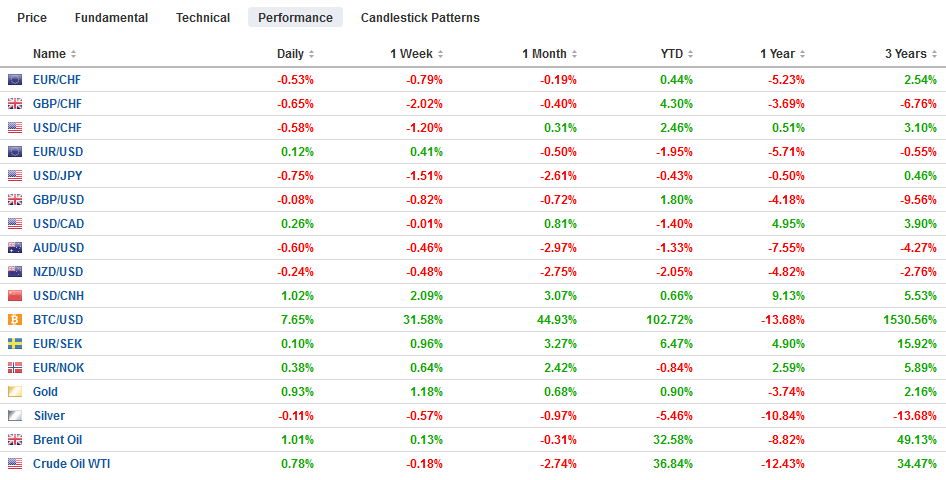

FX RatesOverview: The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the agreement. Now China was given around a month to capitulate to US demands or face a 25% tariff on their remaining exports to the US. The lack of an immediate formal response (retaliation) by China and indications that talks will resume at some point, helped the S&P 500 reverse higher ahead of the weekend, but a pessimistic reading of events dominates today and equities markets are tumbling again. MSCI Asia Pacific Index lost 3.6% last week, and most of the major markets (Shanghai, South Korea, Taiwan, and Singapore) were off over 1% today. Europe’s Dow Jones Stoxx 600 fell around 0.7% in the morning session after its shed 3.4% last week. The S&P 500 slid 2.2% last week and is off around 1.25% in electronic trading. Bonds are rallying. The US 10-year yield is off five basis points to just above 2.40%. The low from the end of March was about 2.33%. The benchmark 10-year German Bund is off a few basis points ( ~minus 6 bp) to push its yield below the 10-year JGB. Italian and Greek bonds are exceptions to the push lower in yields. The dollar enjoys a firmer bias against most of the world’s currencies today. The Japanese yen and Swiss franc are proving most resilient, while among the majors the dollar and Scandi blocks are the heaviest. Declines in the Turkish lira and South African rand are pacing the emerging market currency decline. |

FX Performance, May 13 |

Asia Pacific

China has not specified its retaliatory measures, and most observers seem to still be expecting a formal announcement in near-term, though we are less convinced. On the one hand, the US (and many outside observers) have been critical of China for the apparent lack of the rule of law. Yet, somehow, the reluctance of China to change its laws (when the Trump Administration is seeking an executive agreement, which is a weak form in the US) was the supposed trigger for the collapse. It appears China insisted that all Trump tariffs are lifted with the agreement and this was not acceptable to the US. Note that Mexico and Canada are demanding along similar lines that the steel and aluminum tariffs are lifted before the parliaments approve the new NAFTA deal.

The process by which the US can impose a 25% tariff on the remainder of Chinese goods takes several weeks. Details expected later today. China was given a month to reach an agreement. No new meetings have been announced. Since the last meeting was in the US, Lighthizer and Mnuchin have been invited to Beijing with no specific date reported. However, as economic adviser, Kudlow was admitting on television yesterday that indeed American businesses and consumers pay the tariff, he also pointed to the G20 meeting at the end of next month in Japan as a potential meeting between Trump and Xi. Initially, the meeting was touted as a venue to sign the agreement, and now it may be needed to overcome the deadlock. Separately, some suspect that Kudlow’s contradiction of Trump’s claim that China is paying for the tariff is a sign that he may leave the administration this summer.

Meanwhile, support for Japan’s Prime Minister Abe has risen according to the latest polls. A Nikkei survey put the government’s support at 55% up seven percentage points since March. A JNN TV poll found a four-point gain in the past month to nearly 57.5%. However, the government’s economic plans are less appreciated. The Nikkei survey found 57% opposed to the sales tax increase planned for October. The upper house of the Japanese Diet faces an election in July, and there is some talk that Abe may take advantage of the polls and the weak opposition to dissolve the lower house and hold joint elections. The government is reluctant to delay the sales tax increase again, but if there are to be joint elections, a delay is likely.

