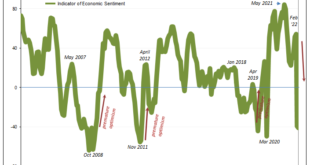

German optimism was predictably, inevitably sent crashing in March and April 2022. According to that country’s ZEW survey, an uptick in general optimism from November 2021 to February 2022 collided with the reality of Russian armored vehicles trying to snake their way down to Kiev. Whereas sentiment had rebounded from an October low of 22.3, blamed on whichever of the coronas, by February the index had moved upward to 54.3. It currently stands at -41.0, collapsing...

Read More »New Day, Same as the Old Day

Overview: It is a new day, but with the continued rise in interest rates and weaker equities, it feels like yesterday. Only China and Hong Kong among the major markets in Asia Pacific resisted the pull lower. Europe’s Stoxx 600 is off by more than 0.5% led by health care and real estate. It is the fourth loss in five sessions and brings the benchmark to its lowest level since March 18. US futures are flattish. Yesterday, the NASDAQ fell by more than 2% for the third...

Read More »Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an “expeditious” campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower. After the equity losses in the US yesterday, including a 2.2% drop in the NASDAQ, Asia Pacific equities...

Read More »Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia, and India managed...

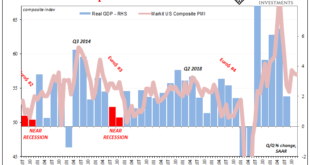

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

Read More »Roll Out of Digital Euro Could Transform Payments in Germany

A digital programmable euro is essential for innovative business models in Germany, according to the Frankfurt School Blockchain Centre (FSBC). The FSBC is a think tank and research centre focusing on the business implications of blockchain. It published the “The Programmable Euro: Review and Outlook” report on behalf of the Finanzplatz München Initiative (fpmi), highlighting the use cases of the digital programmable euro, a blockchain-based euro that enables...

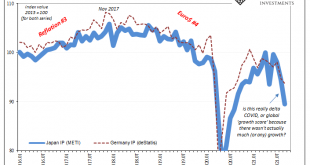

Read More »The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since...

Read More »Turkey gets a Reprieve before US Thanksgiving, but Capital Strike may not be Over

Overview: The dramatic collapse of the Turkish lira was like an accident one could not help look at, but it was not an accident, but the result of a disregard for the exchange rate and compromised institutions. The lira was off around 15% at its worst yesterday, before settling 11.2% lower. After falling for 11 sessions, it has steadied today (~2.7%) but the capital strike may not be over. On the other hand, the Reserve Bank of New Zealand delivered the 25 bp...

Read More »German Angst

On German TV, Dieter Nuhr analyzes the German mindset (Nuhr im Wandel). He offers many insights into why Germans (and their government) stand in their own way. One reason is that Germans can deal with change but still fear it.

Read More »FX Daily, November 9: Falling Yields Give the Yen a Boost

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that the Fed’s Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org