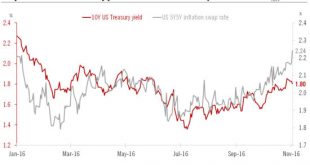

Recent rises in benchmark bond yields have caused us to revise upwards our year-end forecasts for US Treasury and Bund yields.We have revised our year-end target for the 10-year US Treasury yield from 1.7% to 2% and for the 10-year German Bund yield from 0.08% to 0.3%.Since the end of September, markets’ inflation expectations have rebounded, with euro and USD 5Y5Y inflation swap rates and 10-year breakeven yields rising. This rise is due to several factors, the most obvious one being the...

Read More »Is the Gold Bull Market Over?

ABN Amro, Natixis and Wells Fargo have issued bearish calls on gold. Natixis even expects three Fed rate hikes next year. Pater Tanebrarum discusses these opinions critically.Since gold is correlated to CHF, this is a bearish for the Swiss Franc, too. One additional points speaks against a rate hike. The U.S. capacity utilization that is 75% compared to 90% in 1967. So Far a Normal Correction In last week’s update...

Read More »Ganging Up on Gold

So Far a Normal Correction In last week’s update on the gold sector, we mentioned that there was a lot of negative sentiment detectable on an anecdotal basis. From a positioning perspective only the commitments of traders still appeared a bit stretched though, while from a technical perspective we felt that a pullback to the 200-day moving average in both gold and gold stocks shouldn’t be regarded as anything but a...

Read More »Monetarism

At the recent Karl Brunner Centenary event, Ernst Baltensperger characterized Monetarism as a set of five convictions: Money matters (as accepted in the neoclassical synthesis) Rules are preferred over discretion (in contrast to the views of Modigliani, Samuelson or Klein), but some flexibility is accepted Inflation and inflation expectations are key (in contrast to traditional Keynesian views)—adaptive expectation formation, parallels to Phelps Money growth targeting is useful—Brunner...

Read More »FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Swiss Franc Currency Index The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers as so-called “safe haven” buying was reversed during the week after Brexit. But the Swiss Franc index is still stronger in the last month. Via Financial Times. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance. On a three years interval, the Swiss...

Read More »Neo-Fisherianism Turns Mainstream

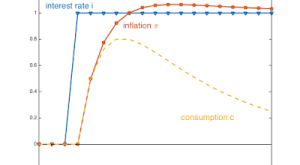

On his blog, John Cochrane offers a stripped down model and some intuition for why inflation would rise after an increase in the interest rate. The model features the usual Euler (IS) equation and a Mickey Mouse Phillips curve—inflation is proportional to consumption (or output). The intuition: During the time of high real interest rates — when the nominal rate has risen, but inflation has not yet caught up — consumption must grow faster [the Euler equation, DN]. … Since more consumption...

Read More »Liquidity Trap Kills Liquidity Effect

In his blog, John Cochrane registers disagreement with Larry Summers and reiterates his own argument that in a liquidity trap, interest rate policy does not have a liquidity effect and thus, only a long-run “expected inflation” or “Fisher” effect: When the liquidity effect is absent, the expected inflation effect is all that remains. Inflation must follow interest rates.

Read More »What Drives Government Bond Yields?

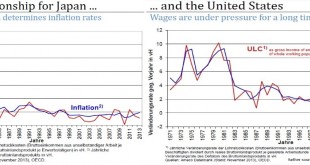

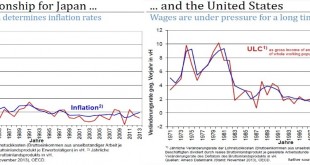

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More »What Drives Government Bond Yields?

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org