Australia’s elections are on May 18. The latest polls put the opposition Labor ahead of the governing Liberal-National coalition. At 51%-49% it is statistically a dead-heat, but the government is widely seen as lagging. Prime Minister Morrison’s last-minute gambit to lower the downpayment needed for first-time homebuyers from 20% to 5% may not enough to put the government ahead. Labor has been out of power for six years and is favored to secure a majority.

The dollar has been confined to about a quarter of a yen below JPY109.85. There is a $360 mln option at JPY109.65 and an option at JPY110.00 for around $380 mln that will be cut today. In the last two sessions, the dollar found bids near JPY109.50. Similarly, it has been blocked near JPY110.10. The Australian dollar seems to build a shelf near $0.6965. However, it continues to trade heavily. A close above $0.7020 would lift the tone. The dollar rose about 0.75% against the Chinese yuan and closed the local session near CNY6.8735. It appears to be the biggest move since last October. Some observers think Chinese officials will depreciate the currency to offset the impact of the tariffs. Others see mostly normal market forces at work, weighing on the yuan in the risk-off environment (like other EM assets), a decline in interest rates, and an expected hit on the economy. We have understood Chinese officials to sanction a CNY6.70 to CNY7.0 range, but that was before the escalation of the trade conflict. A test may be required to renew official guidance.

Europe

The cross-party talks between the UK government and the Labour Party do not appear to amount to very much yet, but without a clear alternative, the talks are set to continue. A ComRes poll out over the weekend shows almost as many approve of revoking Article 50 and remaining in the EU (51%) as favor a second referendum (47% approve ar referendum between May’s deal and remaining in the EU, and 50% approve a second referendum between leave and remain). May lost the Tory majority in parliament. She led the party to a drubbing of historic proportions in the recent local elections. The polls suggest the Conservative Party will suffer in the EU Parliament election to a new political party/business led by Farage. The backbenchers are increasingly restive. May to expect to meet with the 1922 Committee later in the week, which wants May to step down shortly.

Political tensions are on the rise in Italy. There has been such talk before, but it was easier to dismiss. The League, which has acted as the senior member of the coalition, is now seeing its support in the polls slip, ahead of the EU Parliament election later this month. Moreover, one of League leader Salvini’s allies is caught up in a corruption scandal, and Salvini himself appears to have been caught in a power grab for shipping in Italian waters ostensibly as a way to address the refugee flow, encroaching on the mandate of a 5-Star minister. Also, the arranging of a private sector bailout of a troubled lender (Carige Bank) failed, and unless an alternative is found shortly, nationalization may be necessary, which the League is loath to do. There continue to be murmurings that Salvini may precipitate a crisis to call for elections, join forces with its old ally in Berlusconi’s Forza Italia to form a new center-right government.

The euro is trading quietly within the ranges seen before the weekend. Indeed, the euro has been confined to about 10 ticks on either side of $1.1230. There is a billion euro option at $1.12 that expires today. Only a move above $1.1250-$1.1260 is meaningful. Sterling has also been confined to narrow ranges seen at the end of last week. The topside may be reinforced by the GBP600 mln option struck at $1.3040 that expires today.

North America

The US economic calendar is light until the middle of the week when both retail sales and industrial output will be reported. As of May 9, the Atlanta Fed says the Q2 GDP is tracking 1.6%. A report over the weekend claimed that Trump’s calls for the Fed to cut rates were seen in Beijing as a signal that the President is worried about the US economy. What may have been misunderstood is that Trump has wanted easier monetary policy since almost his first day in office and does not reflect a short-term economic assessment.

Canada reported spectacular employment data before the weekend. The economy, less than a tenth the size of the US, added over 100k jobs, nearly three-quarters of which were full-time positions. The participation rate increased, and unemployment fell. The hourly rate for permanent workers unexpectedly accelerated to 2.6% from 2.3%. Canada reports April CPI figures in the middle of the week. It is expected to firm slightly. The macro story and a decline in the discount of Canadian rates relative to the US should lend support to the Canadian dollar. However, the risk-off sentiment seems to be curbing the enthusiasm for the Loonie, which is the best performer within the dollar bloc. Mexico’s central bank meets Thursday and is widely expected to keep the overnight rate at the lofty 8.25%. The peso is under pressure. The greenback looks poised to challenge last week’s highs near MXN19.32, but the more important cap is seen by the end of March high of roughly MXN19.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Australia,EUR/CHF and USD/CHF,Featured,Italy,Japan,newsletter,Trade