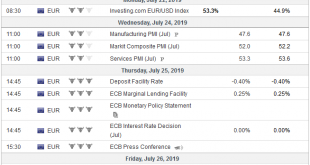

Swiss Franc The Euro has fallen by 0.03% at 1.1007 EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new...

Read More »FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market’s attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa. Japan goes to the polls on July 21 to elect the upper chamber of the Diet. There...

Read More »FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Swiss Franc The Euro has fallen by 0.35% at 1.1024 EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an...

Read More »FX Daily, July 9: No Turn Around Tuesday, as Equities Extend Losses and the Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.13% at 1.1128 EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equity benchmarks are headed for their third consecutive loss today as caution prevails at the start of Q3 after a strong first half. Ten-year benchmark yields are edging higher after a soft start in Asia. Italian bonds continue to...

Read More »FX Daily, June 28: The World may Look Different Come Monday

Swiss Franc The Euro has risen by 0.05% at 1.1106 EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Quarter-end positioning seems to dominate today’s activity. The outcome of bilateral talks at the G20 gathering partly reflects the influence of the US President who eschews multilateral efforts as a hindrance to its sovereignty. Equities...

Read More »FX Daily, June 27: Ready. Set. Wait.

Swiss Franc The Euro has fallen by 0.07% at 1.111 EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The approaching month/quarter-end and the G20 meeting dominate considerations. Although the S&P 500 closed on its lows for the third consecutive session yesterday, Asia Pacific equities liked the apparent increase in the prospect of a...

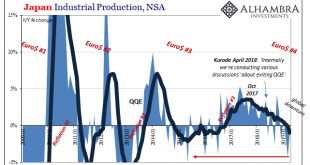

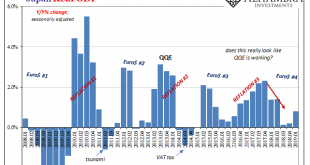

Read More »Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best. I wrote in April last year how Japanese Industrial...

Read More »FX Daily, June 19: Still Patient?

Swiss Franc The Euro has fallen by 0.21% at 1.1169 EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-taking was bolstered by the dramatic shift in Draghi’s rhetoric less than two weeks after the ECB meeting and a Trump’s tweet announcing that there was going to be an “extended” meeting between him and Xi at the G20 meeting and that...

Read More »Weakening Japanese momentum behind strong GDP figures

Japan’s latest GDP report reveals some notable weakness in the economy despite the strong headline figures. The preliminary reading of Japanese GDP for Q1 shows that the economy grew by 2.1% q-o-q annualised, beating the consensus forecast of -0.2%. However, behind the strong headline figures, details of the GDP report reveal some broad-based weakening in momentum. Declining corporate capex and sluggish household...

Read More »Japan’s Surprise Positive Is A Huge Minus

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five. Japan Real GDP,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org