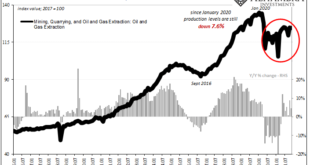

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts. First up, yesterday the Federal Reserve published the November 2021 estimates for Industrial Production in the United States. As has been the...

Read More »Weekly Market Pulse: Growth Scare?

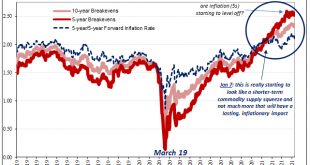

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved. I wrote nearly 2000 words last week about that change in inflation expectations and I’m so glad you took the time to read it. And now you can forget it because over the next four days all but 2 basis points of the move in the...

Read More »Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Or are we? Well, yes, the 10 year is back where it was but that doesn’t mean everything else is and, as you’ve probably...

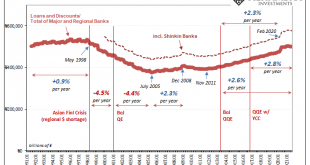

Read More »You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts). After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida...

Read More »Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it. When nominal rates fell from April through July, real rates fell right along with them. The nominal bond yield fell by 63 basis points and the 10 year TIPS yield fell by 57....

Read More »And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

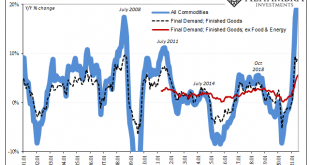

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene. The BLS reports today that its main producer price index (PPI), the one for finished goods, was up 9.19% year-over-year in June 2021....

Read More »Rechecking On Bill And His Newfound Followers

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard). Even nearer-in inflation expectations have rounded off at their current top. Perhaps no more than a short-term rest before each rising again, then again with the rest of the...

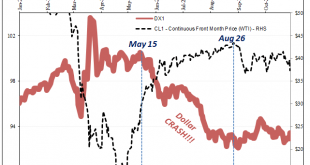

Read More »What’s Going On, And Why Late August?

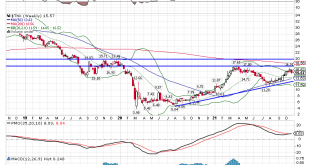

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here? What you’ll hear or have already heard is something about Europe and more lockdowns, fears about a second wave of the pandemic. No, that doesn’t fit the herdlike change in direction you can observe across many different markets (below)....

Read More »Inflation Karma

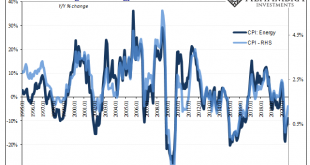

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements. CPI Changes on Energy, 1995-2020 - Click to enlarge And that’s a huge problem…if you are Jay Powell. We’ve been making a big deal out of him making a huge deal out of...

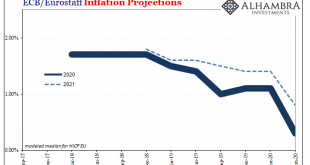

Read More »ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press. It never ends. If you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org