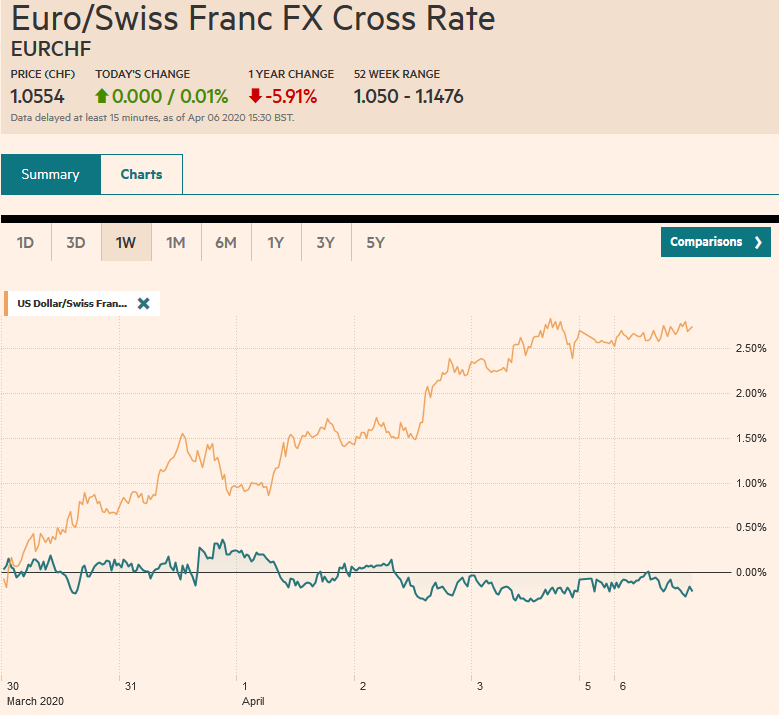

Swiss Franc The Euro has risen by 0.01% to 1.0554 EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the number of states with infection rates above 20% is less than 10 from over 40 last week. Nevertheless, caution is still highly warranted as the “weekend effect” could be a result of lighter hospital traffic. Chinese and Indian markets were closed, but other Asia Pacific markets rallied, led by 4%+ gains

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, COVID-19, Featured, Japan, newsletter, Oil, Switzerland, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.01% to 1.0554 |

EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the number of states with infection rates above 20% is less than 10 from over 40 last week. Nevertheless, caution is still highly warranted as the “weekend effect” could be a result of lighter hospital traffic. Chinese and Indian markets were closed, but other Asia Pacific markets rallied, led by 4%+ gains for the Nikkei, Australia, and Indonesia. South Korea and Singapore benchmarks advanced by more than 3%. Europe is following suit. In late morning turnover, the Dow Jones Stoxx 600 is up around 3%, led by consumer discretionary, industrials, and financials. US shares are higher, pointing to early gains of about 3%. Core bond yields are edging higher, and the US 10-year benchmark yield is up around six basis points to 0.66%. Peripheral European yields are steady to slightly higher as they continue to trade more like risk assets. The dollar-bloc and Scandi currencies are advancing against the dollar, which itself is higher against the yen and Swiss franc. The euro and sterling are fighting for small gains. The JP Morgan Emerging Market Currency Index is slightly higher after losing 3.2% last week. The Hungarian forint is the strongest of the EM currencies, while the Turkish lira is of the few in the space trading lower. Gold is moving higher with the risk assets today to extend its advance for a fourth session and is approaching $1650. Oil is paring the sharp pre-weekend gains, and May WTI is about 2.5% lower as it recovers from a deeper slide when the markets re-opened |

FX Performance, April 6 |

Asia Pacific

Japan’s Prime Minister Abe will propose a state of emergency for two prefectures, Tokyo and Osaka, that turns authority to local officials to enact stay-at-home measures as cases in the metropolitan areas increase. The power of enforcement is vague in Japan. Separately, the JPY60 trillion (~$550 bln) is taking shape. There will be two parts. The first offers assistance to households and businesses that have been impacted by the virus. It includes cash payments to households. The second part is for the aftermath of the contagion, to help promote a strong recovery.

The Reserve Bank of Australia meets tomorrow. It has reduced its cash target rate to 25 bp. This is effectively the zero bound and RBA officials, like New Zealand and Canada’s central bank, are reluctant to cut any further. The RBA has introduced both an asset purchase program and yield curve control. Under the latter, it targets the three-year yield at 25 bp as well.

The dollar is gaining against the yen for the third session. It has resurfaced above JPY109 for the first time since March 27 to reach almost JPY109.40. The next target is JPY109.80-JPY110.00. Initial support is seen in the JPY108.80-JPY109.00 band. The Australian dollar is up over 1% today, as it snaps a four-day decline, but is still within the pre-weekend range. Yet, it is bid in the European morning and looks poised to challenge last week’s high near $0.6200 in the next day or two if it can establish a foothold above the $0.6070 area.

