Swiss Franc The Euro has fallen by 0.28% to 1.0707 EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Many observers are attributing the sell-off in risk assets today to the Federal Reserve’s pessimistic outlook, yet, as we note below, the Fed’s median GDP forecast this year is better than many international agency forecasts, including the OECD’s that was issued yesterday. Moreover,...

Read More »From QE to Eternity: The Backdoor Yield Caps

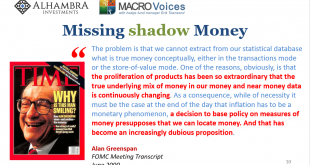

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and then no recovery....

Read More »FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Swiss Franc The Euro has risen by 0.63% to 1.0667 EUR/CHF and USD/CHF, May 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today’s activity has been minor. The...

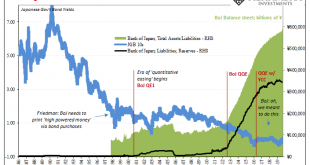

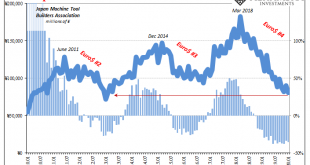

Read More »There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates. No, stupid, declared Milton Friedman. Lower rates don’t mean stimulus they mean monetary policy has...

Read More »FX Daily, April 6: Glimmer of Hope Lifts Markets

Swiss Franc The Euro has risen by 0.01% to 1.0554 EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the...

Read More »FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Swiss Franc The Euro has fallen by 0.34% to 1.0547 EUR/CHF and USD/CHF, April 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly...

Read More »FX Daily, March 25: Relief, but…

Swiss Franc The Euro has risen by 0.02% to 1.0589 EUR/CHF and USD/CHF, March 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are marching higher. While the Dow Jones Industrials posted its biggest advance since 1933, the US is lagging behind other leading benchmarks. The MSCI Asia Pacific advanced, led by Japan’s Nikkei’s 8% gain. It was third consecutive gain, during which time the Nikkei has...

Read More »What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way. Starting with the fact QQE remains ongoing approaching its seventh birthday. Over here in...

Read More »FX Daily, March 10: Markets Stabilize after Body Blow

Swiss Franc The Euro has risen by 0.09% to 1.0597 EUR/CHF and USD/CHF, March 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It appears after a few days of miscues, US officials struck the right chord, and the global capital markets seemed to stabilize shortly after the US session ended. President Trump’s press conference today is expected to spell out in greater detail relief for households and businesses....

Read More »FX Daily, March 06: Panic Deepens, US Employment Data Means Little

Swiss Franc The Euro has fallen by 0.40% to 1.0581 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org