Summary:

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step regarding market psychology is not today’s data but tomorrow’s speech by Yellen. Source Dukascopy Recall in that in March several regional Fed presidents talked up the prospects of a rate hike as early as April. Yellen effectively closed the door on this line at her March speech in NY. Dudley’s comments last week, after the FOMC minutes, likely reflected the views of the Fed’s leadership, and should be reiterated by the Chair. Source Investing.com The interest rate adjustment has stalled alongside the greenback. The August Fed funds futures contract, which offers the clearest view of a June or July hike has stalled at an implied yield of 55 bp or about a 72% chance. As recently as May 16 the implied odds were closer to 20%. The US two-year premium over Germany widened from 125 bp after the US employment figures on May 6 to 143 bp yesterday.

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Daily, FX Trends, GBP, Janet Yellen, newsletter, USD

This could be interesting, too:

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step regarding market psychology is not today’s data but tomorrow’s speech by Yellen. Source Dukascopy Recall in that in March several regional Fed presidents talked up the prospects of a rate hike as early as April. Yellen effectively closed the door on this line at her March speech in NY. Dudley’s comments last week, after the FOMC minutes, likely reflected the views of the Fed’s leadership, and should be reiterated by the Chair. Source Investing.com The interest rate adjustment has stalled alongside the greenback. The August Fed funds futures contract, which offers the clearest view of a June or July hike has stalled at an implied yield of 55 bp or about a 72% chance. As recently as May 16 the implied odds were closer to 20%. The US two-year premium over Germany widened from 125 bp after the US employment figures on May 6 to 143 bp yesterday.

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Daily, FX Trends, GBP, Janet Yellen, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

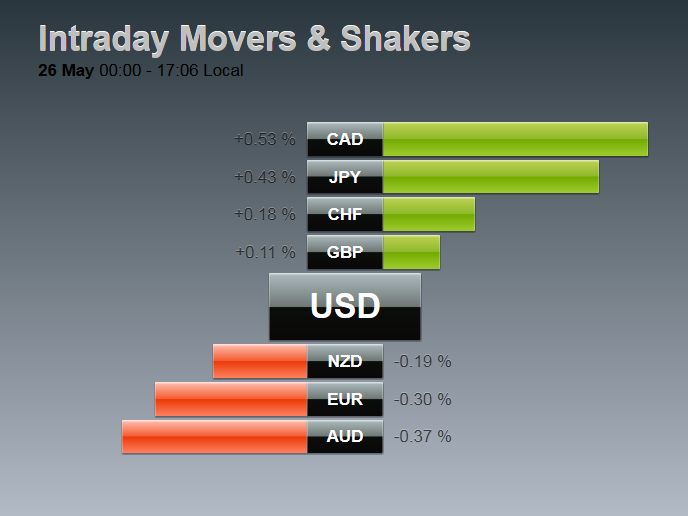

| The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step regarding market psychology is not today’s data but tomorrow’s speech by Yellen. |

Source Dukascopy |

| Recall in that in March several regional Fed presidents talked up the prospects of a rate hike as early as April. Yellen effectively closed the door on this line at her March speech in NY. Dudley’s comments last week, after the FOMC minutes, likely reflected the views of the Fed’s leadership, and should be reiterated by the Chair. |

Source Investing.com |

The interest rate adjustment has stalled alongside the greenback. The August Fed funds futures contract, which offers the clearest view of a June or July hike has stalled at an implied yield of 55 bp or about a 72% chance. As recently as May 16 the implied odds were closer to 20%. The US two-year premium over Germany widened from 125 bp after the US employment figures on May 6 to 143 bp yesterday.

In addition to the dollar’s consolidation, the other feature continued recovery in oil prices. Brent rose above $50 a barrel today, six-month high. The driver is supply. The larger than expected draw down of US inventories, coupled with disruptions in Nigeria, Venezuela and Libya are taking a toll. OPEC meets next week, but reports suggest attempts to freeze output have been largely abandoned. Although Iranian output is increasing, it will likely take several more months at least before pre-embargo levels are reached. Reports suggest the partial sanctions that have continued, the ease of alternative business, and a purposeful campaign by Saudi Arabia slow the Iran’s recovery.

The higher oil prices are helping energy sector equities and sensitive currencies, like the Norwegian krone (0.9%), Canadian dollar (0.3%), Malaysian ringgit (0.5%), Mexican peso (0.3%). The MSCI Asia-Pacific Index extended its recovery from two-month lows. The regional index has risen in four of the past five sessions, despite the Fed tightening and the weakening of the Chinese yuan. Europe’s Dow Jones Stoxx 600 is about 0.2% lower though the materials and energy sector are up (1.0% and 0.7% respectively near midday in London).

The details of the UK’s Q1 GDP were reported. Growth was unchanged at 0.4%, but the year-over-year pace slipped to 2.0% from 2.1%. The composition of the growth was a bit different than expected. Consumption was stronger, but capital investment and services were weaker, and trade was a bigger drag. Sterling extended its recent gains to $1.4740. Sterling has only been higher briefly on May 3 (when its staged a key reversal lows) since the very start of the year.

Many attribute the sterling’s gains to some polls that suggest the “remain” camp is moving ahead of Brexit. While there may be something there, we note that one-month implied volatility is surging today. It was around 11.7% yesterday, and now indicative prices suggest it is closer to 16.4%. It is the biggest jump in nearly two decades.

Why has implied volatility spiked? The higher volatility reflects the demand for options. What options? We look at the pricing skew between puts and calls (25 delta). That skew has exploded. Yesterday participants were paying 1.25% more for puts than calls. Today 5.4% more. If the polls show a tilt toward remain, why are investors still buying sterling puts? We suspect puts are being used as an insurance policy, not as a wager of the referendum’s outcome. On the other hand, some put owners may be using the spot market to neutralize or reduce insurance, which might be a factor helping sterling. The next key chart point for sterling is the high from May 3 (~$1.4770), which corresponds to the 200-day moving average.

The euro is recovering from yesterday’s $1.1130 low. The $1.1200-$1.1220 area may bring in fresh sellers ahead of Yellen’s speech tomorrow. The dollar was pushed back to almost JPY109.40 after stalling near trendline resistance yesterday near JPY110.50. Although the intraday technicals allow for additional sterling and euro gains, the yen may underperform. The greenback has scope to move higher against the yen. The Australian dollar has resurfaced above $0.7200. It can move into the $0.7230-$0.7260 area without challenging the downtrend. Meanwhile, initial support for the greenback against the Canadian dollar may be seen near CAD1.29, and a break warns of risk toward CAD1.2825.