Europe

The speed at which Switzerland has been able to get its facility to aid small and medium-size businesses has been remarkable, and other countries are taking notice. It launched the program on March 25 for CHF20 bln. In its first full week is distributed CHF15 bln to more than 76k businesses. A report suggested that a similar UK program saw 130k requests and less than 1000 loans. The Swiss government doubled the program before the weekend. Interest-free loans can be requested up to 10% of the annual revenue up to CHF500k, The loans are made by Swiss banks, by guaranteed by the government, A second facility guarantees only 85% of the loan, but the bank can charge 50 bp.

In Europe, loan guarantees up to 80%-90% are often encouraged by EU rules, and working with banks appears to be a program that gets a big bang for little outright money commitment today. Germany reportedly is putting together an additional 300 bln euro loan guarantee program for its small and medium-sized businesses. German Finance Minister Scholz suggested that these loans may be fully guaranteed, which would seem to require EU agreement on state-aid. Italy is also set to unveil new measures that could include 90% guarantees on 200 bln euros of loans. Elsewhere, in Hungary, where Prime Minister Orban is ruling by decree after parliament suspended itself and gave the Orban total power for an unspecified period, is reportedly putting together a stimulus package worth about 20% of GDP.

The euro is inside the pre-weekend range (~$1.0775-$1.0865). It would be the first time in five sessions the previous session’s low held. This could set the stage for a turn-around Tuesday. A move above $1.0870 would target $1.0925 initially, and maybe $1.0970 before encountering stronger resistance. Sterling has similarly held above $1.22, the pre-weekend low. It has poked above $1.23, but there has been limited follow-through buying. Resistance is seen near $1.2350. The euro had risen above the GBP0.8835 high seen before the weekend, but encountered selling pressure that pushed it back to below GBP0.8800. The 200-day moving average, around where it found support last week, is about GBP0.8750.

America

The jobs report before the weekend was shocking, and it is widely recognized that these are still the early days. The surveys were conducted in the first part of the month before the 10 mln filed for initial jobless claims or about 6.5% of the US workforce. That is the more meaningful number now that the results of phone surveys with light participation that took place what seems like eons ago. Due to America’s peculiarities, about 3.5 mln Americans will likely lose their healthcare. Many look for as many as 6 mln new filings last week, which will be published April 9. Canada makes its employment report later this week. Reports indicate that roughly 10% of its workforce has filed for jobless benefits. Bank American was among the first large banks to begin implementing the US paycheck protection program, and they reported 85k applications for a little more than $20 bln. Now 41 states have some closure. Moody’s Analytics estimates that the average daily output fell by 29% from the first week in March.

Russia and Saudi Arabia exchanged insults, but they still left the door ajar to a deal. The virtual meeting is now tentatively slated for April 9. The US is in an awkward position. It has long complained about the unfairness of the oil cartel and has threatened sanctions. The price and production war is what a world without a cartel could look like, and it scares the Trump Administration. If Saudi Arabia cannot get OPEC+ to act a cartel, it is threatening to levy tariffs on Saudi oil. Although the US will not formally participate in an output cut agreement, the drop in prices and rising storage costs have spurred several US producers to reduce output. Other non-OPEC areas, from Norway to Chad to Brazil, also have “shut-in” supply. That said, it is the low price that pushes out the marginal producers, and without participating in an orderly market arrangement, as soon as prices rise, there will be overhead supply.

Ahead of the weekend, the Federal Reserve announced it would scale back its Treasury purchases to a still enormous $50 bln a day. This is down from $60 bln a day in the last two sessions and $75 bln a day before that. To put this number in perspective, consider that under the Pandemic Emergency Purchase Program, the ECB intends to buy 750 bln euros before the end of the year. The Fed’s balance sheet expanded by almost twice that amount in the past three weeks.

The Bank of Canada reports its Business Outlook Survey of leading companies today. While the euro and sterling are inside last Friday’s range, the US dollar has traded on both sides of its range against the Canadian dollar. As the North American session is about to begin, the greenback is just above the pre-weekend low (~CAD1.4095). Support is seen near CAD1.40 and then around CAD1.3925. Mexico President AMLO remains reluctant to unleash a significant stimulus program but appears to be softening his stance. A public works program and a facility for low-interest rate loans are being established. The US dollar initially rallied to new record highs against the peso (~MXN25.7850) before falling to around MXN24.82 in Europe. Although the pullback has left short-term momentum indicators stretched for the dollar, the next support area is seen closer to MXN24.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,COVID-19,Featured,Japan,newsletter,OIL,Switzerland