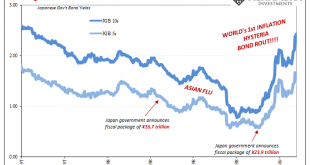

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

Read More »Seizing The Dirt Shirt Title

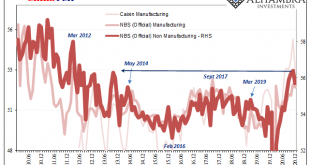

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn. This view had been punctuated by Fed Vice Chairman Richard Clarida, among many others, who in early January...

Read More »FX Daily, January 04: Rising Equities and Slumping Dollar Greet the New Year

Swiss Franc The Euro has fallen by 0.06% to 1.0821 EUR/CHF and USD/CHF, January 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week’s 3.6% gain. It has not rallied for seven consecutive sessions. Led by mining and...

Read More »FX Daily, November 27: Dollar Offered Ahead of the Weekend

Swiss Franc The Euro has risen by 0.19% to 1.0814 EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are finishing the week on a firm tone, while the US dollar remains heavy. In the Asia Pacific, only Australia and India did not end the week on a firm note. The MSCI Asia Pacific completed its fourth consecutive weekly gain, for around a 13% gain. Europe’s Dow Jones Stoxx...

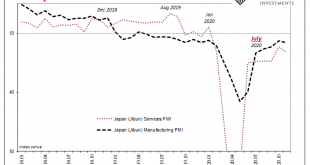

Read More »Deflation Returns To Japan, Part 2

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic. For a country with a population of more than 126 million, the case counts and mortality rates suggest something in the nation’s favor. Total reported coronavirus cases didn’t top 100,000 until the end of...

Read More »FX Daily, November 20: US Treasury-Fed Dispute Spurs Handwringing but Immediate Market Impact was Exaggerated

Swiss Franc The Euro has fallen by 0.14% to 1.080 EUR/CHF and USD/CHF, November 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the stimulus talks between the House Democrats and Senate Republicans was the excuse traders were looking for to extend the US equity gains yesterday, but shortly after the close, confirmation that Treasury was not going to agree to extend several Fed facilities sent stocks...

Read More »FX Daily, November 18: Balancing Pandemic Surge with Optimism about Vaccine

Swiss Franc The Euro has fallen by 0.01% to 1.0806 EUR/CHF and USD/CHF, November 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600...

Read More »FX Daily, November 16: Risk-On Despite Surging Pandemic

Swiss Franc The Euro has risen by 0.04% to 1.0799 EUR/CHF and USD/CHF, November 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Despite the surging pandemic and new restriction measure, risk-appetites appear strong to start the week. Led by 2% gains in the Nikkei and Taiwan’s Taiex, all of the Asia Pacific region’s equity markets advanced. European markets have followed suit and the Dow Jones Stoxx 600 is...

Read More »FX Daily, November 12: Nervous Calm in the Capital Markets

Swiss Franc The Euro has fallen by 0.14% to 1.0788 EUR/CHF and USD/CHF, November 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is a nervous calm in the capital markets today. The equity rally in the Asia Pacific region stalled to end an eight-day rally, though the Nikkei’s rally remains intact. The Dow Jones Stoxx 600 in Europe is consolidating near eight-month highs visited yesterday, and US shares...

Read More »FX Daily. October 29: Markets Continue to Struggle

Swiss Franc The Euro has fallen by 0.11% to 1.0681 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org