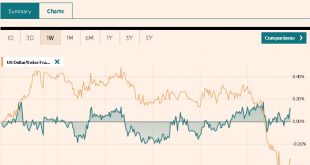

Swiss Franc The Euro has fallen by 0.27% to 1.079 EUR/CHF and USD/CHF, January 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had “concluded” its proportionate measures saw the markets...

Read More »FX Daily, December 27: Equities Rally While the Dollar Slumps into the Weekend

Swiss Franc The Euro has risen by 0.05% to 1.0893 EUR/CHF and USD/CHF, December 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: Equities are finishing the holiday-shortened week on a firm note, encouraged by strong holiday internet sales in the US. Most markets in the Asia Pacific region advanced except China and Thailand, while Japanese markets were mixed after weak industrial output and retail sales. The MSCI Asia...

Read More »FX Weekly Preview: Economic Data in the Holiday-Shortened Week

The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018. Risk assets are doing well, while interest rates have backed up. The CRB...

Read More »FX Daily, December 18: Markets Turn Quiet Ahead of Central Bank Meetings

Swiss Franc The Euro has fallen by 0.22% to 1.0905 EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets have turned quiet as the year-end positioning drives prices in lieu of fresh developments. Equities in the Asia Pacific region were narrowly mixed. The smaller markets in Asia performed better than the large bourses of Japan, China, and Korea, which eased....

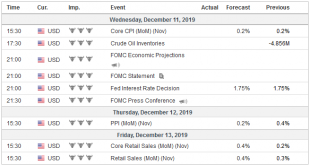

Read More »FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year. The UK and China have their monthly data dumps—a concentration of high-frequency data. The US reports both CPI...

Read More »FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

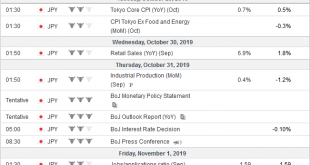

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30,...

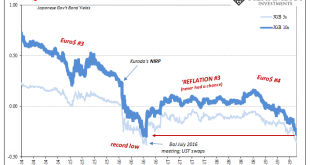

Read More »Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more. But all that likely coordinated “accommodation” was spoiled...

Read More »FX Daily, October 1: Dollar Jumps to Start New Quarter

Swiss Franc The Euro has risen by 0.17% to 1.0893 EUR/CHF and USD/CHF, October 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is rising against nearly every currency today as global growth concerns deepen. Japan’s Tankan Survey showed large manufacturers confidence is a six-year low. The Reserve Bank of Australia cut 25 bp as widely expected and kept the door open for more. The final EMU PMI...

Read More »Dollar Mixed on Central Bank Thursday

As expected, the Fed cut rates by 25 bp; the dollar firmed after the decision but has since given back some gains During the North American session, there will be a fair amount of US data BOE is expected to keep rates steady; UK reported August retail sales SNB and BOJ kept rates steady, as expected; Norges Bank unexpectedly hiked 25 bp Brazil cut rates 50 bp to 5.5%; Indonesia cut rates 25 bp to 5.25%; Taiwan kept rates steady at 1.375%; SARB is expected to remain...

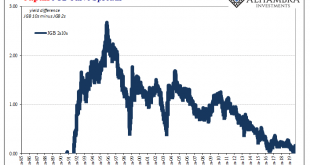

Read More »Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned. Japan JGB, Jan 2014 - Jul 2019 - Click to enlarge Record lows in Germany, those seem to make sense. By every account, the German...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org