Authored by John Mauldin via MauldinEconomics.com, While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »FX Daily, July 11: Dollar Extends Gains

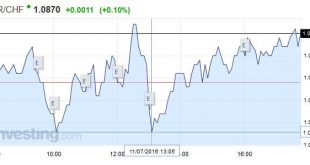

Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put...

Read More »Alan “Bubbles” Greenspan Returns to Gold

Faking It Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. — Alan Greenspan, 1961 He was in it for the power...

Read More »Larry Summers Wants to Give You a Free Lunch

Consequences of Central Bank Policies The existing capital stock continues to be frittered away at the expense of savers and retirees. Nonetheless, central bankers don’t give a doggone about it. This, after all, is one consequence of roughly eight years of near zero interest rate policy. Central planning superheros, leaving a wasteland behind… Image credit: Steve Epting 30 year bond yield Another related...

Read More »Planet Debt

Low Interest Rate Persons She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems. — Donald Trump BALTIMORE – With startling clarity, the presumptive Republican presidential nominee described himself – and Fed chief...

Read More »FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Summary Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act. There have been two developments that are shaping investment climate. The first was the dramatic rally in equity markets last week, with many recovering nearly all that was lost on the Brexit...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »FX Daily, June 21: CHF Strongest Currency Again

Swiss Franc The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons: Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT (see below) The German ZEW (see below) that was better than expected. We know that CHF acts as a proxy for the German economy via strong trade ties and the tradition that German...

Read More »Janet Yellen’s $200-Trillion Debt Problem

Summary More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations. And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it? Blame “Brexit” BALTIMORE – The U.S. stock market broke its losing streak on Thursday [and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org