Summary There is much to like in Bullard’s new paradigm. The problem is that it does not reflect the Federal Reserve’s view or approach. Policy emanates from the Fed’s leadership, but be confused by the noise. The dot plot the recent FOMC meeting was curious. We noted right away that inexplicably there was one official that apparently anticipated one hike this year and then no hikes in 2017 or 2018. There was...

Read More »Down Go the Hopes and Dreams of Three Generations

Summary On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this? If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three...

Read More »FX Weekly Preview: It is All about Europe

Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out...

Read More »FX Review Week till June 17: Jo Cox’s death supports Sterling, negative for CHF

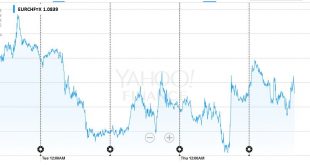

EUR/CHF The EUR/CHF was finished nearly without change after it had fallen to 1.0775 on Thursday. The rise of GBP and EUR on Thursday can be explained with speculation that the death of Jo Cox will help the anti-Brexit camp. We reported that FX speculators bought Sterling with two hands. FX Rates June 13 to June 17, 2016 click to enlarge USD/CHF Speculators have finally positioned themselves long CHF against...

Read More »Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely appropriateness of a rate hike this summer. Although the Fed did not rule out a...

Read More »Fed Softens Stance Slightly

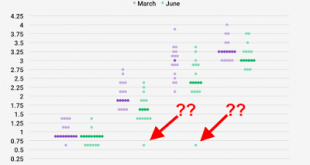

The Federal Reserve anticipated a more gradual tightening path going forward. This weighed on the dollar and lifted equities. August Fed funds futures implies less of a chance of a hike next month. It is now consistent with an 8% chance of a hike, which is less than half the probability assigned at the end of last week.The immediate reaction was driven by the Fed’s dot plots. Although the median continues to...

Read More »Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. DJIA, daily Fed chief Janet Yellen has made it clear she won’t do anything to disturb investors’ sleep. But that doesn’t mean they won’t have nightmares. Our research department...

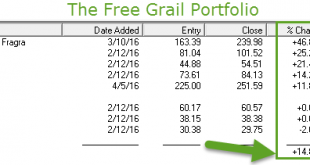

Read More »Free portfolio performance 10 Jun 16

The free portfolio advanced 2.02% this week, but the S&P lost the small amount of 0.12%. Click to enlarge. The Ultima Plus portfolio became operational on 31 December 2015. Click to enlarge. Market Comment Up to Wednesday, the S&P 500 rose to a 10-month high of 2119.12 points, less than 1% below its all-time high of 2130.82 of 12 May last year. But stocks pulled back on Thursday and more decisively on...

Read More »A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. Quite frankly, keeping tabs on it all is beyond human capacity. This also goes for the federal government. Even with all their data gatherers and number crunchers they are incapable of...

Read More »The Trump Risk: Will President Trump Trigger a Recession?

Home of the Brave? BALTIMORE – It is a bright summer day outside. A dry breeze sweeps down Cathedral Street and blows away the hot, humid air. It is hard for us to imagine that anything bad could happen today. But bad things do happen – even on nice days. The weather was fine when General Custer rode out to the Little Bighorn, too. Over the weekend, we worked at putting up a board fence – with half-round treated...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org