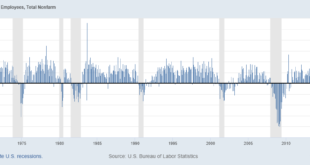

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to...

Read More »Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Our guest this week is Ed Steer, expert gold and market analyst and author of the Gold & Silver Digest. We invited Ed onto GoldCore TV to get his take on what is concerning him most in financial markets, movements in SLV and sanctions against Russia. He also draws our attention to central bank purchases of gold. Ed’s interview serves as a reminder that those who currently do own gold and silver are just the tip of the iceberg when it comes to the number of people...

Read More »Ross Geller inspires Bank of England policy

This morning the UK pound slumped as one of the world’s oldest central banks pressed hard on the panic button. The Bank of England was seen to be shouting ‘Pivot! Pivot! Pivaat!’ as they announced they would temporarily suspend their programme to sell gilts and will instead buy long-dated bonds. In a statement, the bank said that they would be embarking on a “temporary and targeted” bond buying operation. Although we expect it to be about as temporary and as...

Read More »Weekly Market Pulse: No News Is…

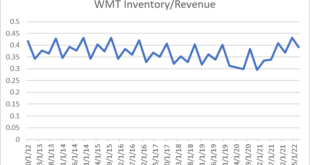

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a...

Read More »Ep 39 – Tavi Costa: Breaking Down the Pressures on the Market

Tavi Costa of Crescat Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the current state of the market, investing in good times and bad, and what future indicators to watch. Connect with Tavi on Twitter: @TaviCosta Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources Fed Zugzwang Germany Announcement Jerome Powell Nose Tweet Bloomberg Misery Index Zombie Company...

Read More »Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More »Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld From the Seinfeld episode “The Opposite” I...

Read More »A muddled message from The Fed

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went. If you’re still wondering if or how to invest in gold then it might be worth paying attention to what central banks are doing in the coming weeks. After all, how do central banks make their decisions when it comes to monetary policy? In years before it might have been quite straightforward...

Read More »The Fed and GDP: Week Ahead

The outcome of the Federal Reserve Open Market Committee meeting on July 27 is the most important event in the last week of July. After a brief flirtation with a 100 bp hike after the June CPI accelerated, the market has settled back to a 75 bp move. The Fed funds futures are pricing about a 10% chance of a 100 bp hike. The market anticipates that after the second 75 bp hike, the Fed will most likely return to a 50 bp hike in September. Fed Governor Wall, a...

Read More »Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org